Central exchange rate increases again

This morning (October 14), the State Bank of Vietnam announced the central exchange rate at VND 25,114/USD, up VND 2 compared to the closing price of the previous session.

With an margin of plus/ minus 5%, commercial banks today are allowed to trade USD in the range of VND 23,907 - VND 26,317/USD.

At the State Bank of Vietnam Transaction Office, the reference exchange rate today is as follows:

Buy in: 23,907 VND/USD.

Selling: VND 26,317/USD.

Bank USD reverses to increase, black market maintains high price threshold

At commercial banks, USD prices today broke the streak of 10 consecutive days of price decline. In the same direction, the black market USD price moved in an upward trend, fluctuating between 27,030 - 27,150 VND/USD.

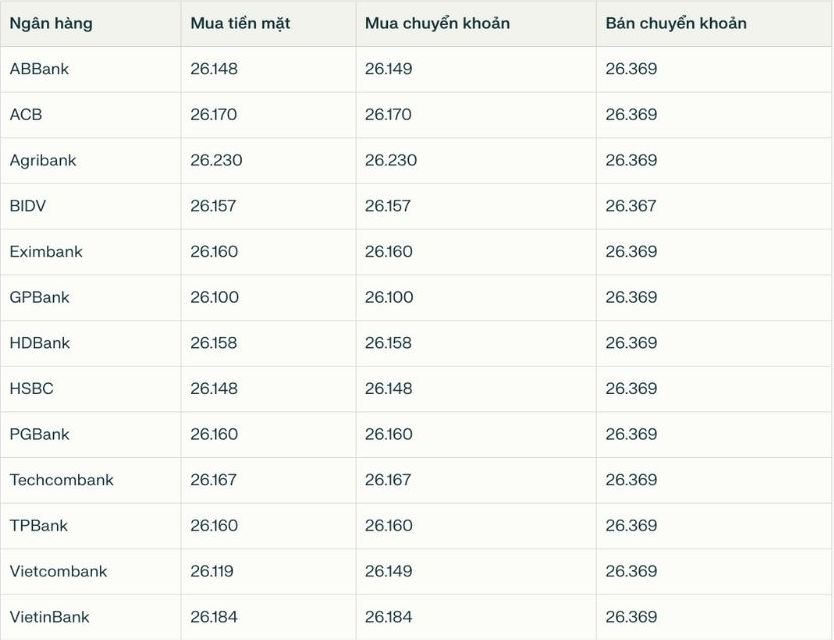

Banks simultaneously listed USD selling prices at VND26,369/USD.

Bank with the highest cash and bank transfer price: VietinBank (26,184 VND/USD).

The difference between the buying and selling prices at banks is 221 VND/USD.

Yen exchange rate

Despite a slight recovery and currently trading at 152.313 USD/JPY, the Japanese Yen is still reaching its lowest level since February 2025. Meanwhile, in the free market, the Yen is still flooded with red when exchanged between 174.5 - 176.6 USD/JPY (buy - sell).

Market analysis

The USD holds steady today after US President Donald Trump eased his tough declaration of tariffs on China and the possibility of meeting with Chinese counterparts, bringing hope to ease tensions between the two major economies.

The currency market was more stable in the trading sessions this morning in the Asian region, after a chaotic trading session last weekend when Trump suddenly announced the imposition of an additional 100% tax on Chinese goods exported to the US. However, US President Donald Trump has taken conciliatory steps, contributing to easing trade tensions.

US Treasury Secretary Scott Bessent said Trump is still expected to meet Chinese President Xi Jinping in South Korea later this month.

This event will boost the USD, keeping the Euro below 1.16 USD, trading around 1.1566 USD. The British pound fell slightly by 0.06% to $1.3328, while the New Zealand dollar fell to a 6-month low of $0.57145.

"There is a common wish or an escape and an agreement to prevent bilateral relations from getting out of control, because both the US and China know well that they cannot simply bypass the opponent's leverage," said Lombard Odier's macro strategist Homin Lee.

The Japanese market returned after a long holiday with prolonged political instability as first female prime minister candidate Sanae Takaichi struggled after the Junior coalition withdrew from the ruling coalition.

First Sentier Investors expert Nigel Foo predicts that the Yen will soon increase in price again due to unreasonable interest rate differential between the US and Japan.