Company Generale (SocGen - a large multinational bank headquartered in France) has just announced a strategy for a multi-asset investment portfolio for the second quarter. The bank still holds 7% of its portfolio in gold and predicts that gold prices could reach $4,000/ounce.

SocGen pointed out that there are growing doubts about the special position of the United States, leading to a change in investment flows globally. In this situation, investors should keep gold as an important preventative asset.

At 7%, gold is still the largest commodity in SocGen's portfolio. Gold is still a strong upward asset in the context of geopolitical reshaping under the US administration, causing strong policy responses, said analysts.

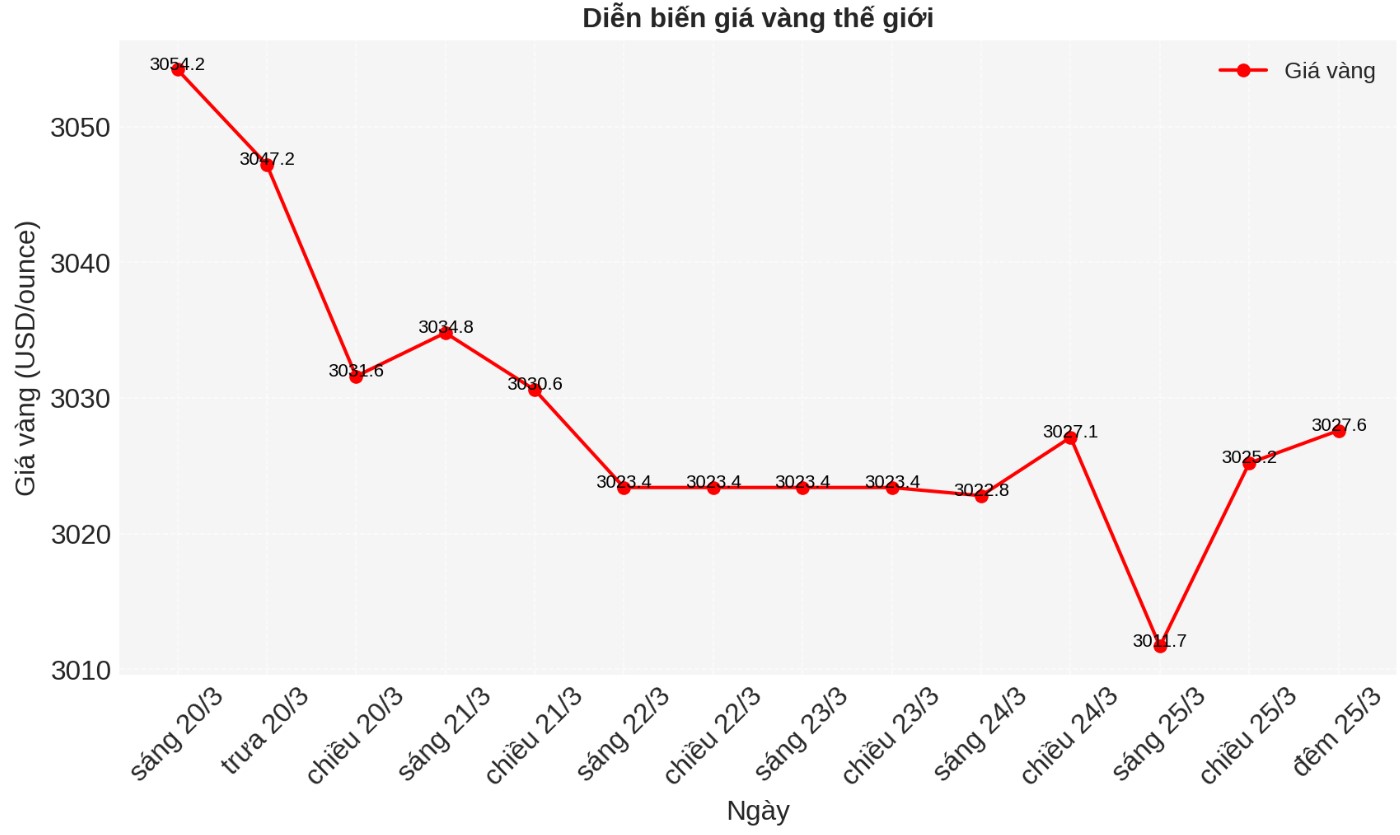

Although gold prices are currently fluctuating above $3,000/ounce, SocGen expects gold prices to continue to increase. The French bank forecasts gold prices to average around $3,300/ounce in the fourth quarter.

Analysts said geopolitical uncertainty continues to support gold as an important global currency. They also pointed out conditions that could push gold prices to $4,000/ounce.

As the geopolitical situation remains very uncertain, the decline in dependence on the US dollar could continue, meaning central banks around the world will continue to buy gold without interruption.

With the risk of a weaker US dollar leaning and central banks speeding up their dependence on the US dollar due to increased geopolitical uncertainty, we remain optimistic about gold," said analysts.

Experts also pointed out that gold prices could be further supported, increasing to $4,000/ounce, if the Russian Central Bank's 210 billion-dollar assets are seized to support Ukraine: "This will set a precedent and urge non-Western countries to accelerate the decline in dependence on the US dollar in central bank reserves to protect against any sanctions or bank account seizures."

In addition to gold, SocGen also sees potential in copper and continues to maintain a downward view on oil prices. We think it is too early to bottom out oil, as a rich exploitation policy and downside risks to US economic growth still create a discount asymmetry for this asset. We continue to favor favor favorites," the analysts said.

For copper, we keep the 2025 forecast at 10,000 USD/ton, but adjust the 2026 target to 11,000 USD/ton, the analysts added.