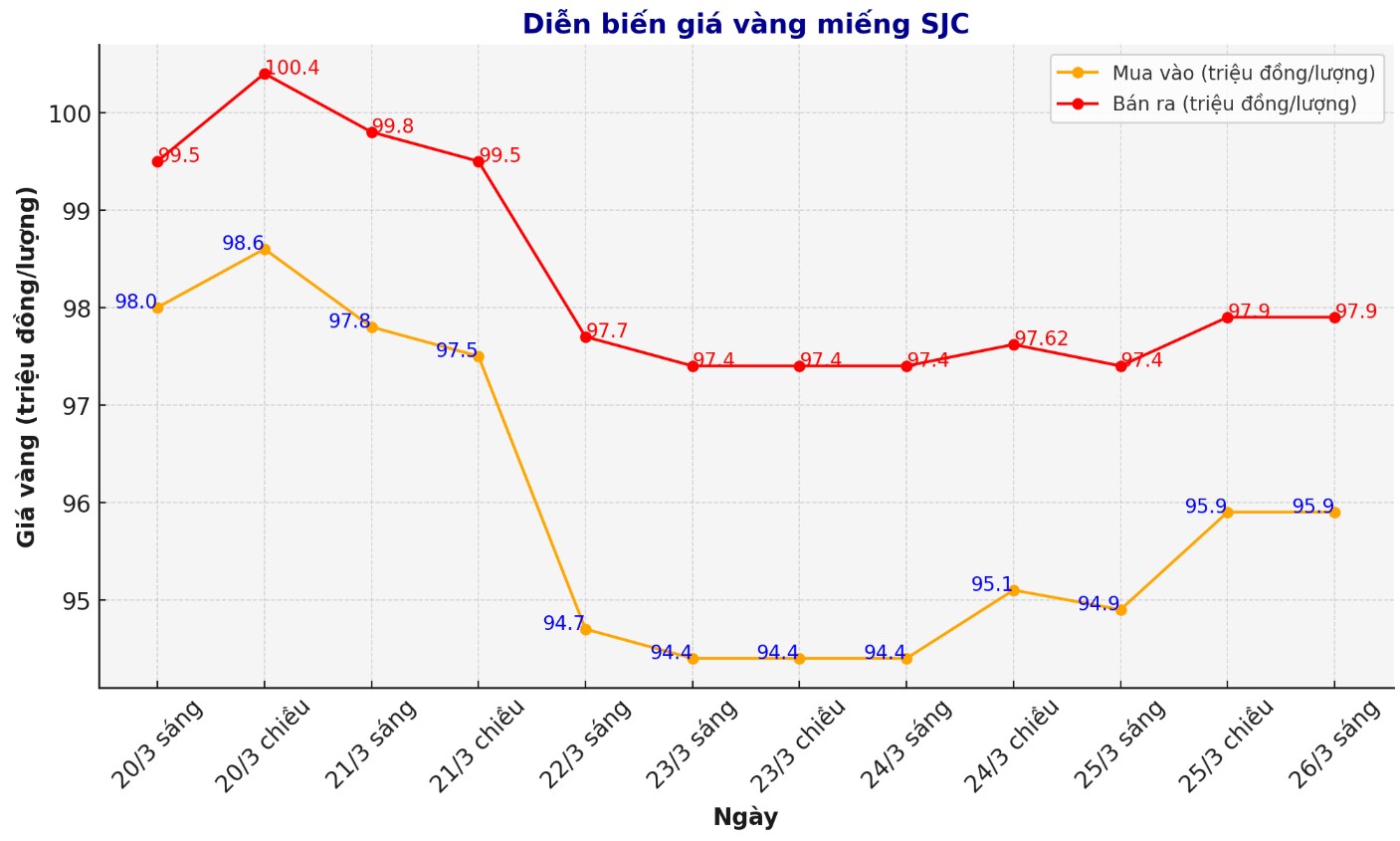

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND95.9-97.9 million/tael (buy - sell), an increase of VND800,000/tael for buying and an increase of VND280,000/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at VND95.9-97.9 million/tael (buy - sell), an increase of VND800,000/tael for buying and an increase of VND300,000/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 96-97.9 million VND/tael (buy - sell), an increase of 700,000 VND/tael for buying and an increase of 320,000 VND/tael for selling. The difference between buying and selling prices is at 1.9 million VND/tael.

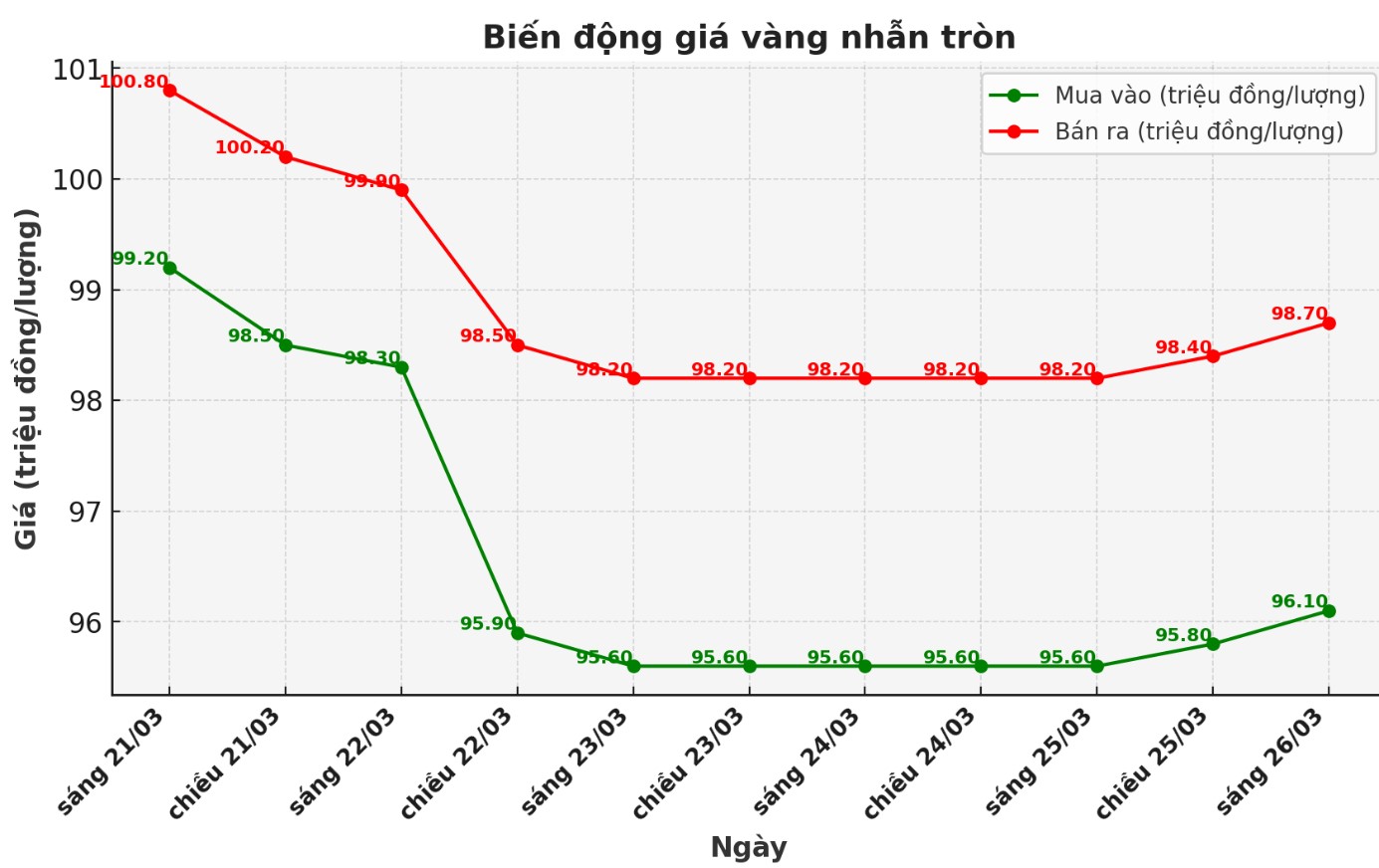

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 96.1-98.7 million VND/tael (buy in - sell out); increased by 300,000 VND/tael for both buying and selling. The difference between buying and selling is listed at 2.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 96.3-98.8 million VND/tael (buy - sell); increased by 300,000 VND/tael for buying and increased by 200,000 VND/tael for selling. The difference between buying and selling is 2.5 million VND/tael.

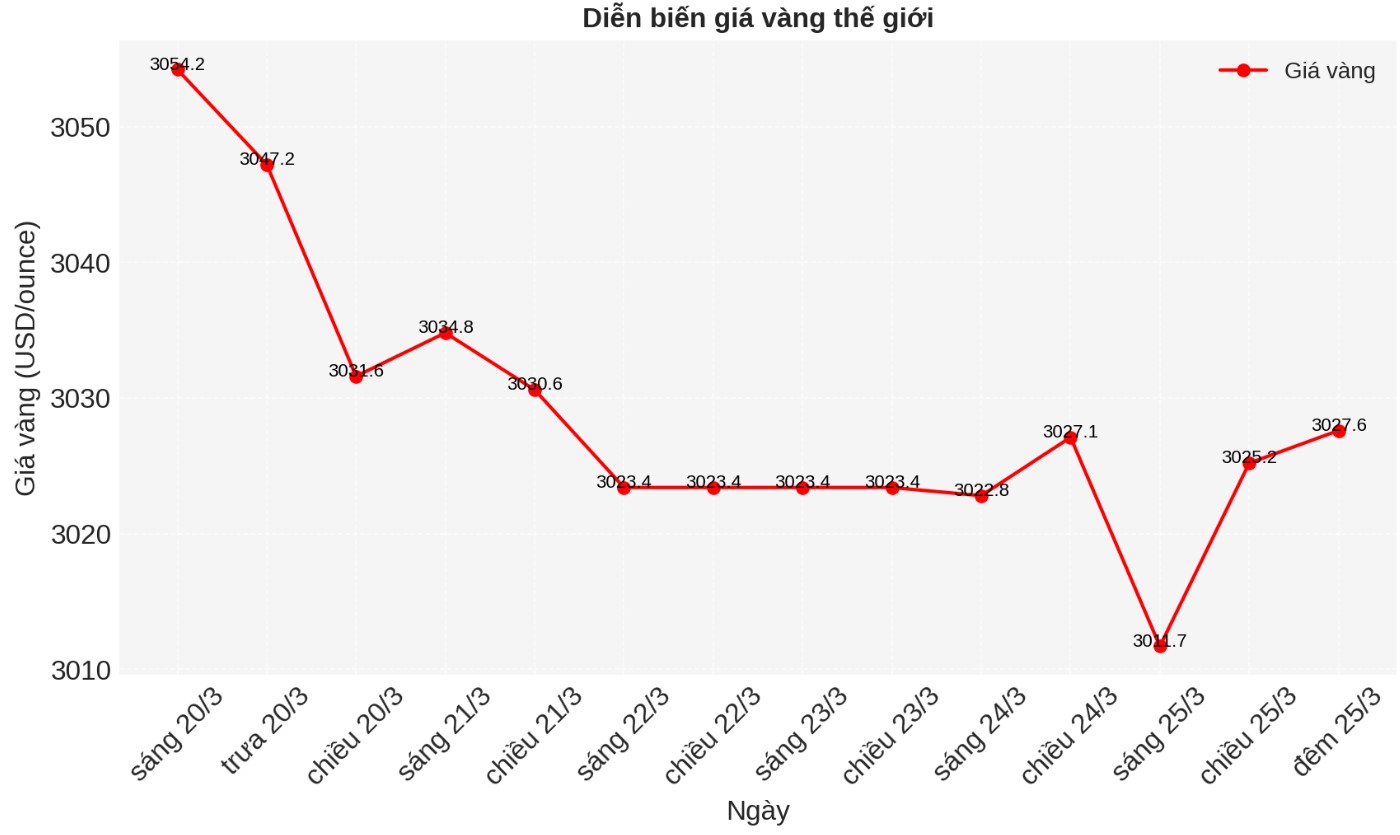

World gold price

As of 9:36 p.m. on March 25, the world gold price was listed at 3,027.6 USD/ounce, up 2.4 USD/ounce.

Gold price forecast

World gold prices increased in the context of the USD decreasing. Recorded at 9:30 p.m. on March 25, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.772 points (down 0.15%).

Gold prices have increased as they attract demand for safe-haven assets amid market concerns about US trade and foreign policy. Technical charts also support gold and silver prices, continuing to attract buying from investors. Gold prices in April increased by 9 USD, to 3,024.6 USD/ounce. Silver prices in May increased by 0.49 USD, to 33.94 USD/ounce.

The Asian and European stock markets have fluctuated in different directions overnight. US stock indexes are expected to open almost unchanged today in New York after a quiet trading session overnight.

A title from Barron's today reads: "Mr. Trump's uncertainty about tariffs will disrupt the quiet of the stock market; prepare for a new storm".

Technically, April gold investors are currently holding a near-term technical advantage. The next upside price target for speculators is to close above strong resistance at $3,100/ounce.

The bears' next downside price target is to push the contract price below the solid technical support level of $2,900/ounce. The first resistance level seen at this week's highest level was 3,038.4 USD/ounce and then the record high of the contract at 3,065.2 USD. The first support level seen at this week's low was $3,007.7/ounce and then $3,000/ounce.

Major non-market markets today saw Nymex crude oil prices rising and trading around 69.50 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.358%.

Economic data to watch this week

Wednesday: long-term orders in the US.

Thursday: homes waiting for transactions (number of unclosed home purchase contracts), US Q4 GDP.

Friday: US core PCE Index, US personal income and expenses.

See more news related to gold prices HERE...