From July 1, 2025, according to Decree 94/2025/ND-CP, lending technology platforms including fintech apps linked to financial companies are required to check credit information (CIC) before disbursing to customers.

This helps control credit risks, limiting the spread of over-borrowing and bad debt through digital platforms. However, for borrowers especially those who use fast- loans if they do not know how to check CIC themselves, they may have their loan refused for unknown reasons.

What is CIC?

CIC is the abbreviation of the National Credit Information Center of Vietnam, under the State Bank of Vietnam (SBV). This is a place to store credit history of each individual, including:

Number of available loans, principal and interest debts,

History of debt repayment on time or late payment,

Rating personal credit by group (group 1 to group 5).

How to check your CIC before borrowing money via app

Step 1: download the official CIC application

App name: CIC Credit Connect

Found on: App Store (iOS) and Google Play ( Android)

Developing unit: Vietnam National Credit Information Center (CIC) - under the State Bank

Step 2: Register for personal account

Providing CCCD/CMND, phone number and email

Facial authentication via eKYC

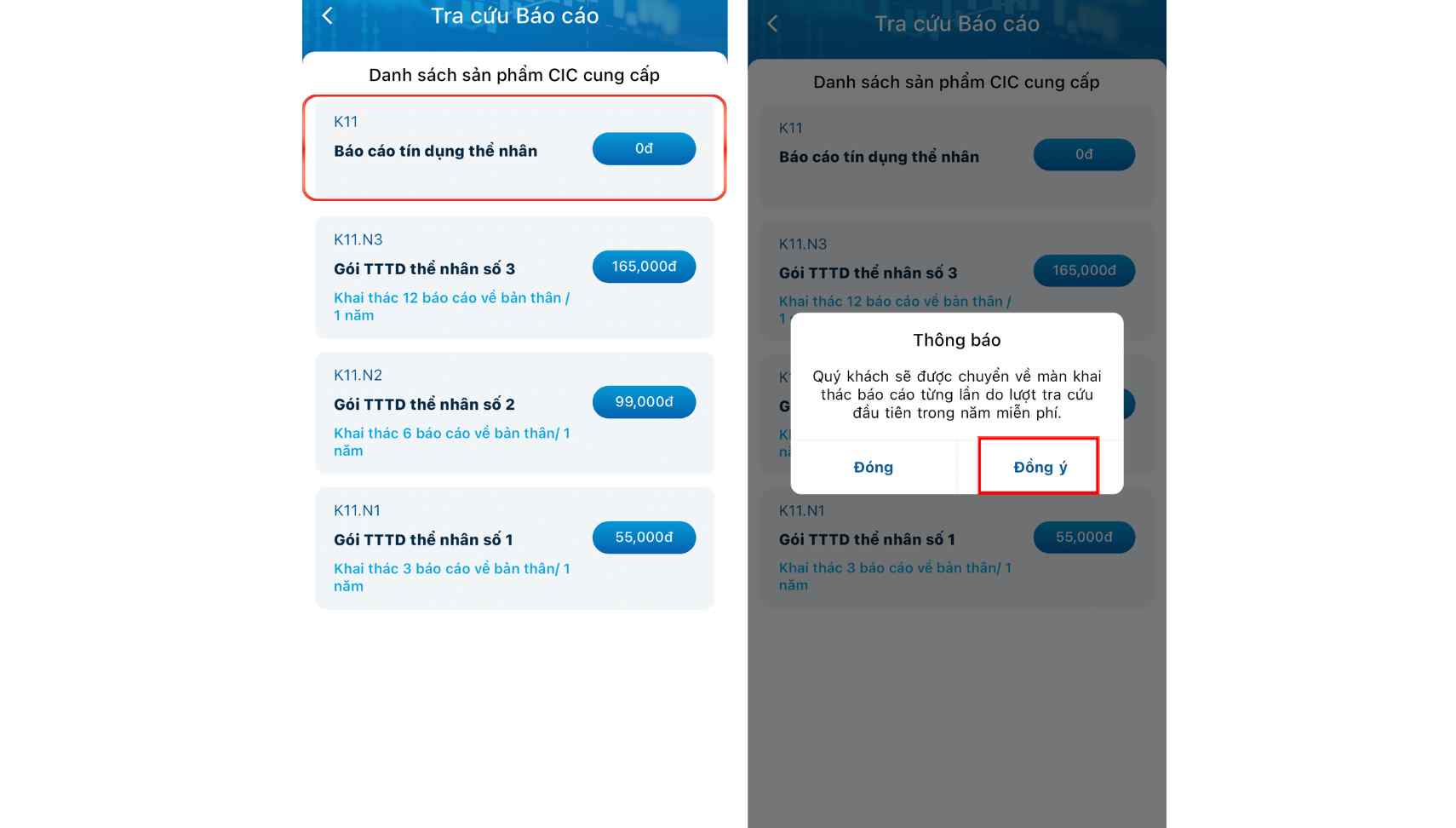

Step 3: Look up credit information

In the "Credit Report" section

See the overview of debts, debt groups, repayment times for each loan

If you are classified as a debtor group of 2 or more, the possibility of being approved for a loan by the app will be very low.

Step 4: Handling if there is bad debt

Payment of all overdue debts

applied for an update to the data (usually within 3060 days)

Then proceed to register for further loans on the app

Notes when borrowing via a CIC-chescked app

Do not try to borrow from multiple apps at the same time to "bypass documents" - this can easily cause debt to increase and credit ratings to be poor.

CIC data cannot be deleted, so if you have been late or overdue for more than 10 days, borrowers should proactively pay and monitor credit scores regularly.

If the app does not check CIC and lend too easily, users need to be vigilant because it could be a disguised black credit app that collects high fees and illegally collects debts.

See more articles on Decree 94/2025/ND-CP HERE.