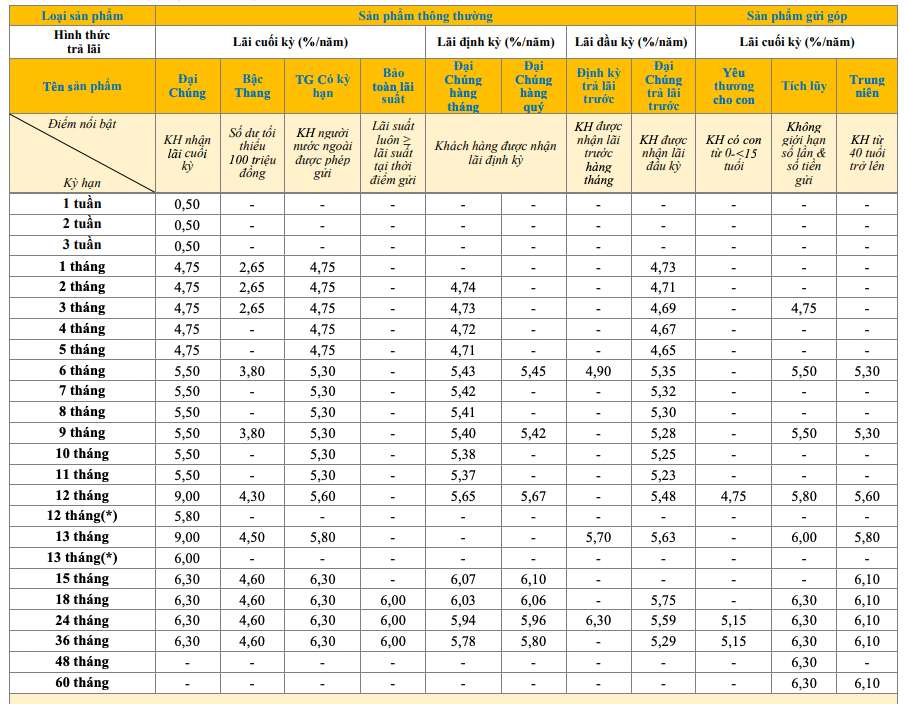

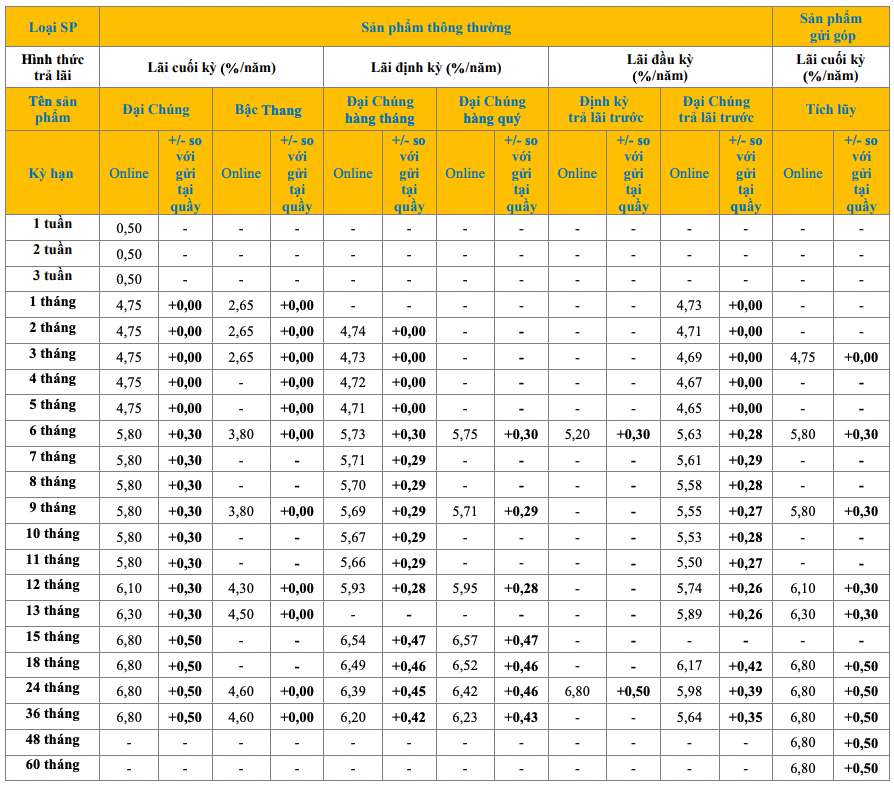

Lãi suất PVcomBank hiện ở mức cao nhất thị trường, lên đến 9% cho kỳ hạn 12 tháng với số tiền gửi tối thiểu 2.000 tỉ đồng. Ở điều kiện thường, PVcomBank niêm yết lãi suất 12 tháng cao nhất ở mức 6,1% khi khách hàng gửi tiền online và 5,8% khi gửi tiền tại quầy.

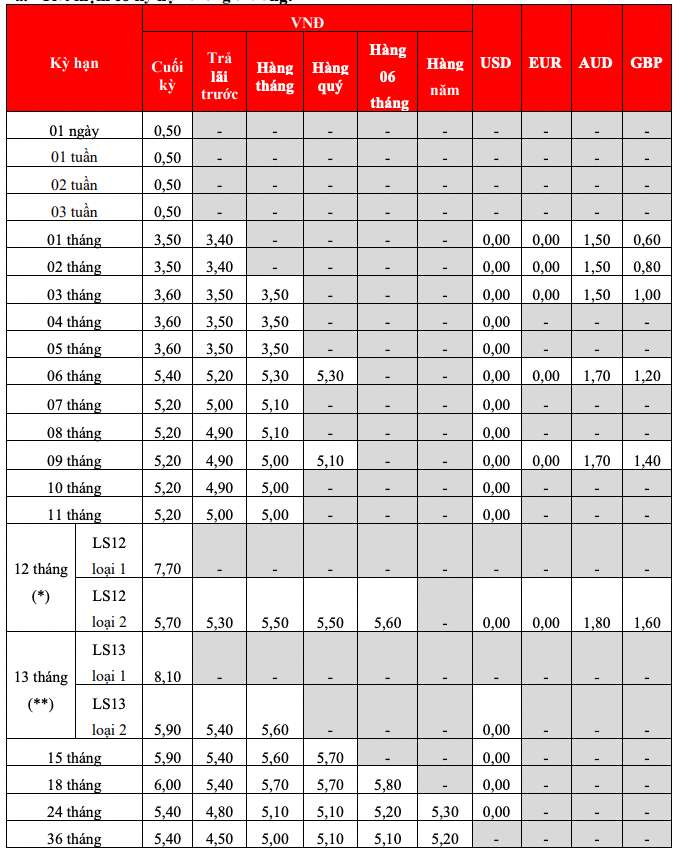

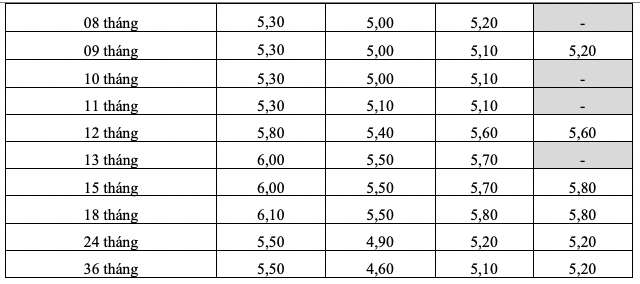

Theo sau, HDBank với mức lãi suất 7,7% cho kỳ hạn 12 tháng, điều kiện duy trì số dư tối thiểu 500 tỉ đồng. Ở điều kiện thường, HDBank niêm yết lãi suất 12 tháng cao nhất ở mức 5,8% khi khách hàng gửi tiền online và 5,7% khi gửi tiền tại quầy.

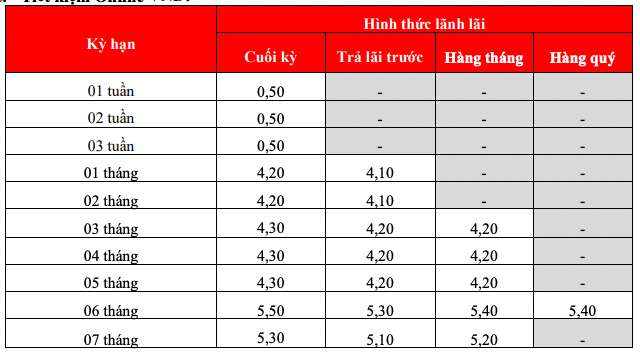

Top banks with high interest rates when depositing savings for 12 months under normal conditions can be mentioned such as: PGBank, Cake by VPBank, Vikki Bank, BacABank...

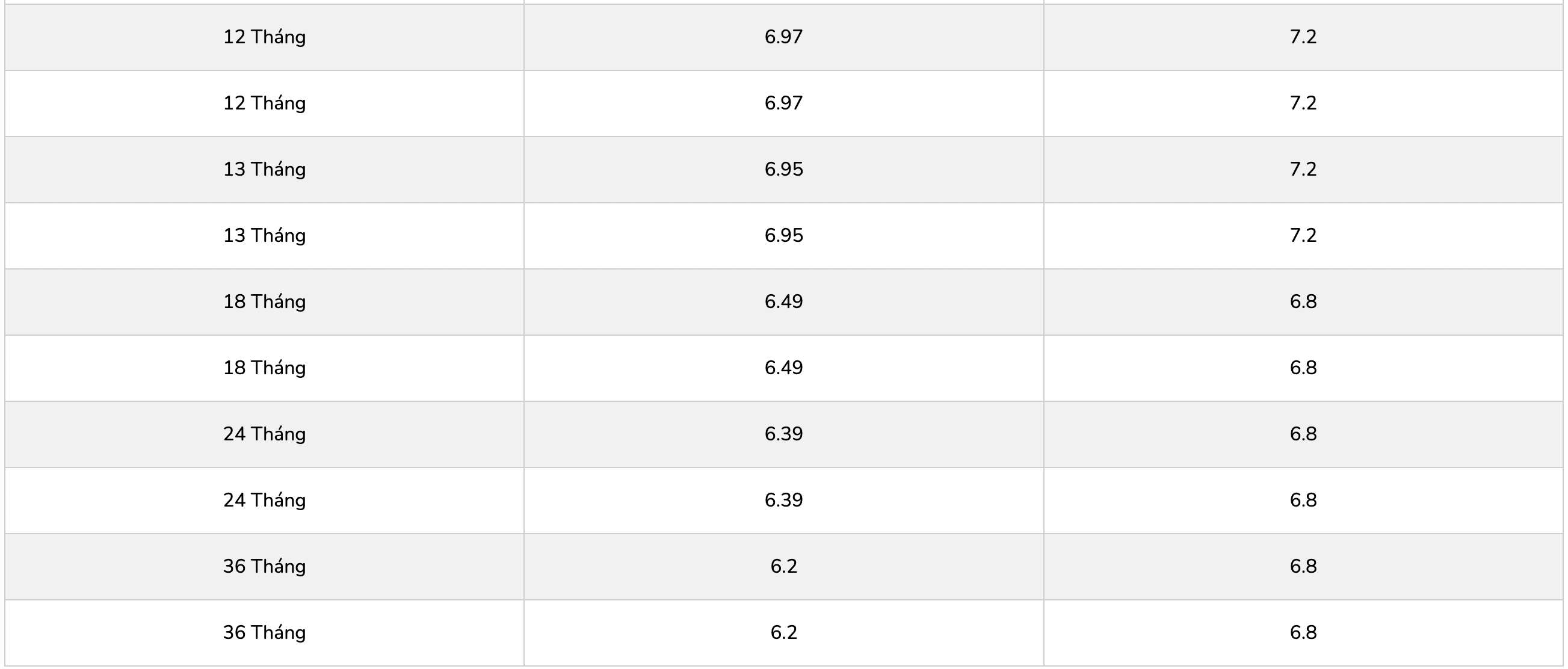

PGBank is listing the highest interest rate for a 12-month term at 7.2%/year when customers receive interest at the end of the term.

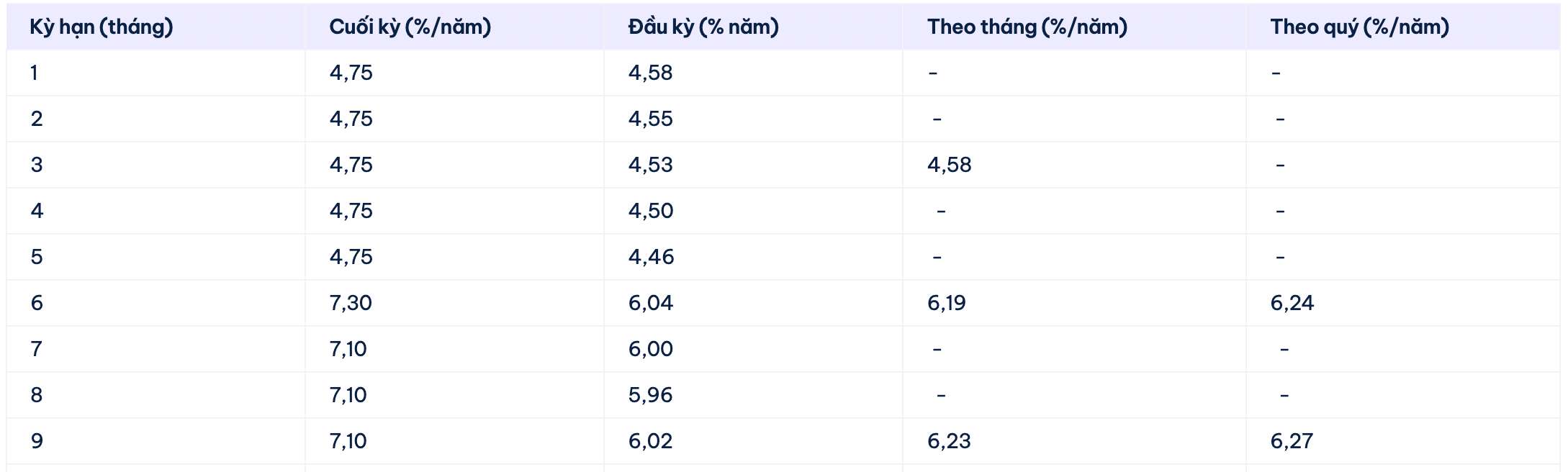

Cake by VPBank is listing the highest interest rate for a 12-month term at 7.1%/year when customers receive interest at the end of the term. Customers receiving interest at the beginning of the term, by month, by quarter receive interest rates of: 6%; 6.27%; 6.31% respectively. Currently, Cake by VPBank lists the highest interest rate of 7.3% for a 6-month term.

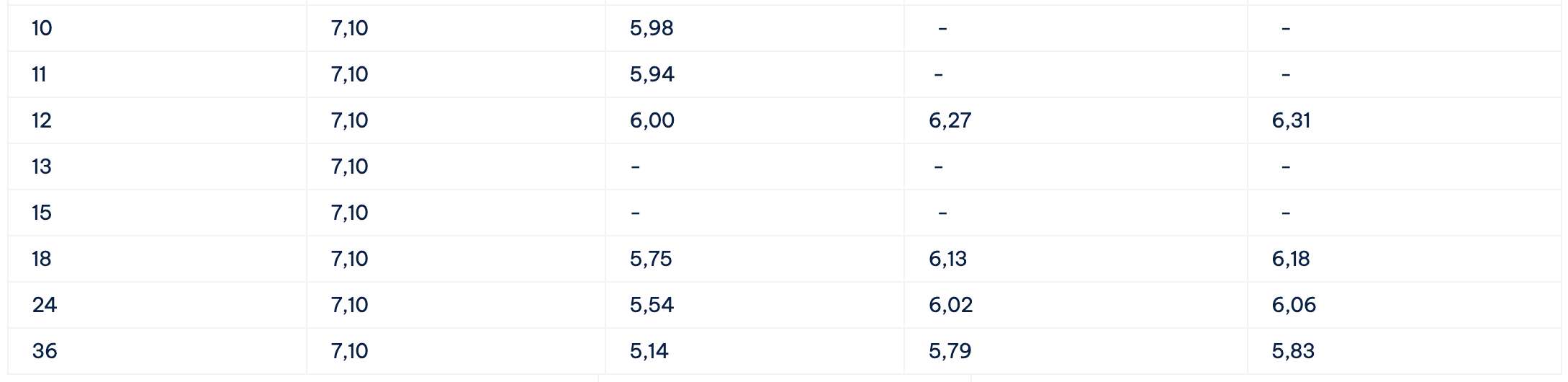

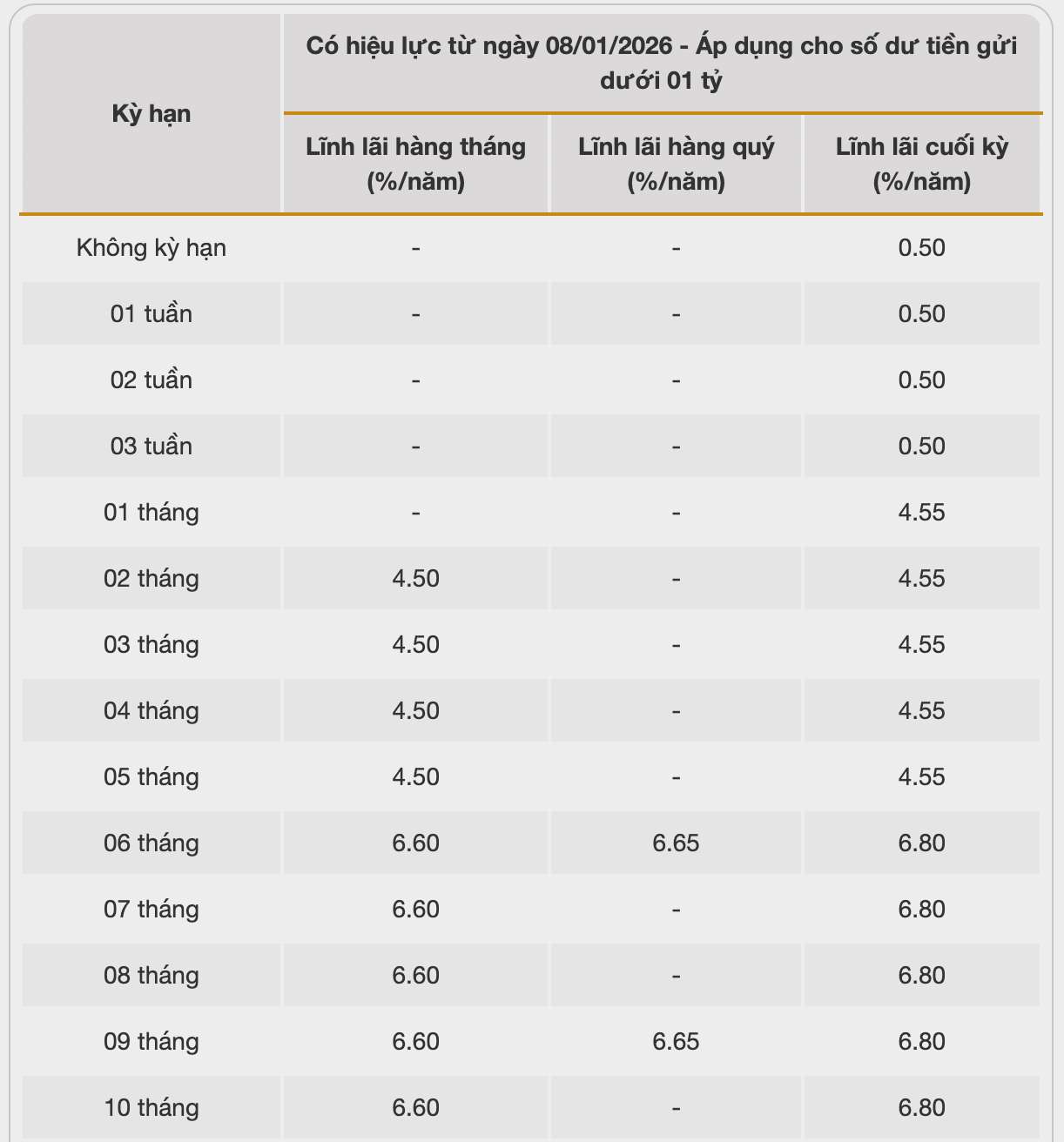

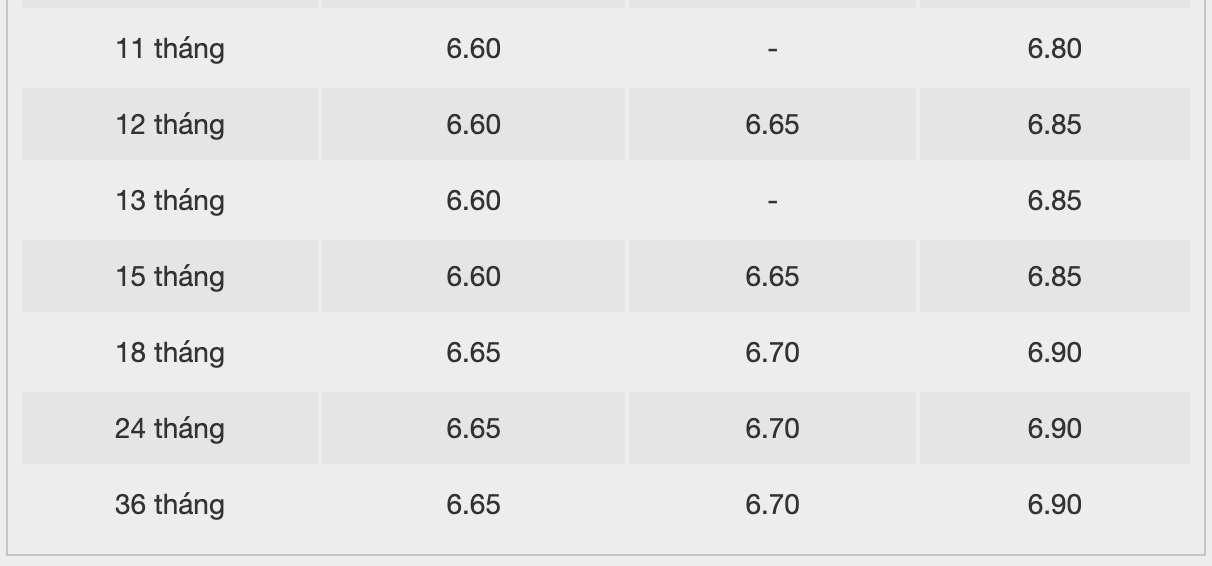

BacABank is listing the highest interest rate for a 12-month term at 6.85% when individual customers deposit money online and receive interest at the end of the term. Currently, BacABank is listing the highest interest rate at 6.9%/year for terms from 18-36 months.

Vikki Bank is listing the highest interest rate for a 12-month term at 6.6% when individual customers deposit money online and receive interest at the end of the term. Currently, Vikki Bank is listing the highest interest rate at 6.7%/year for a 13-month term.

How much interest do you receive when depositing for 12 months?

You can refer to how to calculate interest to know how much interest you receive after depositing savings. To calculate interest, you can apply the formula:

Interest = deposit x interest rate %/12 x number of months deposited

For example, if people deposit 500 million VND into Bank A, with a term of 12 months and enjoy an interest rate of 7.1%/year, the interest received is as follows:

500 million VND x 7.1%/12 x 12 = 35.5 million VND.

For example, if people deposit 600 million VND into Bank A, with a term of 12 months and enjoy an interest rate of 7.1%/year, the interest received is as follows:

600 million VND x 7.1%/12 x 12 = 42.6 million VND.

* Interest rate information is for reference only and may change in each period. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more information about interest rates HERE.