Proactively buying fire and explosion insurance for 11 years

Talking to PV of Lao Dong Newspaper, Mr. Le Quoc Kien (living in Ho Chi Minh City) said that he has been " inconsiderate" buying fire insurance for his house for more than 11 years.

He believes that fire insurance is not an expense, but a small investment but brings great value: peace of mind not being "uddenly lost" in assets worth billions of dong.

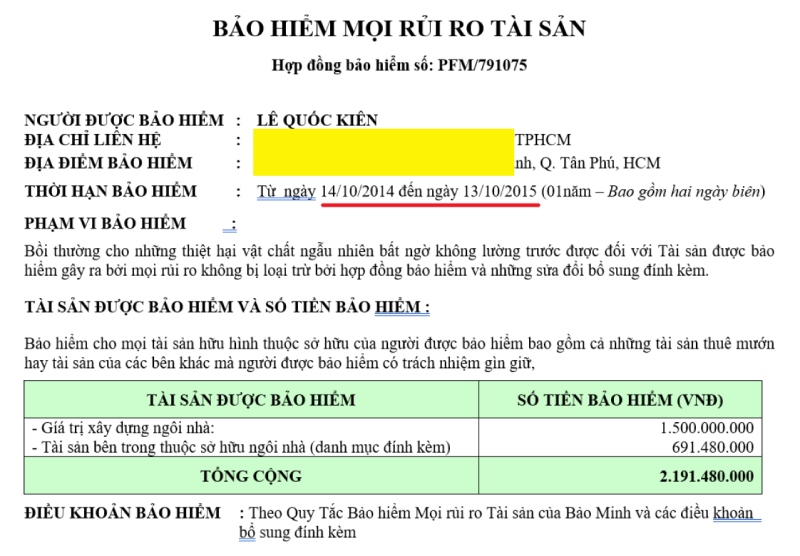

"Since 2014, I have proactively bought fire insurance for my real estate, even though the house has only 4 floors with a floor area of 400 m2. For example, a house in Tan Phu district has a construction value and an internal asset of about 2.2 billion VND, I spend 3.7 million VND per year on insurance, equivalent to 0.17% of the asset value. This figure is only 308,000 VND/month, or 10,000 VND/day" - Mr. Kien said.

In addition, since 2017, Mr. Kien bought insurance for a house in District 9 and decided to remove the theft insurance item. After the insurance company assessed the fire safety of this house as high, the insurance fee was only 0.1% of the asset value, helping to significantly reduce annual expenses. The annual insurance premium is divided into only 53,000 VND/day.

"Many people have opposed me, thinking that this is a " fee", but I always believe: disease prevention is cheaper than treatment. I see 10,000 VND or 53,000 VND per day not as money lost, but as investment - investment for safety, investment for good sleep by limiting the risk of losing everything" - Mr. Kien shared.

However, not everyone has the above thinking, in more than 15 years of working in real estate leasing, Mr. Kien has realized that most investors do not know about or are not interested in fire and explosion insurance.

"They still take risks with the mentality of 'my house will never burn'. This is a popular but risky thought, because fire and explosion are not expected, but if they do, the consequences can cost you everything.

In addition, another reason why homeowners do not want to buy insurance is the "fear of being denied compensation" when an incident occurs. This comes from two sides: The homeowner does not understand the contract clearly, leading to violations of certain terms and insurance companies, for business profits, proactively "swerving" to avoid compensation" - Mr. Kien stated his opinion.

Still need to improve regulations

Decree No. 105/2025/ND-CP has just been issued by the Government detailing a number of articles and measures to implement the Law on Fire Prevention, Fire Fighting and Rescue.

The Decree clearly stipulates 44 types of facilities subject to compulsory fire and explosion insurance, including apartment buildings, collective housing with 5 floors or more or with a total floor area of 1,000 m2.

Talking to reporters, Ms. Tran Thi Lan - a tenant in a 6-storey mini apartment in Cau Giay district said that she did not know whether the building had been purchased for fire insurance or not. More than 20 rooms are rented here, mainly for students and short-term stays. Ms. Lan believes that requiring each tenant to buy insurance on their own is not feasible, while the homeowner also has certain concerns when having to buy insurance and be legally responsible for the contract if an incident occurs.

According to Lawyer Quach Thanh Luc (Hanoi Bar Association), with the characteristics of residential areas such as boarding houses, mini apartments, collective houses, etc., it will be difficult to determine the representative to sign the insurance contract.

The lawyer said that there should be clear instructions on the form of legal representation to avoid risks, insurance contracts that are not signed legally, and insurance companies that may refuse to pay.

Some other facilities are also subject to compulsory fire and explosion insurance such as: kindergartens, kindergartens, kindergartens with 50 children or more or a total floor area of 500 m2 or more; Primary schools, junior high schools, high schools, high schools with many levels, universities, colleges, vocational high schools, vocational schools; Hospitals; Stadium with a capacity of 2,000 seats or more. Gymnasium, sports training room, swimming pool, sports competition yard with stands, racetrack, shooting range...