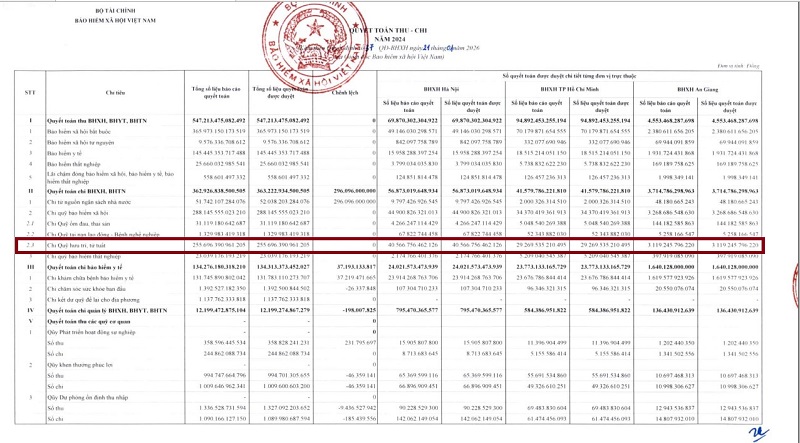

According to a report by Vietnam Social Security, in fiscal year 2024, the total revenue of Vietnam Social Security reached 547 trillion VND.

This revenue mainly comes from compulsory social insurance with 366 trillion VND and health insurance reaching 141 trillion VND. Other revenues include voluntary social insurance of about 10 trillion VND and unemployment insurance in the total revenue structure.

Regarding budget expenditure, total expenditure for social insurance and unemployment insurance regimes nationwide is 363 trillion VND.

In which, the most important highlight is the pension and death fund with a total expenditure of up to 255 trillion VND. In addition, the Unemployment Insurance Fund has paid 23 trillion VND to support workers.

Notably, expenditures for health insurance medical examination and treatment accounted for a large proportion with 134 trillion VND. Finally, expenditures for the management of the entire industry's apparatus were finalized at 12 trillion VND.

Previously, Lao Dong Newspaper informed that pensions were adjusted according to the new Social Insurance Law from July 1, 2026, but priority was given to low-wage people and people retiring before 1995, so not everyone was increased equally.

According to the 2024 Law on Social Insurance, effective from July 1, 2025, pension adjustments in the coming time will be implemented according to a new mechanism, linked to the consumer price index (CPI) and the balancing capacity of the state budget as well as the Social Insurance Fund.

Article 67 of the 2024 Law on Social Insurance stipulates that pensions are adjusted based on the increase in the consumer price index, in accordance with the capacity of the state budget and the Social Insurance Fund. This means that when living costs increase, the State will consider adjusting pensions to ensure the actual value of the money that retirees are receiving.

Notably, the new law also sets out the requirement to adjust the pension increase level in a satisfactory way for those with low pensions and those who retired before 1995. This is a group that is suffering great disadvantages due to low salary levels and social insurance regimes in previous periods, leading to significant disparities compared to retirees in later periods. Prioritizing this group is to narrow the pension gap between generations of workers.

It's a bit of a bit of a bit of a bit of a bit of a bit.

It's a bit of a bit of a bit of a bit of a bit of a bit.

It's a bit of a bit of a bit of a bit of a bit of a bit.