High-end apartments dominate market supply

According to the Vietnam Real Estate Market Report 2025 and the 2026 Trend Forecast of the Research and Development Department of BHS Group (BHS R&D), the real estate market in 2025 recorded a clear recovery as supply and trading volume doubled compared to 2024.

In which, the North continues to play the role of "leading locomotive", with supply and transaction volume accounting for more than 50% of the entire market. The South recorded strong growth when supply in 2025 increased 3 times compared to the previous year. The Central region, although accounting for the smallest proportion, still had significant growth in both supply and transactions. Supply and transaction volume gradually increased quarter by quarter, peaking in the third quarter of 2025 before cooling down in the fourth quarter. The market-wide absorption rate in 2025 reached 90.3%, higher than the 83.7% of 2024.

In the fourth quarter of 2025 alone, the total primary supply of high-rise housing reached more than 38,000 apartments, mainly concentrated in Ho Chi Minh City (33%), Hung Yen (26.6%) and Hanoi (13%). Hanoi and Ho Chi Minh City alone recorded nearly 17,600 apartments in the quarter. The market also witnessed 52 new projects or new subdivisions, providing more than 30,300 apartments.

Q4/2025 transaction volume reached more than 31,400 units, in which Ho Chi Minh City continued to dominate with many consecutive sales openings, many projects achieved a consumption rate of 90 - 100% immediately after launching.

In Hanoi, the supply of high-rise housing in the fourth quarter of 2025 decreased sharply compared to previous quarters, reaching more than 5,000 units, down 58% compared to the previous quarter and down 63% compared to the same period in 2024. However, the transaction volume still reached nearly 4,100 units, with an absorption rate of 81.4%.

According to rankings, Grade A and luxury apartments accounted for nearly 85% of the total supply in the quarter, leading to a large concentration of transactions in these two segments. The market almost no longer has Grade C apartments. For the whole year 2025, the supply and transaction volume of apartments in Hanoi reached more than 22,000 units and 21,000 units respectively, down 31.4% and 30.4% respectively compared to 2024.

Apartments under 55 million VND/m2 almost disappear in Hanoi

According to BHS R&D, the Hanoi high-rise housing market currently has almost no more apartments priced below 55 million VND/m2. The average new asking price in the fourth quarter of 2025 reached more than 122 million VND/m2, an increase of nearly 9% compared to the previous quarter and an increase of more than 42% compared to the same period last year, due to the increase of high-end projects and projects entering the handover phase.

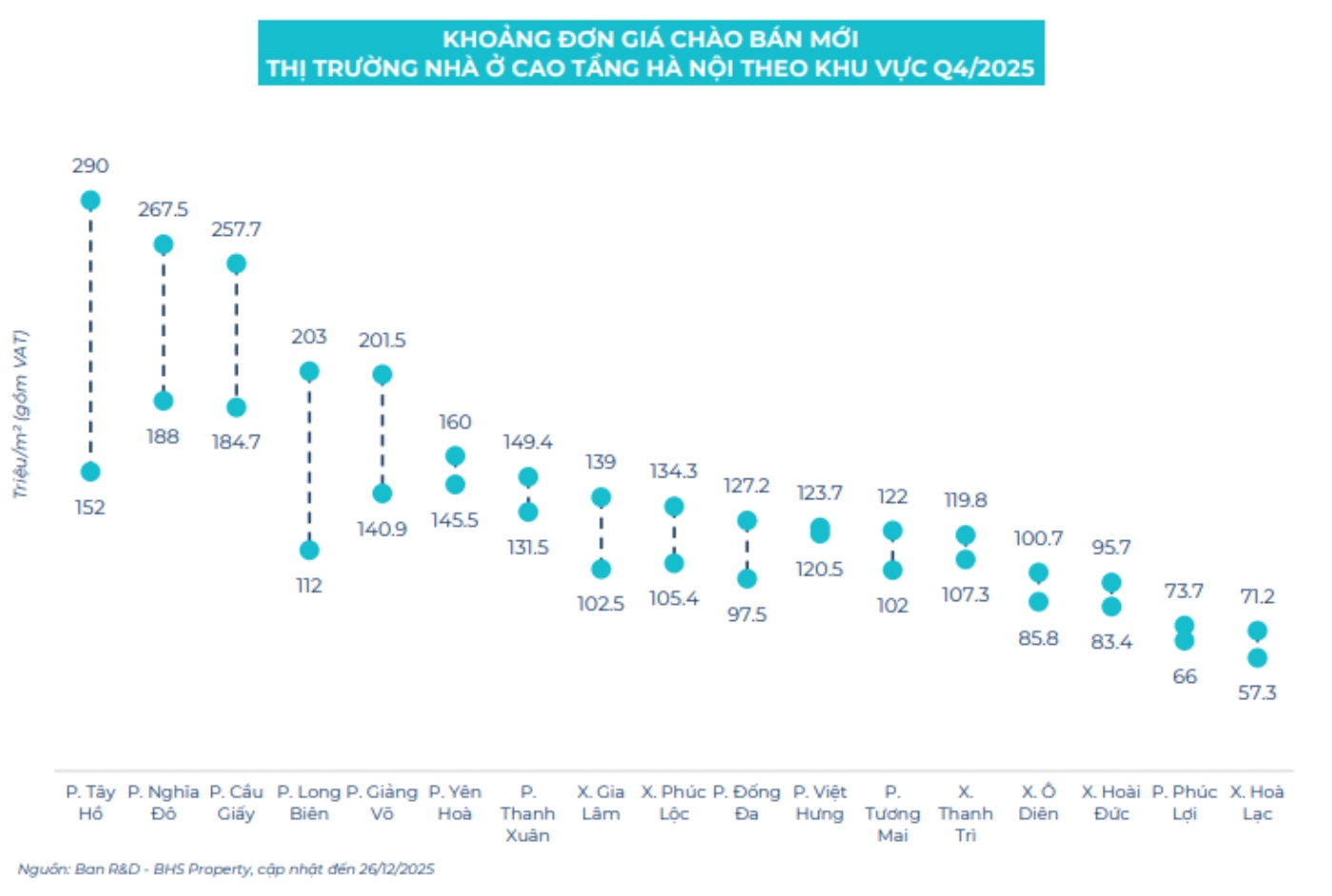

The period 2021 - 2025 witnessed the price range increasingly expanding, reflecting the strong differentiation of the market. The highest price once reached nearly 320 million VND/m2 in the third quarter of 2025, while the lowest price only fluctuated around 40 - 50 million VND/m2, causing the difference between the high-end and affordable segments to be nearly 8 times by the end of 2025. The areas with the highest primary price currently include Tay Ho, Nghia Do, Cau Giay, Long Bien and Giang Vo wards. In which, Tay Ho ward area recorded new apartment prices for sale in the fourth quarter of 2025 reaching the highest level with prices ranging from 152 - 290 million VND/m2.

In Ho Chi Minh City, supply and transactions in Q4/2025 continued to increase. Primary supply reached nearly 12,500 units, an increase of 17.4% compared to the previous quarter and 1.8 times higher than the same period last year.

Primary selling prices tend to decrease in the second half of 2025, mainly due to the merger of Binh Duong and Ba Ria - Vung Tau into Ho Chi Minh City, pulling down the average newly offered price level, although it still increased by 14% compared to the same period last year. The price range in Ho Chi Minh City is still very large, with the highest price ever fluctuating from 400 - 600 million VND/m2, while the lowest price is stable below 50 million VND/m2.

However, from the beginning of 2025, this range began to narrow due to the absence of super-luxury supply at the core center. Da Kao Ward, Binh Trung Ward and Thanh My Tay Ward are the areas with the highest apartment prices in the fourth quarter of 2025.

BHS Group forecasts that the period 2026 - 2027 will witness a boom in apartment supply, with many large projects preparing to launch, mainly concentrated in areas adjacent to major cities, where there is a large land fund and more reasonable prices. Meanwhile, the inner city area continues to cling to high prices and under infrastructure pressure.

In the context that selling prices at the end of 2025 have approached the "peak" threshold and new supply is expected to increase sharply, apartment prices in the coming time are forecast to remain flat or only increase slightly.