Based on Article 13 of Decree 88/2024/ND-CP amended by Clause 1, Article 10 of Decree 151/2025/ND-CP and Clause 4, Article 11 of Decree 49/2026/ND-CP stipulating compensation for non-agricultural land that is not residential land when the State recovers land as follows:

1. Households and individuals who are using land for non-agricultural, commercial, and service production and business purposes before July 1, 2014 and do not have land use right documents, if they meet the conditions for compensation specified in Clause 1, Article 5 of Decree 88/2024/ND-CP, are entitled to compensation according to the area already used and recovered; the type of land for compensation calculation is applied as in the case of land allocated by the State with land use fees, stable long-term land use term.

2. Households and individuals who are using non-agricultural land that is not residential land before July 1, 2014 and have violated the land law, if they meet the conditions for compensation specified in Clause 2, Article 5 of Decree 88/2024/ND-CP, will be compensated for land according to the area used and recovered; the type of land for compensation calculation is applied as in the case of land allocated by the State with land use fees, stable long-term land use term.

3. Households and individuals who are using non-agricultural land that is not residential land due to being allocated without proper authority or using land due to buying, receiving liquidation, price reduction, and distribution of houses and construction works attached to land not in accordance with regulations before the 2024 Land Law takes effect, if they meet the conditions for compensation specified in Clause 3, Article 5 of Decree 88/2024/ND-CP, the compensation for land shall be implemented according to the following regulations:

- Land that has been used stably before October 15, 1993 shall be compensated for land according to the provisions of point c, clause 2, Article 8 of Decree 88/2024/ND-CP;

- Land used stably from October 15, 1993 to before July 1, 2014 shall be compensated for land according to the provisions of point c, clause 3, Article 8 of Decree 88/2024/ND-CP;

- In case the land is allocated from July 1, 2014 to before the 2024 Land Law takes effect, and there are documents proving that money has been paid to use the land, it will be compensated for land according to the provisions of point c, clause 3, Article 8 of Decree 88/2024/ND-CP.

4. Land compensation for households and individuals currently using non-agricultural land that is not residential land under land use limits specified in Clause 1, Article 99 of the 2024 Land Law shall be implemented as follows:

- In case compensation is made with land for the same purpose of use as the recovered land type, the land use term for compensation is the remaining use term of the recovered land.

In case land users have a need to increase the land use term, the land use term shall be determined according to the provisions of Article 172 of the 2024 Land Law and land users must pay land use fees and land rent for the term increased compared to the remaining land use term of recovered land;

- In case of monetary compensation, the determination shall be according to the provisions of Clause 7, Article 13 of Decree 88/2024/ND-CP;

- In case of compensation in the form of land with a purpose of use different from the type of recovered land or in the form of housing, it shall be implemented according to the provisions of Article 4 of Decree 88/2024/ND-CP.

5. In case households and individuals are compensated for land according to the provisions of Clause 2, Article 99 of the 2024 Land Law, compensation is carried out according to the provisions of Clause 4, Article 13 of Decree 88/2024/ND-CP.

6. In case land users are compensated for land according to the provisions of Article 100 of the 2024 Land Law, it shall be implemented as follows:

- Land compensation is carried out for cases of recovering the entire land area of the project or the remaining area after recovery is not sufficient for the project to continue and is carried out according to the provisions of point a, clause 4, Article 13 of Decree 88/2024/ND-CP;

- In case of monetary compensation, the determination of the compensation amount shall be carried out in accordance with the provisions of Clause 7, Article 13 of Decree 88/2024/ND-CP.

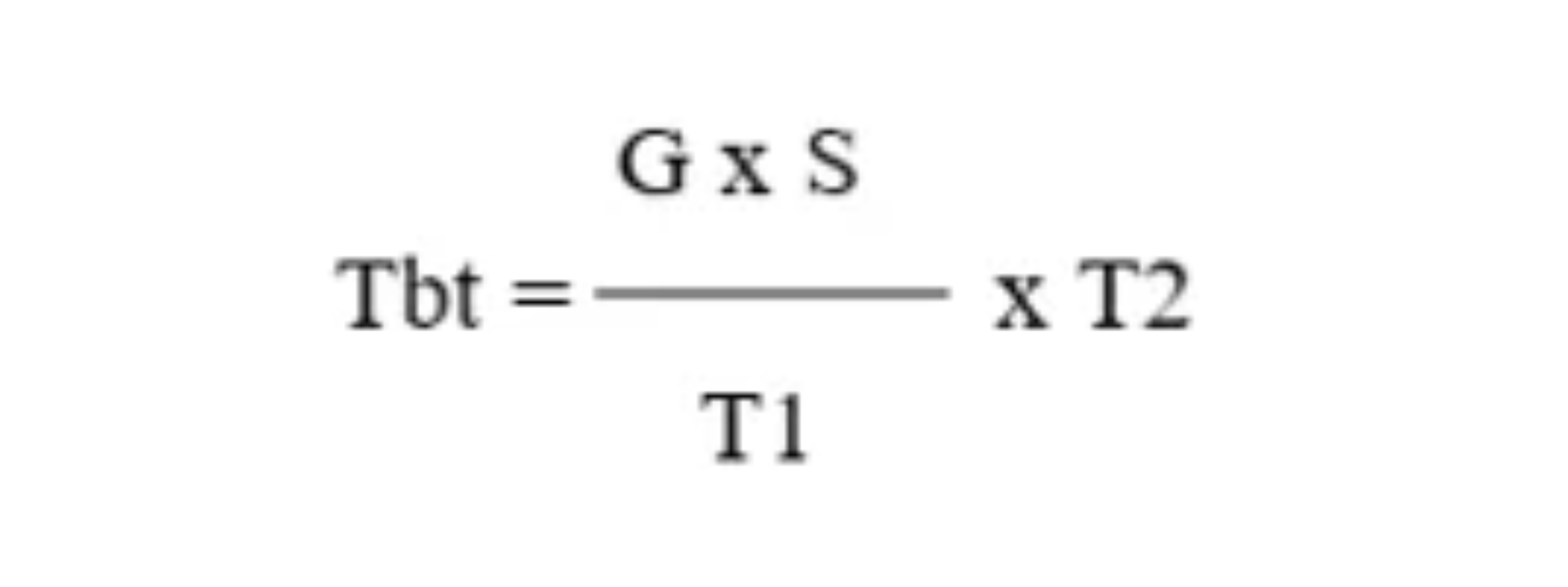

7. In case the person currently using non-agricultural land is not residential land belonging to land used for a definite term but is compensated in cash according to the provisions of Article 13 of Decree 88/2024/ND-CP, it is determined as follows:

In which:

The amount of compensation;

Land price calculated according to the land price table and the land price adjustment coefficient for cases specified in Clause 3, Article 5 of Resolution 254/2025/QH15 or calculated according to specific land prices for cases specified in Clause 5, Article 7 of Resolution 254/2025/QH15 at the time of approval of the compensation, support, and resettlement plan.

Area of land recovered;

T1: Land use term;

T2: Remaining land use term: equal to (=) land use term minus (-) the term of land use calculated to the time of approval of the compensation, support, and resettlement plan.

8. Households and individuals who are using commercial and service land, non-agricultural production facilities land, and other non-agricultural land with a long-term stable use term that are eligible for compensation according to regulations when the State recovers land are compensated according to the type of recovered land specified in Clause 4, Article 171 of the 2024 Land Law.

9. For the remaining recovered area of the land plot but not compensated for land according to the provisions of Clauses 1, 2 and 3, Article 13 of Decree 88/2024/ND-CP, the commune-level People's Committee shall decide on other support for each specific project based on the actual situation in the locality.