The latest land price list for District 1 in Ho Chi Minh City?

YouMe Law Firm LLC said that from October 31, 2024 to December 31, 2025, the latest residential land price list in District 1 of Ho Chi Minh City will be implemented according to the new land price list issued with Decision 79/2024/QD-UBND.

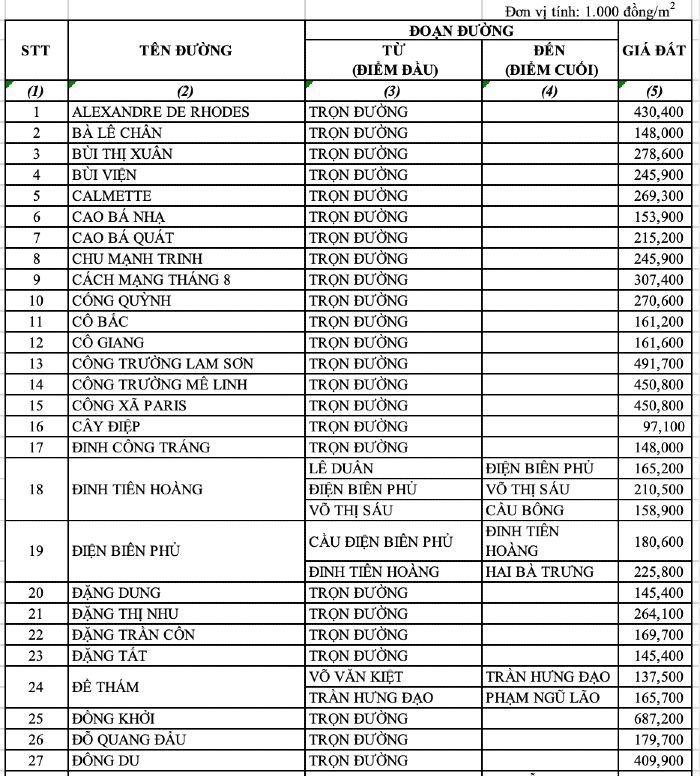

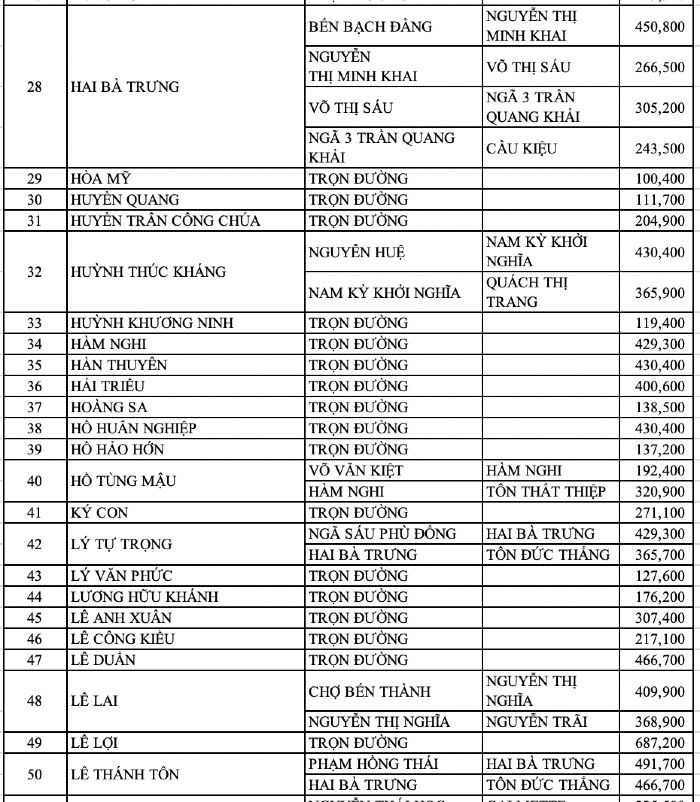

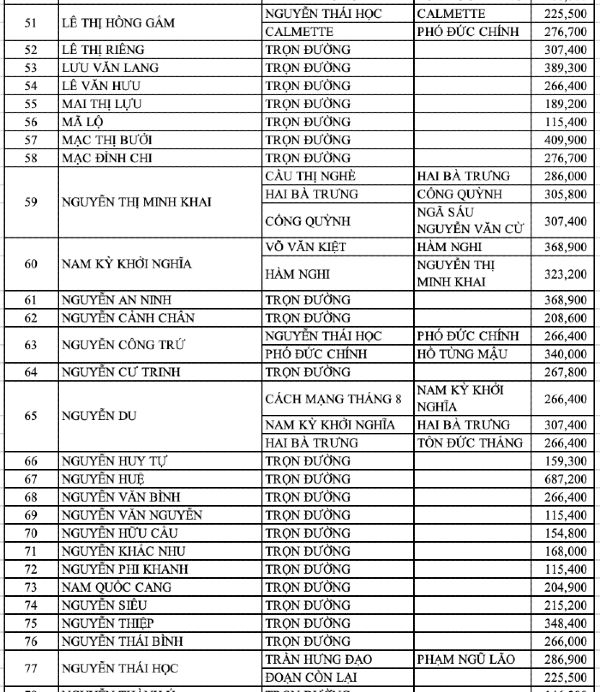

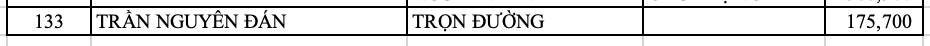

The land price list of District 1, Ho Chi Minh City is as follows:

points to note in the new land price list

- Location 1 in Table 8 (attached Appendix 2)

+ The remaining positions are calculated according to Point b, c, Clause 1, Article 4 of the Regulations issued with Decision 02/2020/QD-UBND (amended in Decision 79/2024/QD-UBND), specifically as follows:

+ The following locations not adjacent to the road frontage include:

- Location 2: applicable to plots of land and land with at least one side adjacent to an alley with a width of 5m or more, calculated at 0.5 of location 1.

- Location 3: applicable to plots of land, land plots with at least one side adjacent to an alley with a width of 3m to less than 5m, calculated at 0.8 of location 2.

- Location 4: applicable to plots of land and land with remaining locations calculated at 0.8 of location 3.

- In case the above locations have a depth from the inside edge of the road (roadway, sidewalk, sidewalk) of the road frontage (according to the cadastral map) of 100m or more, the land price will be calculated down 10% for each location.

-Cases with remaining locations are applied in Table 7 (Annex 1 attached) >> Note: Currently updated.

According to the new regulations, the new land price list mentioned above is used as a basis in the following cases:

- Land price for calculating land use fees at resettlement places for people compensated for residential land, people allocated resettlement land in cases where they do not meet the conditions for compensation for residential land, which is forged land, determined according to the land price list at the time of approval of the compensation, support and resettlement plan;

- Calculating land use fees when the State recognizes the right to use residential land of households and individuals, changing the land use purpose of households and individuals;

- Calculating land rent when the State leases land and collects annual land rent;

- Calculating land use tax;

- Calculating income tax from land use rights transfer for households and individuals;

- Calculating fees in land management and use;

- Calculating fines for administrative violations in the land sector;

- Calculating compensation for the State when causing damage in land management and use;

- Calculating land use fees and land rents when the State recognizes land use rights in the form of land allocation with land use fees collection, land lease with one-time land rental fees collection for the entire lease term for households and individuals;

- Calculating starting price for auctioning land use rights when the State allocates land or leases land in cases where land plots and land areas have been invested in technical infrastructure according to detailed construction planning:

- Calculating land use fees for cases of land allocation without auctioning land use rights to households and individuals;

- Calculating land use fees in cases of selling state-owned houses to tenants.

Decision 79/2024/QD-UBND takes effect from October 31, 2024 to December 31, 2025.