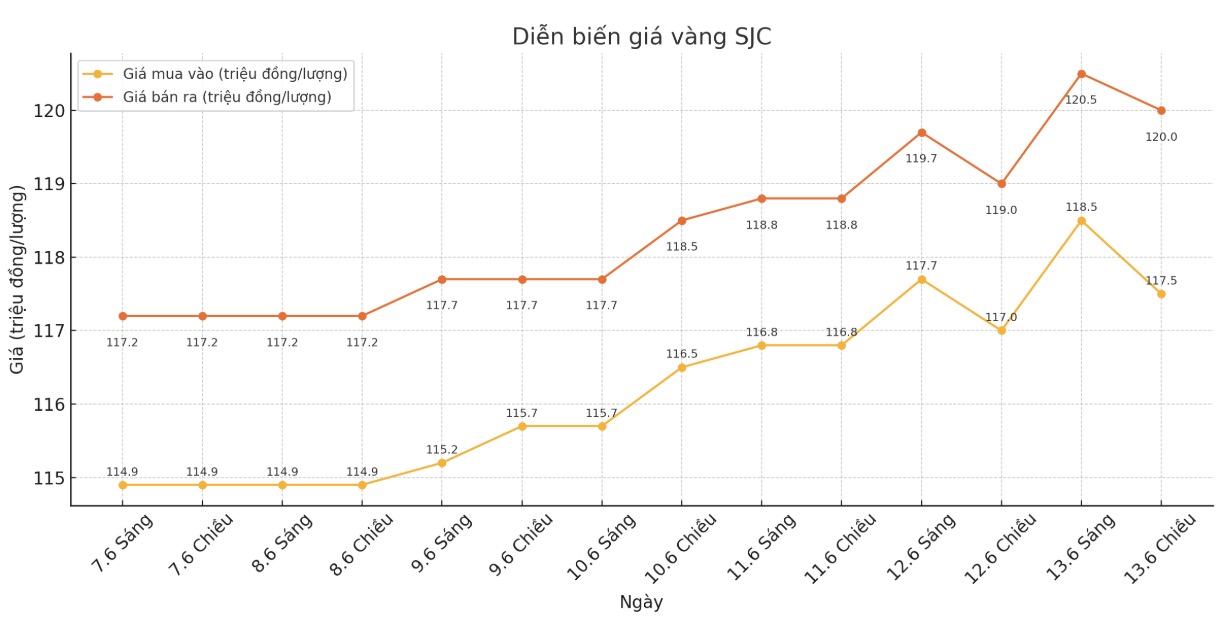

SJC gold bar price

As of 6:05 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 117.5-120 million/tael (buy - sell); increased by VND 500,000/tael for buying and increased by VND 1 million/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.5-120 million VND/tael (buy - sell); increased by 500,000 VND/tael for buying and increased by 1 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-120 million VND/tael (buy - sell); increased by 500,000 VND/tael for buying and increased by 1 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117-120 million VND/tael (buy - sell); increased by 700,000 VND/tael for buying and increased by 1 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

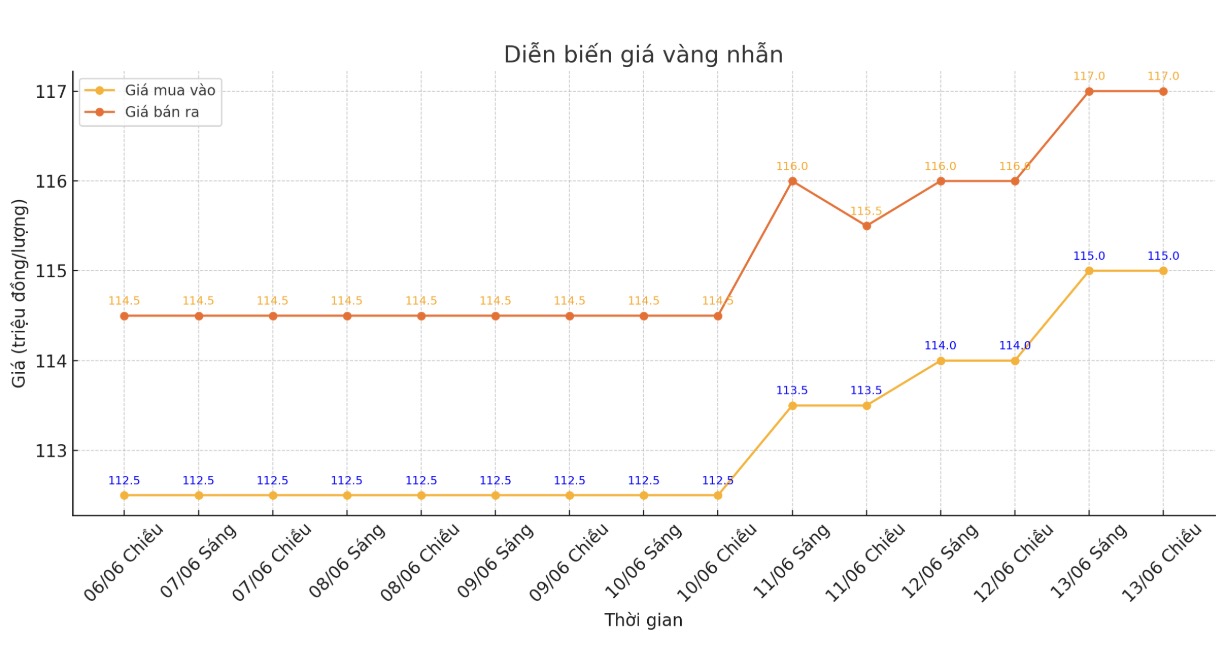

9999 gold ring price

As of 6:05 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 115-117 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114-117 million VND/tael (buy - sell), an increase of 1.2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

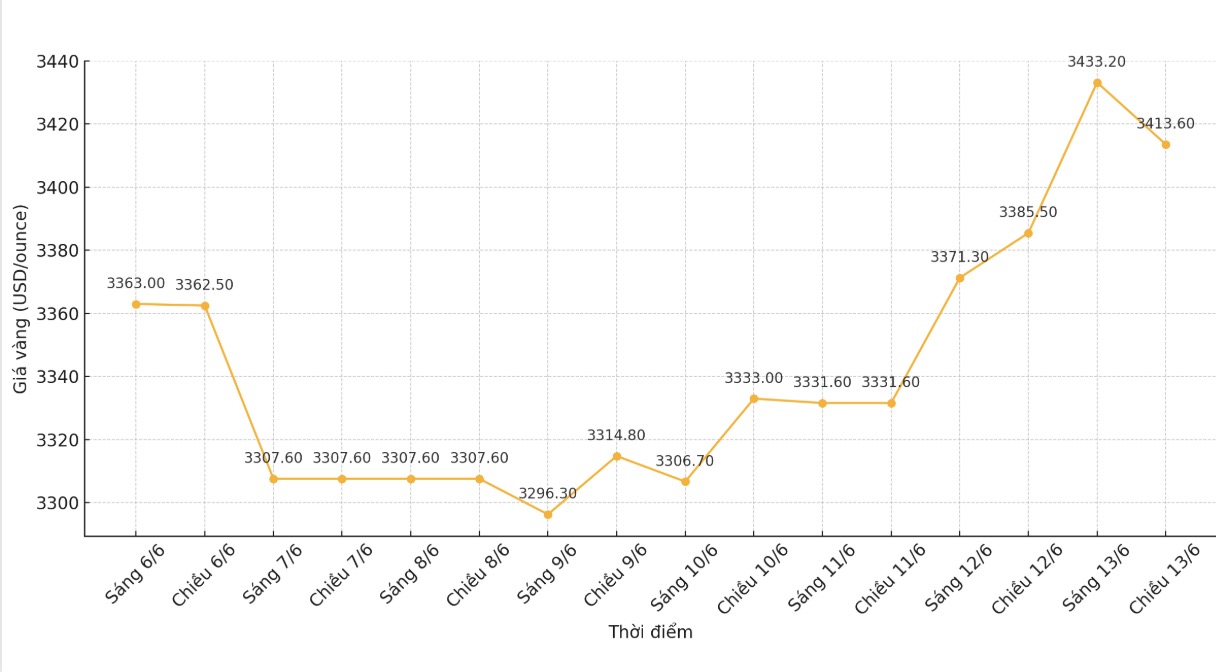

World gold price

The world gold price was listed at 6:10 p.m. at 3,413.6 USD/ounce, up 28.1 USD.

Gold price forecast

Gold prices rose to nearly two-month highs on Friday, driven by increased safe-haven demand amid rising tensions in the Middle East.

Spot gold prices rose 1.2% to $3,423.49 an ounce at 09:51 GMT, after hitting a new high since April 22 in the trading session. Gold prices have risen more than 3.5% this week.

US gold futures also rose 1.2% to $3,444.1 an ounce.

The Middle East has fallen into an intensified conflict as Israel conducts attacks on Iran. Israel said it had targeted nuclear facilities, ballistic missile factories and military commands. At the same time, it said that this was the beginning of a long campaign to prevent Tehran from developing nuclear weapons.

Iran has launched about 100 drones towards Israel in retaliation.

This increased stress has added an uncertain factor to the market, right after US President Donald Trump's trade policies.

"Currently, these attacks have contributed to the optimistic sentiment in the gold market... with the situation still changing. It is too early to say whether this shock will cause gold prices to increase steadily. If there is disruption in oil supply either directly or indirectly by political measures or if the conflict spreads in the region, gold could have a longer-term reaction, said Carsten Menke, an analyst at Julius Baer.

Gold is considered a safe investment in times of political and economic instability. It also tends to thrive in a low-interest- rate environment.

"We expect gold prices to reach $3,400/ounce by the end of this year and $3,600/ounce by the end of next year," Commerzbank said in a report.

physical demand for gold has weakened at major Asian centers this week as rising prices have discouraged buyers, with prices in India surpassing 100,000 rupees.

Spot silver prices were steady at 36.36 USD/ounce, platinum prices fell 1.5% to 1,274.30 USD, and palladium increased 0.5% to 1,061.06 USD. All three metals recorded growth for the week.

See more news related to gold prices HERE...