The "wave" of real estate in Ho Chi Minh City has begun

After the Lunar New Year 2025, buyers returning to the market, investors in the North are also bustlingly "hunting" for houses in the South. Demand growth in many segments, especially projects near key infrastructure projects.

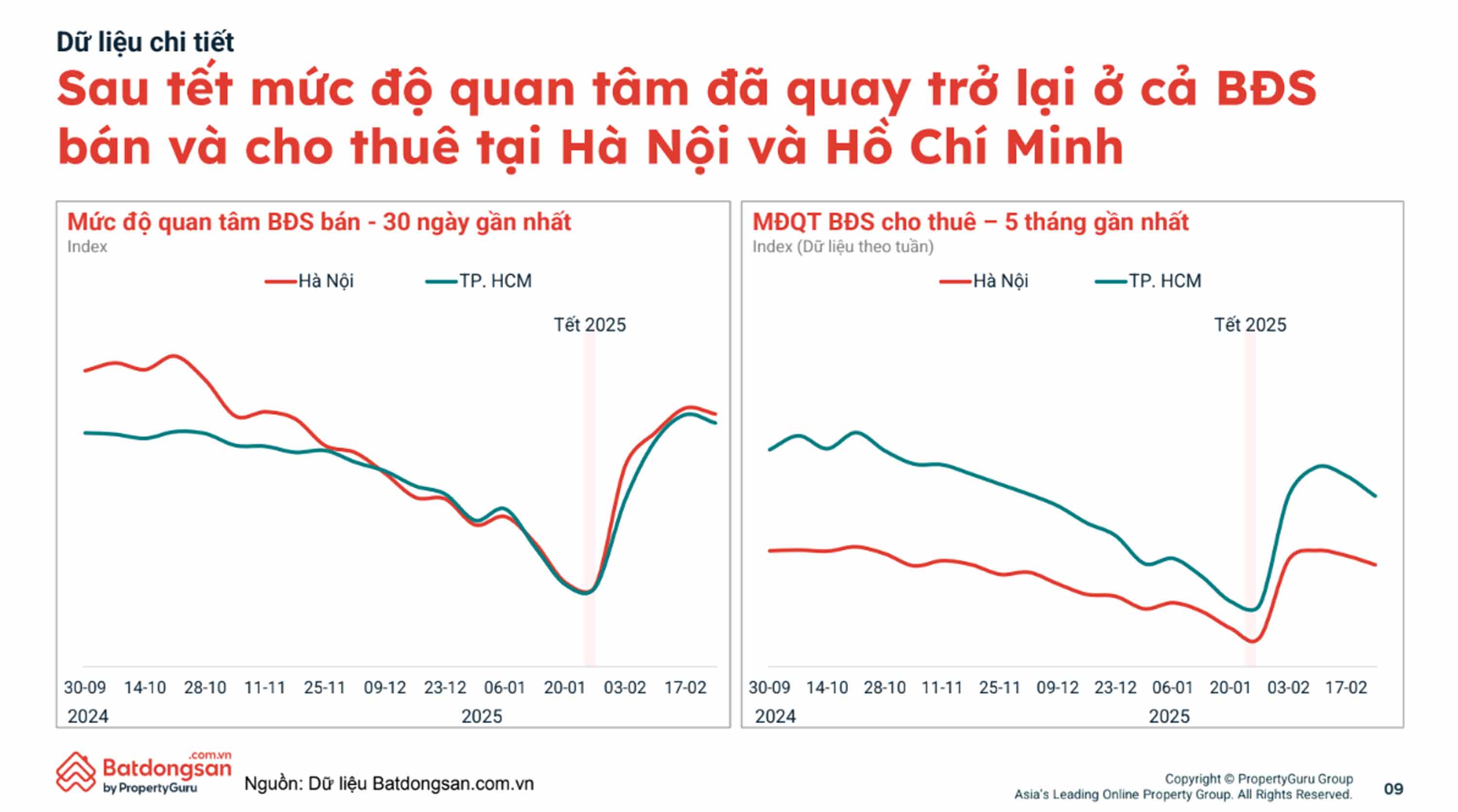

The Batdongsan.com.vn report shows that the level of interest in real estate after Tet has increased 4-6 times, reflecting the market's "going first" mentality.

At the end of 2024, the Ho Chi Minh City People's Committee issued a new Land Price List in the area. Accordingly, land prices in District 1, Le Loi and Nguyen Hue streets were adjusted to VND687.2 million/m2, Ham Nghi and Han Thuyen streets also had prices of about VND430 million/m2, an increase of more than 300% compared to the old price list.

Although still much lower than the actual price, the new price has played a role as a guideline and reference for buying and selling and transferring transactions, creating a premise for the real estate market to develop healthily and have confidence for buyers.

According to the reporter's records, since the beginning of February 2025, land in District 2 and District 9 has "heated up", increasing by 100-200 million VND/land compared to the end of 2024, but transactions have been bustling due to scarce supply.

An apartment project in Thu Thiem opened for sale at the beginning of the new year with a price of up to 450 million VND/m2, setting a new level for apartments in Thu Duc City, has also achieved an absorption rate of 100%.

In the center of District 2, an existing project that has just "growth" to introduce the riverside villa area to the market, along with the largest high-rise subdivision in the South, has attracted the attention of the market. This project benefits from completed and continuously expanded infrastructure works such as: Do Xuan Hop Street, Lien Phuong, Mai Chi Tho Avenue, An Phu Intersection, Ho Chi Minh City Expressway, Long Thanh - Dong Nai... easily accessible from District 1, Binh Thanh, Tan Son Nhat Airport, Long Thanh International Airport and neighboring provinces. This is a new central urban area of Ho Chi Minh City with full international standard amenities, from sports-entertainment centers to inter-level schools, international hospitals and commercial service systems....

Notably, the first high-rise subdivision here also received great attention from the market when it was introduced at the end of last year. The scarcity of supply, convenient transportation, full amenities, potential for business exploitation, price increase in the future and the reputation of project developers have made investors eager to own these product lines.

However, according to experts, the wave of buyers hunting for real estate in Ho Chi Minh City has just begun, transactions will continue to increase and prices may "bleep" strongly from the third quarter of 2025 onwards, when infrastructure factors, trust, policies... are strongly "permeated" the market.

Economic growth, lending interest rates decrease: motivation for home buyers

The cash flow back to real estate is said to be thanks to economic recovery, low deposit interest rates and credit support policies for home buyers, the optimistic market sentiment positively affects the real estate market.

In 2024, our country's GDP will reach 7.09%, exports will increase by 14.3%, FDI will reach 31.38 billion USD (11 months), along with major infrastructure projects, including Metro Line 1, and the approval of the new real estate business law, to increase transparency and protect the rights of buyers as well as investors, has unblocked resources and gradually warmed capital flows into real estate.

In the first 2 months of 2025, the macroeconomic situation will continue to be stable, inflation will be controlled, and consumer indexes will increase. GDP is forecast to be optimistic at 6.8% for 2025 and 6.5% for 2026 (according to the World Bank).

Over the past two years, the SBV has also maintained stable interest rates, oriented to keep deposit interest rates and reduce lending interest rates to support businesses and people, thereby promoting economic growth. As of March 1, 2025, many commercial banks continue to adjust deposit interest rates down by 0.1 - 0.4%, for medium and long terms. This move has been affecting the real estate market.

According to experts, when deposit interest rates decrease, investors prioritize high-yield assets, preventing price spikes, such as real estate and stocks. Real estate is considered a safe channel, optimal capital protection in the context of reduced savings interest rates.

Attractive loan interest rates (some banks apply preferential rates from 3.88%/year for home loans) help investors easily access capital, thereby boosting real estate demand, especially in areas with great potential such as Thu Duc - a new growth zone of Ho Chi Minh City with planning, economy and infrastructure development.

At the same time, in a low interest rate environment, real estate loans have lower interest costs, increase profits from buying and selling and renting, thereby promoting the value of investment portfolios, especially for long-term investments.

Obviously, the excitement of the Ho Chi Minh City market on the first day of the year not only reflects the health of the economy but also marks a new development cycle of real estate. Many people quickly joined the market to seize the opportunity to increase investment value in the context of interest rates remaining low.

In addition, legal regulations also help create a more transparent and stable environment for investors. As concerns gradually decrease, cash flow into real estate is stronger. At the same time, the strong urbanization trend, the demand for high-end housing, in the new center, urban areas developed by reputable units, guaranteed legality and handover time are still long-term and healthy growth drivers for the real estate market.

Buyers understand that this is a good time to put money down when the market is at a time of "transformation", prices have not yet increased. The opportunity belongs to those who are sensitive, taking advantage of this opportunity to invest long-term, before prices increase sharply from the third quarter of 2025 as experts have predicted.