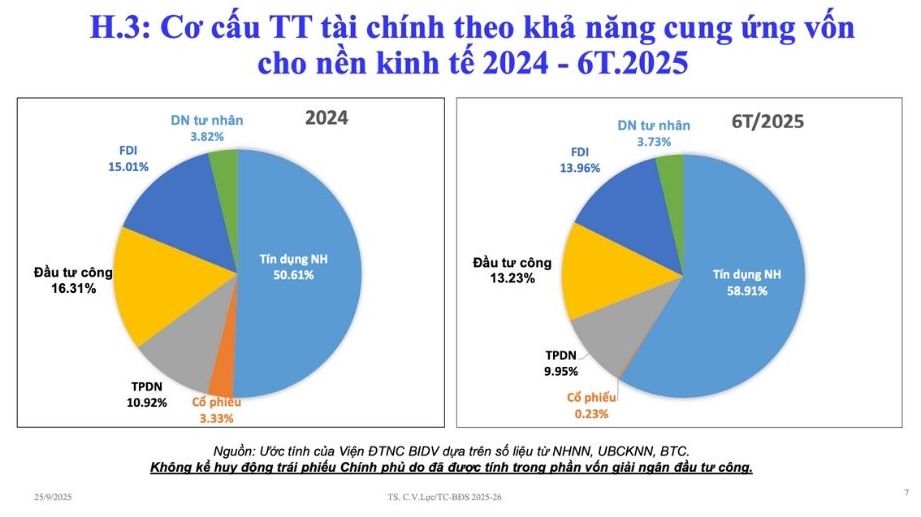

The financial market is developing rapidly, diversely but unbalanced

Speaking at the VWAS 2025 Senior Financial Advisors Forum on the afternoon of September 25, Dr. Can Van Luc - Chief Economist of BIDV - analyzed the financial market structure according to the ability to provide capital for the economy in 2024 and the first 6 months of 2025, and commented that "real estate credit is increasing too much".

Up to now, real estate business credit has increased by 20 - 21%, double the overall credit growth rate of the whole system. Lending to buy houses and repair houses to recover is slower, increasing by only 12%.

According to Mr. Luc, the reason is that the economy's dependence on banking capital is increasing. As of mid-2025, bank credit accounts for 58.91% of the total capital supply to the economy while the proportion of FDI capital and public investment is 13.96% and 13.23%, respectively. These figures at the end of last year were 50.6%, 15.01% and 16.31%, respectively.

The bond and stock channels as of mid-2025 only accounted for 9.95% and 0.23% respectively, while at the end of last year they were nearly 11% and 3.3%, respectively. This shows that the Vietnamese financial market is developing rapidly, with many products and services but the allocation is not uniform.

7 shortcomings in the real estate market

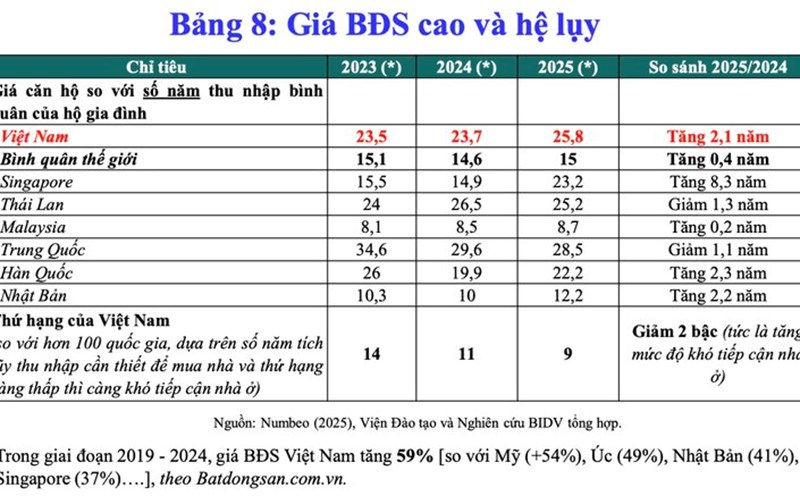

Sharing about the real estate market, in addition to many supporting factors, Dr. Can Van Luc pointed out 7 shortcomings that contribute to pushing up housing prices.

First, legal problems and the fear of mistakes and responsibility limit supply.

Second, the reality of low supply and few licensed projects leads investors to focus on investing in high-end projects due to higher profitability compared to the low-end segment.

Third, experts also pointed out that one of the biggest disadvantages of the real estate market today is the imbalance between supply and demand. "While the real demand for mid-range, low-end housing and social housing segments is very high, the supply is not enough, causing housing prices to increase" - Mr. Luc said.

Fourth, the situation of speculation and "inflating prices, making prices" still occurs. Regarding this issue, Mr. Luc frankly acknowledged: "There are 2 subjects "pricing" which are the investors themselves intentionally pushing up prices and some brokers participating in price-taking, pushing up real estate prices. According to a recent survey by Batdongsan.com.vn, with 600 investors, up to 86% of investors sold their homes within a year, only 14% of them are holding a long-term home".

Regarding real estate tax, currently, transactions only have to pay a 2% registration fee, but there is no specific real estate tax for cases such as second homes, abandoned houses or inheritance houses. Real estate tax revenue currently accounts for about 1.6% of total budget revenue, while other countries reach 4-5%.

Sixth, input costs are rising. For real estate projects from the original time until the sale of products, there are 6 costs: land valuation costs, site clearance costs, construction costs, management and operation costs.

In addition, the merger of provinces and cities such as Binh Duong province into Ho Chi Minh City also causes land prices to increase, narrowing the price list gap between regions.

Basic solutions

In order to overcome the above shortcomings, Dr. Can Van Luc offers a number of fundamental solutions:

Increasing supply by removing legal obstacles is necessary. Currently, the Government plans to establish a national housing development fund, focusing on providing social housing, affordable housing and rental housing for people.

It is necessary to strictly handle the situation of "inflating" prices, "making" prices and land auctions.

In the long term, the market needs to study the taxation of real estate according to the roadmap. This requires complete information data and takes about 1-2 years to prepare.

Strictly manage financial resources flowing into real estate. Avoid spreading investment when many businesses are implementing too many projects in the same locality at the same time, to limit risks.