Hanoi apartment prices accelerate, Ho Chi Minh City remains stable

According to data from the One Mount Group Center for Market Research and Customer Insight, in the second quarter of 2025, the Hanoi market recorded a recovery after a period of stagnation at the beginning of the year, with 7,800 newly opened apartments - nearly double compared to the first quarter of 2025.

The transaction volume also increased accordingly, reaching 7,800 units - an increase of 143% compared to the total of the first 3 months of the year - nearly equivalent to new supply - showing that the Hanoi market is still absorbing very well, although the selling price is anchored at a high level.

Meanwhile, Ho Chi Minh City welcomed about 1,900 new apartments for sale in the second quarter of 2025. Although new supply in Ho Chi Minh City is limited, the consumption exceeds supply, up to 2,900 units (up 72% over the same period), including products that have been opened for sale before. This shows that although the Ho Chi Minh City market is not exploding in supply, demand is still strong as buyers actively absorb both old and new products, especially in the East of the city.

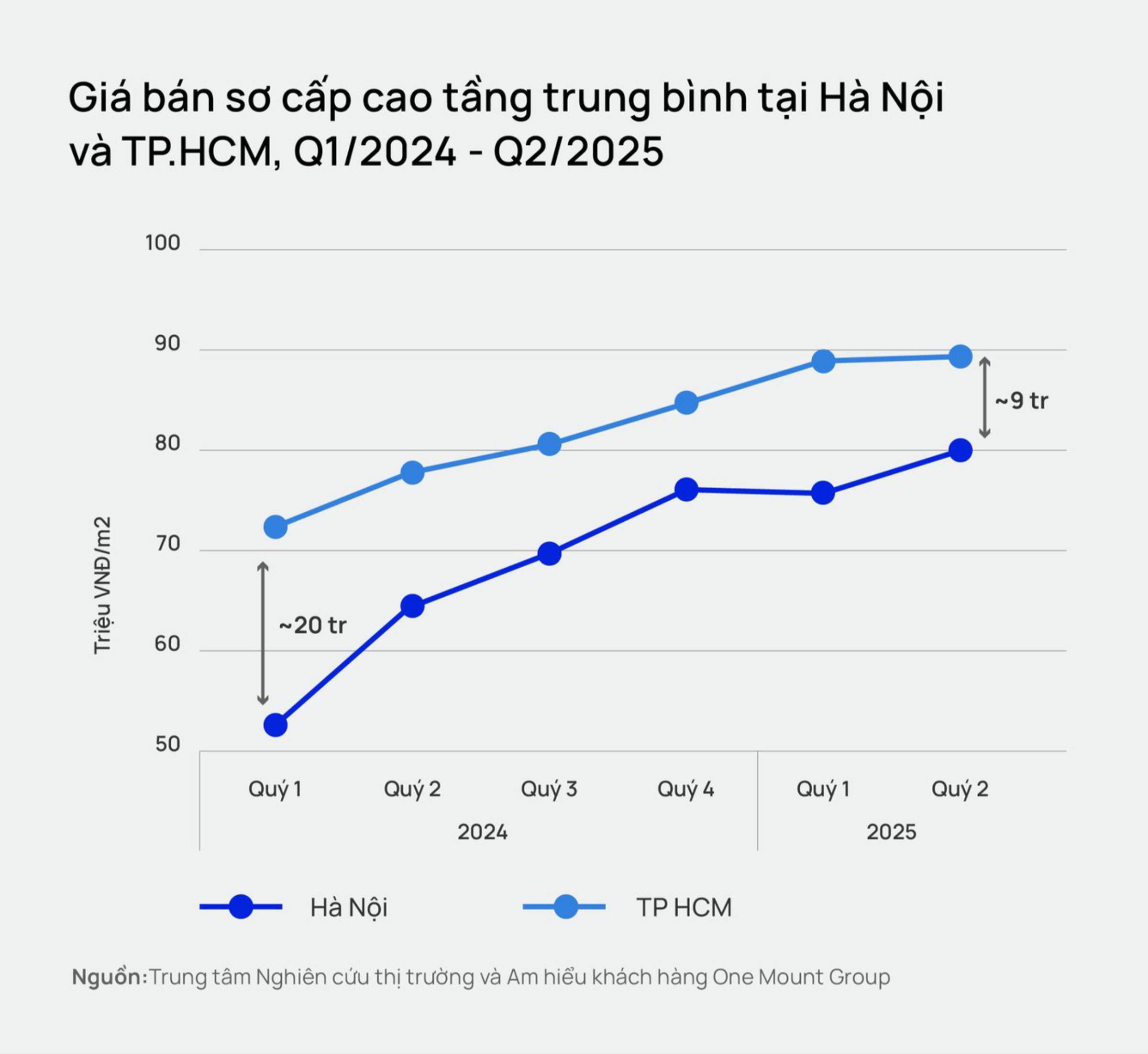

In Hanoi, the average selling price in the primary market in the second quarter of 2025 reached about 80 million VND/m2, up 5.6% compared to the previous quarter and jumped to 24% compared to the same period in 2024.

The average apartment price in Ho Chi Minh City is around 89 million VND/m2, almost unchanged compared to the previous quarter (not significantly fluctuating) and 15% higher than the same period.

Primary apartment prices in Hanoi are increasing rapidly, increasingly shortening the distance from Ho Chi Minh City. If in early 2024, the average price in Ho Chi Minh City was nearly 20 million VND/m2 higher than in Hanoi, then by mid-2025, the difference would be only about 9 million VND/m2.

Mid-range apartment disappears in Hanoi

According to Mr. Tran Minh Tien - Director of the One Mount Group Center for Market Research and Customer Insight, differences in supply structure and product segment are the main reason why Hanoi prices have increased faster than Ho Chi Minh City in the recent period.

In Hanoi, new supply in the second quarter of 2025 will focus on the high-end and luxury segments. Notably, 4 luxury projects with large quantities of products are opened for sale at an average price of more than 80 million VND/m2 (excluding VAT and maintenance costs) contributing to pushing up the average selling price.

In fact, no mid-range projects have opened for sale in Hanoi this quarter. Apartments with softer prices (under 65 million VND/m2) are only scattered in urban areas in the East of Hanoi or neighboring areas (Van Giang, Hung Yen).

Meanwhile, in Ho Chi Minh City, supply is limited but the structure is more diverse. In particular, in the second quarter, there were two mid-range segment projects (accounting for about 42% of new supply), so the average price of the Ho Chi Minh City market did not increase dramatically but maintained a sideways state.

Mr. Tran Minh Tien from One Mount Group predicts that the price of primary apartments in Ho Chi Minh City could reach 100 million VND/m2 by the end of 2025 if the market absorbs the large supply of high-end goods in the near future.