Motor vehicle insurance is a key business but has high potential compensation risks

According to the FCTC of the first quarter of 2025 of Petrolimex Insurance Corporation (PJICO), net revenue from insurance business activities reached VND 894.3 billion, almost unchanged compared to the same period last year. Total insurance business expenses also increased slightly to VND652.3 billion, while compensation expenses increased sharply by 24%, to VND425 billion.

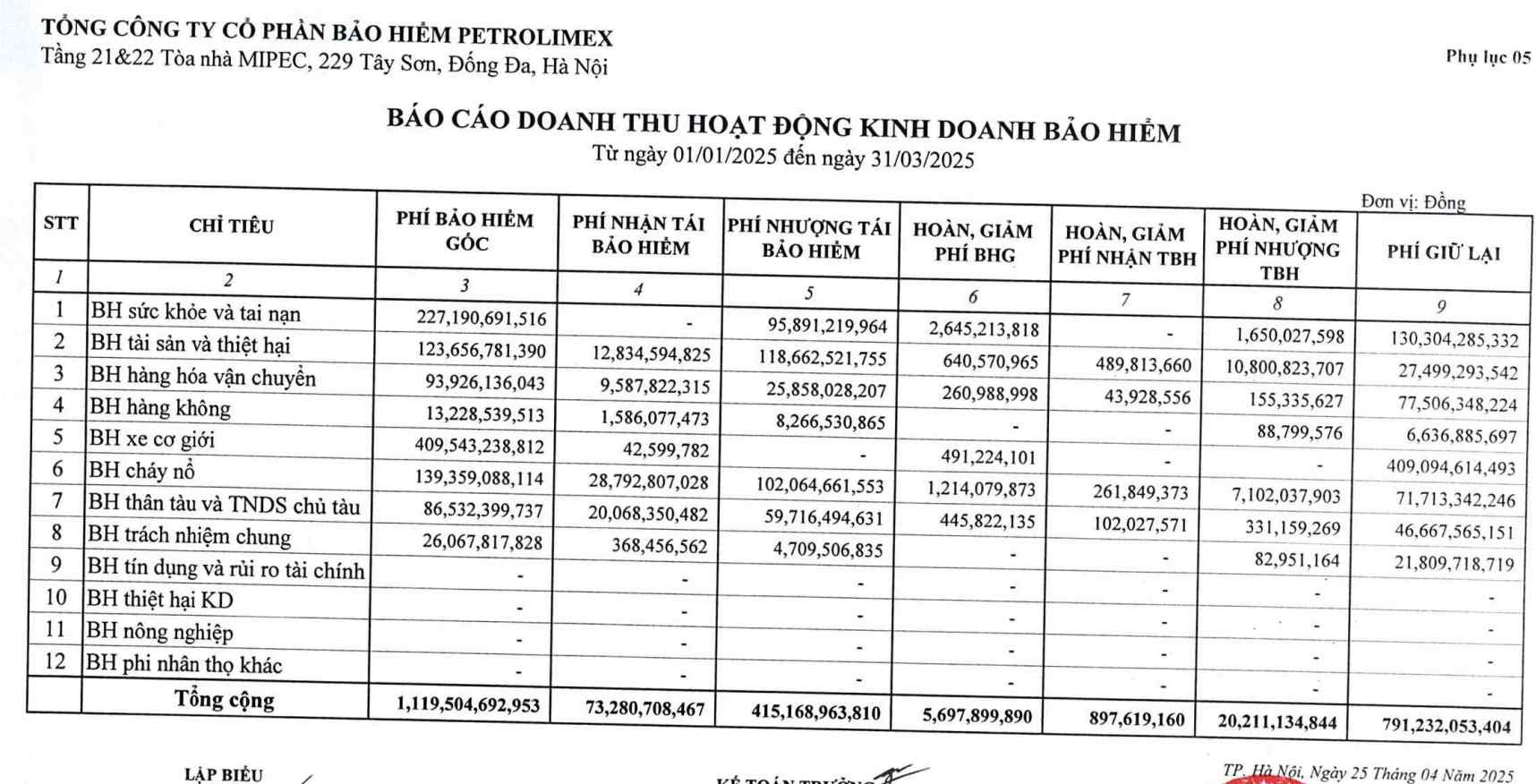

Total insurance premium revenue this quarter reached VND1,167 billion, up 4.2% over the same period, with the majority coming from principal insurance premiums of more than VND1,119 billion.

Motor vehicle insurance continues to be the largest contributor, bringing in 409.5 billion VND in revenue, accounting for more than 36% of the total principal insurance premium. Health insurance and accident insurance ranked second with 227.2 billion VND, followed by fire and explosion insurance (139.4 billion VND), property and damage (123.7 billion VND), ship owner's body and assets (86.5 billion VND).

PJICO recorded up to VND 415.2 billion in reinsurance transfer fees, focusing on high-risk operations such as fire and explosion, assets, vehicle bodies and transported goods. In parallel, the enterprise also collected 73.3 billion VND in reinsurance fees. After deducting transfers, refunds and related costs, PJICO's total retained insurance premium reached more than VND 791.2 billion. Of which, motor vehicles contributed the largest with more than 409 billion VND.

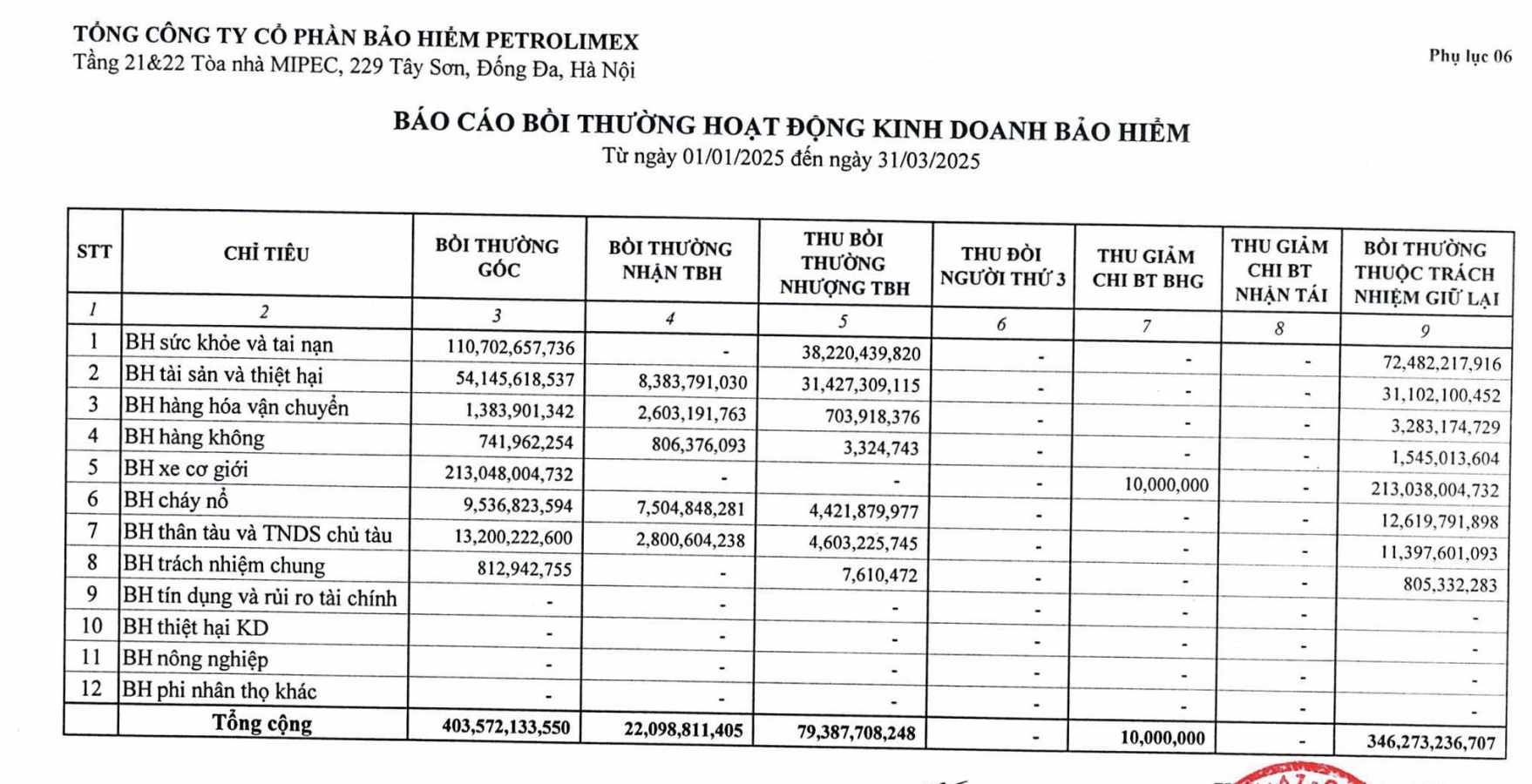

In the compensation report for insurance business activities, motor vehicle insurance continues to be the business that accounts for the largest proportion of compensation costs. The total principal compensation for motor vehicle insurance is up to more than VND 213 billion, accounting for about 52.8% of the total compensation cost of all insurance activities during the period.

Notably, all of this compensation is the responsibility of the enterprise to retain it, without support from reinsurance. This shows that businesses are taking on all the compensation risks arising from motor vehicle operations themselves, instead of sharing the risks with reinsurance businesses as in many other operations such as fire and explosion, transportation goods or body insurance.

While this strategy can help the company optimize profits under good loss control, it also poses great risks if the compensation ratio increases or events cause great damage appear. The payment of almost all compensation costs for motor vehicles from retained sources shows that this is a segment that brings in both large revenue and significant cost burden in Petrolimex's insurance business structure.

At the end of the first quarter of 2025, PJICO recorded after-tax profit of VND 71.3 billion, up slightly over the same period. This result was achieved thanks to good control of business management costs - down 4.8% to VND185 billion, along with other income that doubled, reaching VND17.5 billion.

Investing VND497 billion in stocks and bonds

As of March 31, 2025, PJICO recorded total assets of VND 8,489.9 billion, almost unchanged compared to the beginning of the year. Short-term assets continue to dominate with more than VND 7,128 billion, of which short-term financial investment remains at a high level of VND 4,137 billion. The largest contributor is VND 4,088 billion in term deposits, in addition to VND 22.4 billion in short-term investment stocks and VND 30 billion in other investments.

A notable item in the asset structure is reinsurance assets up to VND 2,015 billion, accounting for nearly 24% of total assets. This clearly reflects PJICO's orientation in using reinsurance as a tool to spread financial risks. Meanwhile, money and money equivalent items decreased by about 10%, to 135.4 billion VND. Inventory also doubled sharply to VND40.6 billion, and customers had to collect a slight increase, reaching VND551 billion.

Long-term assets recorded VND 1,361 billion, a slight increase mainly due to the increase in the value of fixed assets and intangible assets. Long-term financial investments continue to remain at nearly VND595 billion. Of which, PJICO has invested VND84.8 billion in stocks and VND390 billion in bonds, totaling about VND497 billion.

However, PJICO did not explain in detail the stock code portfolio or the issuer of related bonds. The enterprise has also set aside 2.8 billion VND in reserve to reduce long-term stock investment prices and has another long-term investment at 123 billion VND.

Purely negative cash flow, debt must be paid 3.5 times more than equity

As of March 31, 2025, Petrolimex Insurance Corporation (PJICO) recorded a total capital of VND 8,489.9 billion, a slight increase compared to the beginning of the year. Of which, outstanding loans account for VND6,622 billion, about 3.5 times higher than equity (VND1,867.8 billion). The debt structure is almost entirely focused on short-term debt, with a value of VND 6,573.9 billion, while long-term debt is only at VND 48.2 billion, down slightly compared to the beginning of the term.

The majority of PJICO's debt is insurance professional reserves with a total value of more than VND 4,640 billion, accounting for about 70% of short-term debt. These provisions include: provisions for principal insurance and reinsurance fees (VND 2,320 billion), provisions for insurance compensation (VND 1,913 billion), and large-scale provisions (VND 406.8 billion). The capital structure shows stability, with financial leverage remaining high but no unusual fluctuations occurring during the period.

Regarding cash flow, in the first quarter of 2025, PJICO recorded pure cash flow from business activities at VND63.9 billion, down sharply compared to VND152.7 billion in the same period last year. Cash flow from investment activities continued to be negative at VND 21.9 billion, but improved compared to the same period last year.

Financial activities also recorded a negative cash flow of VND 56.7 billion, mainly due to principal repayment of up to VND 289.6 billion, nearly three times higher than the same period, along with a dividend of nearly VND 109 billion. Meanwhile, the enterprise has newly borrowed VND 341.7 billion, a sharp increase compared to VND 68.9 billion in the same period, showing the need for additional working capital or financial restructuring.

As a result, PJICO's net cash flow in the first quarter of 2025 was negative by 14.7 billion VND, while the same period last year was positive at 27 billion VND.