According to a new report by Batdongsan.com.vn, in the first two months of 2025, the asking price of land in the suburbs of Hanoi increased by 30% to 80% depending on the area, for example, Quoc Oai recorded an increase of 74%. This shows that land prices in the suburbs still tend to grow well after a year.

However, interest in land has not increased accordingly, even showing signs of moving sideways or decreasing slightly. This partly reflects that the number of transactions has not had many changes compared to last year.

Mr. Nguyen Quoc Anh - Deputy General Director of Batdongsan.com.vn - said that there are a number of reasons for this trend. First of all, land prices in the suburbs of Hanoi have increased continuously in recent years, causing many investors and buyers to wait and observe the market before deciding. In addition, in recent times, after information about the plan to merge some provinces, speculators tend to look for opportunities in provincial areas instead of focusing on land near the capital as before" - Mr. Quoc Anh said.

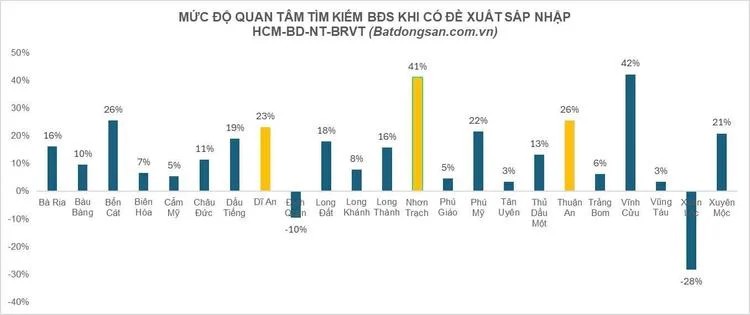

Immediately after the news of the merger appeared, the demand for real estate in related localities increased significantly, reflecting the interest of investors. Big data from Batdongsan.com.vn shows that the level of interest in areas such as Nhon Trach recorded an increase of 41%, Thuan An (Binh Duong) and Di An (Binh Duong) increased by 26% and 23%, respectively.

Real estate prices in these areas also show signs of increasing but are not uniform. Binh Duong maintains a stable growth trend, showing sustainable development.

However, in Nhon Trach and Ba Ria Vung Tau, prices have increased by 20-30%, approaching the peak of 2022 - the time when many large investors are out of stock. This raises questions about the possibility of the market being pushed up too quickly and poses a potential risk of correction.

Mr. Dinh Minh Tuan - Southern Regional Director of Batdongsan.com.vn - said that this period has many potential risks, especially for new investors entering the market. Real estate prices not only depend on merger information but are also affected by many other factors such as infrastructure, location, job demand, immigration, and local economic foundation.

He recommended that buyers and investors should pay attention to risks such as changes in planning or slower-than-expected mergers; the risk of buying at prices higher than real value, especially in areas with hot growth.

Mr. Dinh Minh Tuan emphasized: It is undeniable that synchronously connected infrastructure will attract investment in developing industry, services, tourism, and rapid urbanization. Therefore, the demand for housing, commercial services, and tourism has increased, causing real estate prices to increase, but there will be people who take advantage of information to push up real estate prices for profit. They use tricks to create waves, make profits, then withdraw and leave many side effects. In particular, in the face of the current merger information, investors must be alert, cautious in reviewing and analyzing all aspects, choosing to buy in the right place, at the right time, avoiding following the crowd psychology and then suffering losses".