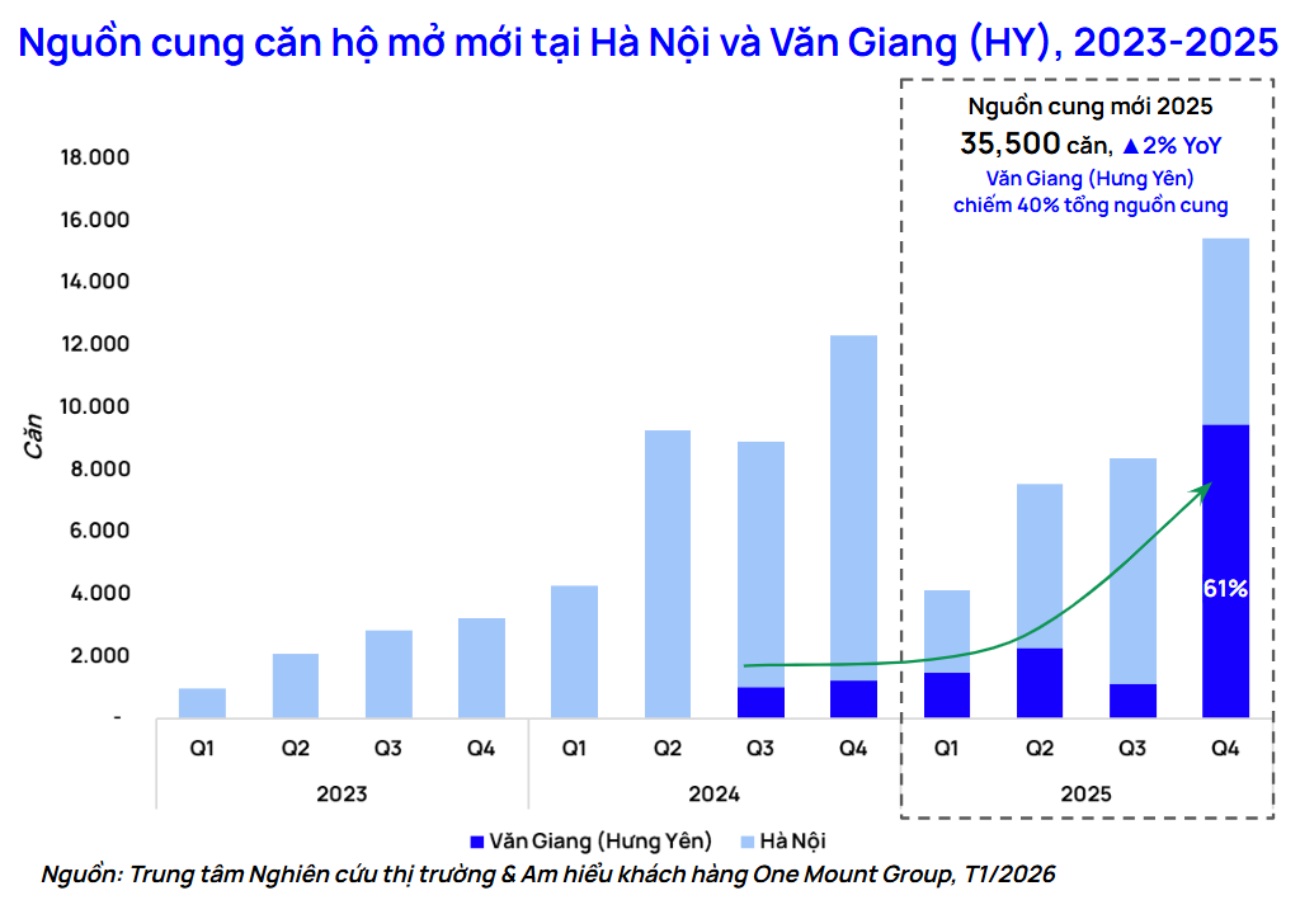

According to the One Mount Group Market Research and Customer Understanding Center, 2025 continues to affirm the stable growth momentum of the Hanoi primary apartment market. The total new supply of the whole market reached about 35,500 units, an increase of 2% compared to 2024, reflecting positive signals about investor confidence as well as market absorption capacity, in the context of macroeconomic and legal framework gradually stabilizing.

Notably, the supply structure recorded a clear shift to the Van Giang area (Hung Yen). In 2025, this area contributed about 40% of the total new supply, a sharp increase compared to 7% in 2024. In the fourth quarter of 2025 alone, Van Giang became the driving force leading the supply of the entire market thanks to 4 large-scale high-rise projects simultaneously launching goods, accounting for more than 60% of the new sales in the quarter.

Stepping into 2026, the trend of moving the supply of apartments to the East (Hanoi) and Van Giang (Hung Yen) areas is forecast to continue to increase and play a leading role in the supply structure of the market.

According to forecasts by the One Mount Group Market Research and Customer Understanding Center, about 54% of the new primary apartment supply in 2026 will be concentrated in this area, led by large urban areas and large-scale high-rise projects.

In parallel with the increase in supply, the price level of primary apartments in Hanoi in 2025 recorded gradually stabilizing towards the end of the year, after a period of continuous "hot" growth from 2024. The average selling price of the whole market in the fourth quarter of 2025 reached about 86 million VND/m2, almost flat compared to the previous quarter.

In Van Giang (Hung Yen), the average primary selling price is only about 67 million VND/m2, the lowest in the entire market. Meanwhile, the price of primary apartments in the inner city of Hanoi averages about 109 million VND/m2, 1.6 times higher. Thus, apartment prices in Van Giang are only about 62% compared to the inner city of Hanoi, creating clear space to access housing for buyers, and contributing to keeping the general price level of the entire market in a more stable state.

Mr. Tran Minh Tien - Director of One Mount Group Market Research and Customer Understanding Center - said that according to survey data from One Mount Group on the income structure of homebuyers, about 95% of households in Hanoi belong to the group of public income and fairly well-off income.

In the context that the price level in the inner city has far exceeded the affordability of the majority, areas such as Van Giang (Hung Yen) - where selling prices are more reasonable but still ensure infrastructure and growth potential are becoming the priority choice of the market.

The survey results of 328 customers choosing to buy apartments in Van Giang (Hung Yen) conducted by One Mount Group Market Research and Customer Understanding Center show that, besides the trust and prestige of the investor, reasonable selling price is an important factor when making a purchase decision, followed by the potential for price increase and amenities, synchronous and modern living environment.

In addition, this development also shows that the East (Hanoi) and Van Giang (Hung Yen) areas are entering a similar development phase to the "city on the other side of the river" models in many major cities around the world. This is not only a geographical expansion, but also reflects the population reduction policy and the formation of new urban axes in the east of the capital.