Apartment prices are increasing rapidly, has the market peaked?

After a period of strong increase, the Hanoi apartment market is entering a phase of differentiation, when prices are still high, but according to experts, investor sentiment is starting to be wary of the risk of stagnation.

According to Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, although prices have increased sharply recently, liquidity in the apartment market is still maintained at a high level. However, Mr. Quoc Anh believes that the hot increase in Hanoi apartment prices has strongly impacted market sentiment.

Hanoi apartment prices are increasing too rapidly, leading to many investors fearing that the apartment market is reaching its peak," he said.

He assessed that risks arise when prices have increased continuously for a long time, while investor sentiment is starting to worry about the possibility of adjustment.

Records from actual transactions also show clearer signs of differentiation in the secondary market. Mr. Le Dinh Chung - Vice Chairman of the VARS Real Estate Market Research and Evaluation Council - said that in Hanoi, apartment selling prices have increased rapidly in a short time, many areas recorded an increase from hundreds of millions to billions of VND per unit. However, by the end of the year, the upward trend tended to slow down, with the appearance of "loss-cutting" sales by a part of investors buying according to FOMO psychology during the hot growth period. However, according to Mr. Chung, the price level in the central area is generally still maintained stably.

Notably, data from Cushman & Wakefield released on January 29, 2026 shows that the average primary apartment selling price in Hanoi in Q4/2025 reached about 3,852 USD/m2, down 10% compared to the previous quarter but still up sharply 32% compared to the same period in 2024. The quarterly price decrease is mainly due to the increase in supply in the mid-range segment, accounting for nearly 45% of the total new supply, pulling the general price level down. However, compared to the same period last year, apartment prices are still at a high level.

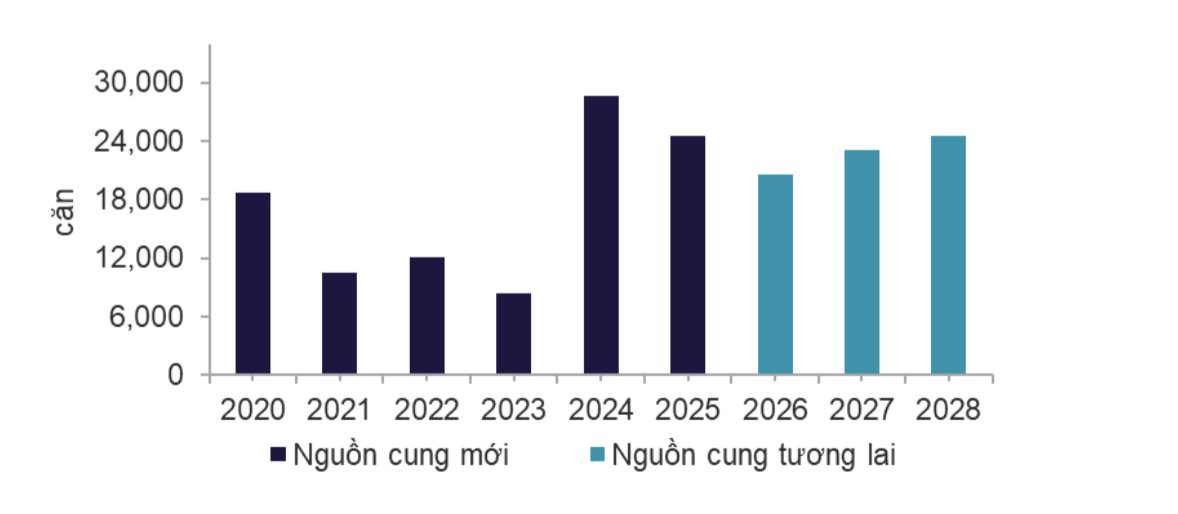

According to Cushman & Wakefield, house prices continue to be under pressure from increased input costs, including land and building materials prices, while supply in the central area is still limited. This unit forecasts that in the period 2026–2028, the Hanoi market may receive more than 68,000 new apartments, with the trend of supply continuing to shift to satellite areas.

Apartment prices may slow down, or even remain flat for a long time

Commenting on the trend in the coming time, Ms. Do Thi Thu Hang - Senior Director, Research and Consulting Department, Savills Hanoi - said that entering 2026, apartment prices in Hanoi will continue the upward trend, but the increase may be lower than the previous period.

According to Ms. Hang, the price level is unlikely to cool down at least in the first half of 2026 due to the impact of the new Land Law and the 2026 land price list, expected to be applied from January 1, 2026 with prices closer to the market.

Ms. Hang analyzed that construction costs continue to be under pressure from raw material prices, labor costs and financial costs, forcing investors to reflect them in selling prices. Meanwhile, the supply-demand mismatch has not been thoroughly resolved. Although the supply in 2026 is forecast to improve, most new projects are still concentrated in the mid- and high-end segments, while affordable housing continues to be scarce, causing the average market price level to remain high.

More cautiously, Ms. Nguyen Hoai An - Senior Director of CBRE Vietnam, Hanoi branch - said that if supply continues to increase sharply in the coming time, Hanoi apartment prices may stagnate, even go sideways for a long period. According to Ms. An, apartment prices cannot keep increasing but only increase to a threshold suitable for people's ability to pay. She said that the developments in Hanoi today are quite similar to what happened in Ho Chi Minh City a few years ago, when apartment prices once increased sharply and then stagnated, even slightly decreased for a long time, before recovering with the market's excitement.