The Government issued Decree No. 291/2025/ND-CP (effective from November 6, 2025) amending and supplementing a number of articles of Decree No. 103/2024/ND-CP dated July 30, 2024 regulating land use fees, land rent and Decree No. 104/2024/ND-CP dated July 31, 2024 regulating the Land Development Fund.

In particular, regarding the method of calculating land use fees when granting Land Use Rights Certificates and Property Ownership Certificates (Certificates) for cases of land use cases that are not allocated in accordance with the authority prescribed in Article 140 of the Land Law, Decree No. 291/2025/ND-CP has amended and supplemented points a, b, c, Clause 3, Article 12 of Decree No. 103/2024/ND-CP stipulating the method of calculating land use fees for households and individuals granted Certificates by competent state agencies as prescribed in Point a, Clause 3, Article 140 of the Land Law.

According to the new regulations, households and individuals who are granted a Certificate by a competent state agency as prescribed in Point a, Point b, Clause 3, Article 140 of the 2024 Land Law will have land use fees calculated as follows:

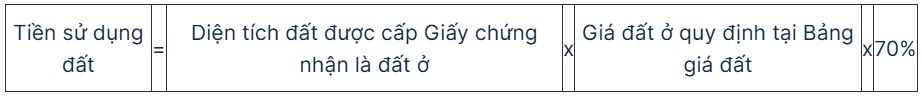

a) In case of being granted a Certificate of land use rights and ownership of assets attached to land (Certificate) as prescribed in Point a, Point b, Clause 3, Article 140 of the 2024 Land Law without documents proving that the money has been paid for land use, the land use fee for the area granted a Certificate of residential land shall be calculated as follows:

b) In case of being granted a Certificate as prescribed in Point a, Point b, Clause 3, Article 140 of the 2024 Land Law and having documents proving that he/she has paid the full amount to be eligible for land use as prescribed in Clause 5 of this Article, he/she shall not have to pay land use fees.

In case there are documents proving that the money has been paid for land use but the fee paid for land use is lower than the fee according to the provisions of law at the time of payment, the amount of money paid will be converted to the percentage of the land area where the land use fee has been paid according to the policy and the land price at the time of payment; the land use fee for the remaining land area will be calculated according to the provisions of Point a of this Clause at the time of submitting a complete valid dossier to request a Certificate.

c) For the remaining area as prescribed in Point c, Clause 3, Article 140 of the 2024 Land Law, in case of being recognized as residential land purpose (if any) and being granted a Certificate, the land use fee shall be collected at 100% of the land use fee calculated according to the policy and residential land price prescribed in the Land Price List at the time of submitting a complete valid dossier requesting a Certificate.