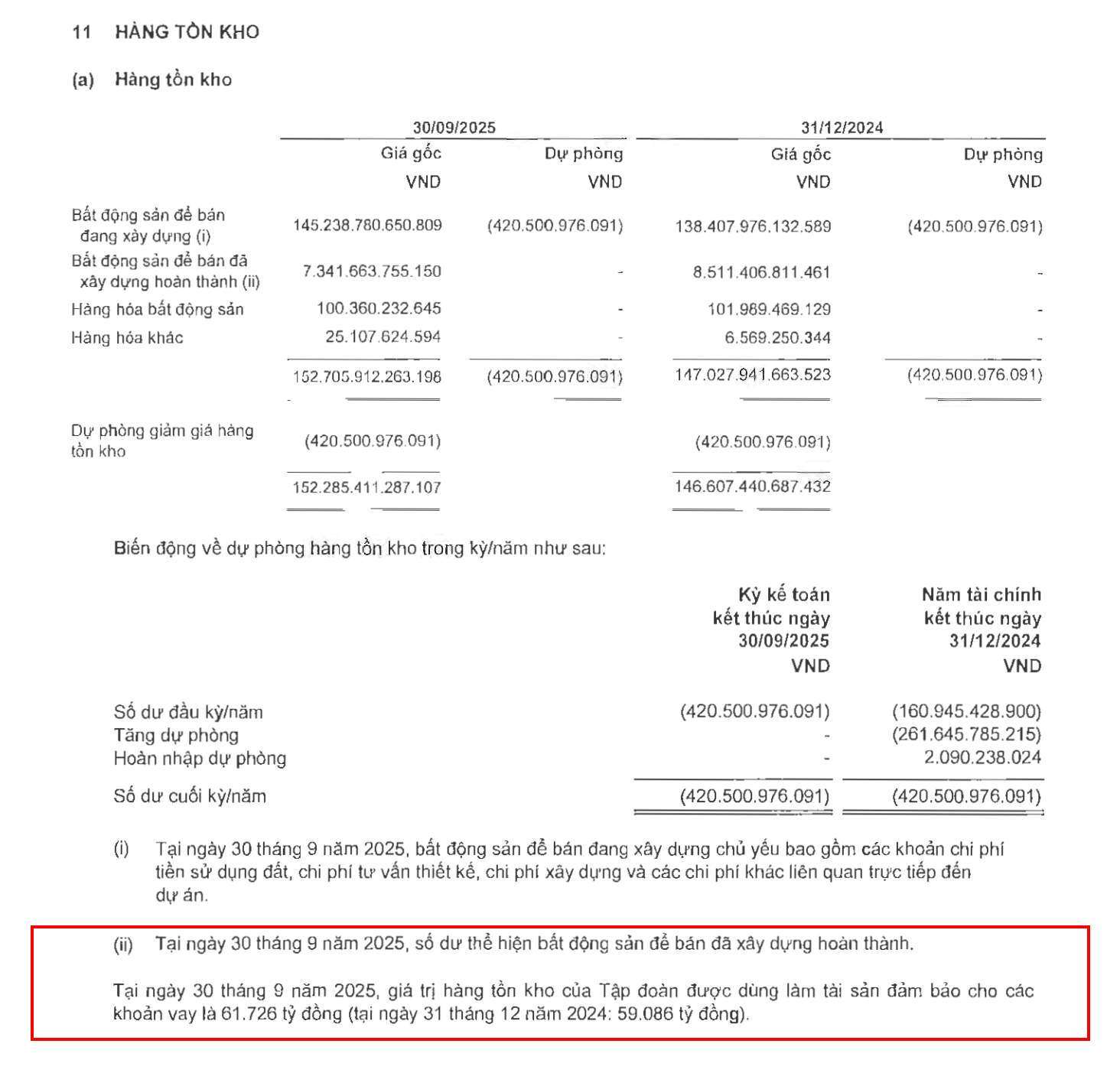

By the end of the third quarter of 2025, No Va Real Estate Investment Group Joint Stock Company (Novaland, code NVL) continued to be the enterprise with the largest inventory in the industry, reaching VND 152,285 billion, up 4% compared to the end of 2024 and accounting for about 63% of total assets. Of which, VND 145,239 billion (more than 95%) is the value of land fund and projects under construction; the rest is completed real estate waiting for handover.

Novaland did not explain in detail, but according to the business's operations, the largest inventory value could be located in large projects such as Aqua City (Dong Nai), NovaWorld Phan Thiet (Binh Thuan), NovaWorld Ho Tram (Ba Ria - Vung Tau).

By September 30, 2025, the value of the enterprise's inventory has been used as collateral for loans worth VND 61,726 billion; total loan debt is VND 64,283 billion, an increase of more than VND 2,700 billion compared to the beginning of the year.

Next is Vinhomes Joint Stock Company (code VHM), with inventory value by the end of the third quarter of 2025 reaching VND 125,608 billion, accounting for 16.3% of total assets. Mainly due to businesses stepping up the implementation of a series of large-scale projects, including the Vinhomes Green Paradise (Can Gio, Ho Chi Minh City) super project of 2,870 hectares, starting construction in the third quarter.

According to the explanation, more than VND97,239 billion in Vinhomes' inventory structure is real estate for sale under construction. Mainly the cost of land use fees, site clearance, purchase of subsidiaries as part of the cost of project purchase, construction and development costs at a series of projects such as Vinhomes Green Paradise Can Gio, Vinhomes Ocean Park 2 and 3, Vinhomes Grand Park, Vinhomes Ocean Park, Vinhomes Smart City and a number of other projects.

The enterprise also has VND 11,563 billion in inventory of real estate for sale that has been completed, including villas, apartments and commercial townhouses in a number of projects in the North.

Notably, Vinhomes said that unrecorded sales by the end of September 2025 reached VND223,937 billion, up 93% over the same period last year, reflecting the number of signed but undelivered contracts. In the first 9 months of 2025, Vinhomes' sales reached VND162.582 billion, up6% over the same period in 2024.

In third place is Kinh Bac Urban Development Corporation (code KBC), with inventory of VND 25,091 billion, up 81% compared to December 31, 2024. The majority of which are Trang Cat service urban area (16.201 billion VND), Loc Giang industrial park (1.,443 billion VND), social housing in Nenh town (1.,276.8 billion VND) and Phuc Ninh urban area (1.,123 billion VND).

Followed by Khang Dien Housing Investment and Trading Joint Stock Company (code K Human), with inventory of VND23,086 billion, up 4% compared to the beginning of the year and accounting for nearly 70% of total assets. The warehouse is concentrated in the projects Khang Phuc - Tan Tao Residential Area (VND 8,272 billion), Binh Trung - Binh Trung Dong (VND 4,764 billion), Doan Nguyen - Binh Trung Dong (VND 3,668 billion), Khang Phuc - Phong Phu 2 Residential Area (VND 1,864 billion), Binh Trung Moi - Binh Trung Dong (VND 1,237 billion). Most of the assets have been mortgaged.

Nam Long Investment Joint Stock Company (code NLG) recorded inventory of VND 17,852 billion, down slightly by 1%. Of which, the Izumi project (Dong Nai) accounts for VND 8,711 billion, Waterpoint (Tay Ninh) is VND 7,018 billion, followed by the Can Tho project (989 billion) and Ehome PG Hai Phong (365 billion).

Phat Dat Real Estate Development Joint Stock Company (PDR) has inventory of VND 14,977 billion, an increase of VND 899 billion (6.4%) compared to the end of 2024, accounting for 61.8% of total assets. Of which, The EverRich 2 ( River City) accounted for VND3,598 billion, Thuan An 1 - Thuan An 2 (VND3,193 billion), Tropicana Ben Thanh Long Hai (VND1,994 billion) and Phuoc Hai (VND1,523 billion).

Next, Dat Xanh Group Joint Stock Company (code DXG) recorded VND14,635 billion in inventory value, an increase of more than VND1,200 billion compared to the beginning of the year. Unfinished real estate accounts for VND10,249.6 billion, finished real estate VND3,809 billion, the rest is real estate goods worth VND570 billion.

Construction Development Investment Corporation (DIC Corp, code DIG) recorded inventory of VND 8,655 billion, down nearly 6% compared to the previous quarter. The warehouse is allocated at Dai Phuoc Eco-tourism Urban Area (2,143 billion), Nam Vinh Yen (2,090 billion), A2 - Vung Tau Center Point apartment building (1,493 billion), Hau Giang P4 residential area (1,078 billion), Long Tan - Nhon Trach tourist area (1,000 billion).

Taseco Real Estate Investment Joint Stock Company (TAL) has inventory of VND 7,623 billion, while Van Phu Real Estate Development Joint Stock Company (VPI) recorded VND 5,408 billion; both increased by over 80% compared to the end of last year.

The value of inventory in the asset structure of real estate enterprises is likened to a "double-edged sword".

For leading, prestigious enterprises and those with a solid financial foundation, inventory is considered "reserved" - reflecting abundant land fund and future supply. If the market develops positively with good liquidity, this group of businesses can record sudden revenue from opening for sale and handover, creating a long-term competitive advantage. If real estate prices increase, increasing inventory can bring in large profits.

However, for businesses facing great financial pressure, the burden will increase significantly when large inventories are prolonged, causing costs, locking down cash flow and affecting businesses' ability to repay debts.