According to Cushman & Wakefield's Report on the Industrial Real Estate Market in the Northern Key Economic Region, by the end of the fourth quarter of 2025, the total accumulated supply of industrial park (IP) land in the Northern market reached approximately 23,990 ha.

The market in the last quarter of 2025 continued to maintain its vibrant growth momentum with the addition of about 640 hectares of new industrial land, from three strategic projects: Phuc Son Industrial Park (125 hectares), Que Vo 2 Industrial Park - Phase 2 (277.64 hectares) and Dong Van V Industrial Park in Ninh Binh (237 hectares).

The continuous implementation of industrial park infrastructure projects not only consolidates the leading position of existing industrial capitals such as Bac Ninh with 5,452 ha and Hai Phong with 5,796 ha, but also shows a strong expansion to potential satellite areas such as Ninh Binh and Phu Tho.

Compared to the scale of 16,800 ha recorded in the fourth quarter of 2024, the total supply of the whole region has achieved a breakthrough growth rate of about 42.8%. This strong increase largely comes from the redefinition of administrative boundaries and the merger of new provinces into the research area from the previous quarter, combined with the speed of licensing new projects being accelerated in 2025.

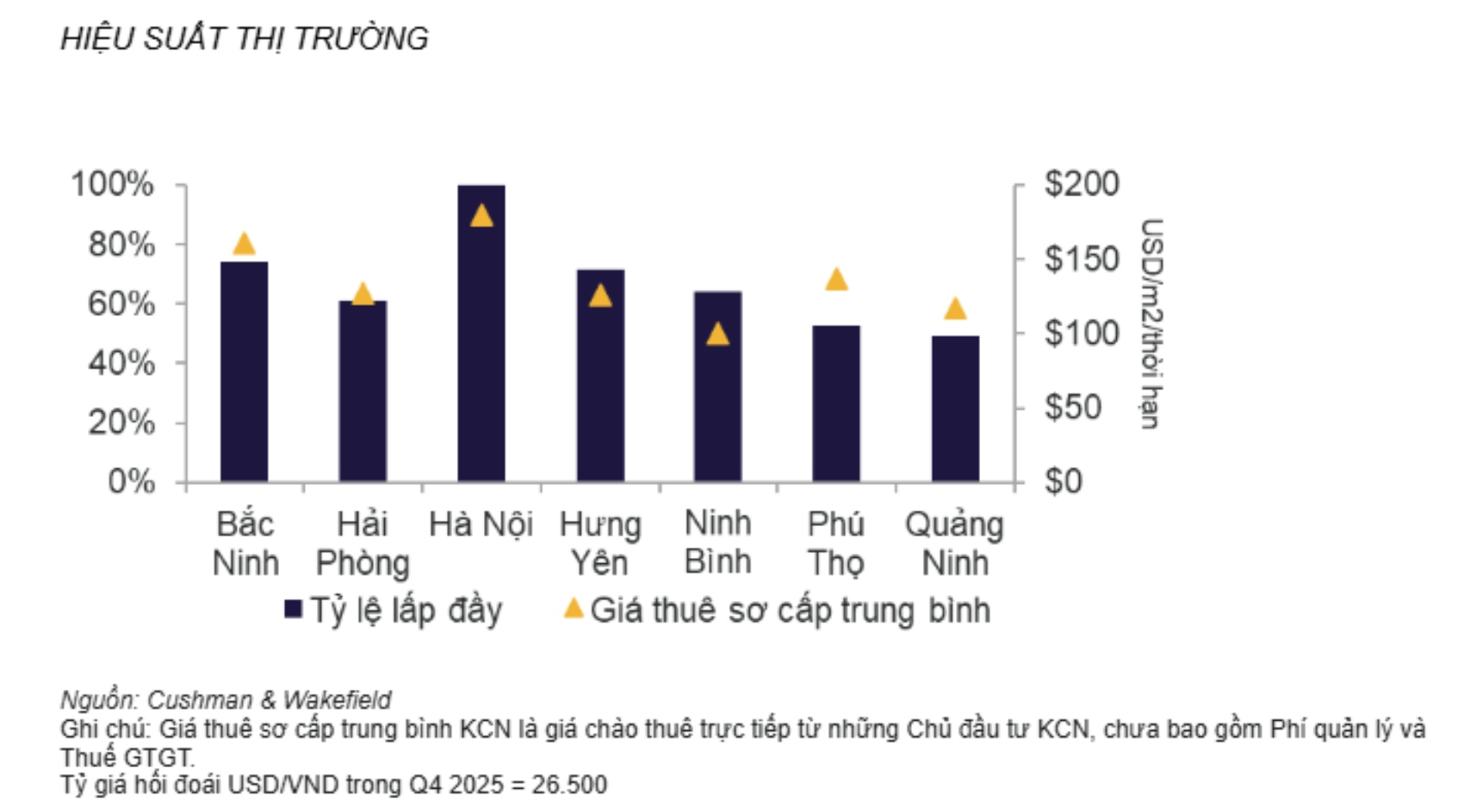

The land market for industrial parks in the North in the fourth quarter of 2025 recorded a net absorption area of about 63 ha. The average occupancy rate of the whole region adjusted to 65.74%. This index recorded a slight decrease compared to 67% of the previous quarter and a decrease of about 2.26 percentage points compared to 68% of the same period in the fourth quarter of 2024. The decrease in occupancy rate does not reflect a weakening of demand, but mainly due to pressure from the large new supply entering the market, making the actual absorption rate unable to keep up with the expansion rate of the existing land fund.

The main driving force promoting demand in the quarter still focuses on high-tech industries, manufacturing electronic components and circuit boards, typically large-scale investment projects in the industrial capital of Bac Ninh. By locality, Hanoi continues to maintain an absolute 100% occupancy rate due to a shortage of land funds, while Bac Ninh maintains its attractiveness with an occupancy rate of 74.1%. Newly joined areas after the merger such as Quang Ninh (49.27%) and Phu Tho (52.87%) currently have an average occupancy rate, creating great room to attract investors looking for large leases at optimal costs.

The average asking rent for land in industrial parks (IPs) throughout the Northern region in the fourth quarter of 2025 recorded slight growth, reaching 135 USD/m2/rent term (equivalent to 3.57 million VND/m2). Compared to the level of 133 USD recorded in the previous quarter, the rent has increased by about 1.5%. When compared to the same period last year, the market maintained sustainable growth momentum at 3.8% compared to the level of 130 USD (equivalent to 3.4 million VND) in the fourth quarter of 2024.

In the period 2026 - 2029, it is forecast that the market will receive about 5,050 hectares of new industrial land from projects being planned for implementation. This expansion not only focuses on traditional industrial capitals but also strongly spreads to satellite areas, helping to consolidate the position of the North as an important production and logistics center of the country.

The main driving force for growth is strengthened by the completion of strategic infrastructure projects such as Gia Binh International Airport and the expansion of the North-South expressway, helping to optimize the logistics network and inter-regional connectivity. In addition, the policy of administrative synchronization after the merger of the province will remove legal barriers, create a transparent investment environment to attract multinational corporations in the field of high technology and electronic components.

Mr. Nguyen Phuoc Thuan, Leasing Director, Cushman & Wakefield Vietnam - said: "We are recording a trend of more selective decision-making from leasing businesses. Besides the price factor, investors are increasingly prioritizing localities with long-term expansion potential, synchronous infrastructure and a clear legal framework.

According to Mr. Nguyen Phuoc Thuan, provinces with large land funds and increasingly complete infrastructure connections will have many advantages when manufacturers not only plan to enter the market, but also aim to expand operations in the next 5-10 years. As the Northern industrial market enters a new stage of development, policy synchronization and infrastructure readiness are becoming no less important than the land fund factor, contributing to forming a transparent and effective investment environment, capable of attracting the next generation of manufacturing, electronics and logistics businesses.