Upgrading residential land for rice-growing land requires permission

Pursuant to Clause 1, Article 121 of the 2024 Land Law, it is stipulated that:

Article 121. Change of land use purpose

1. Cases of changing land use purposes that must be permitted by competent state agencies include:

a) Conversion of rice-growing land, special-use forest land, protective forest land, and production forest land to other types of land in the agricultural land group;

b) Conversion of agricultural land to non-agricultural land;

c) Conversion of other types of land to concentrated livestock land when implementing large-scale concentrated livestock projects;

d) Conversion of non-agricultural land allocated by the State without land use fees to other types of non-agricultural land allocated by the State with land use fees or land lease;

d) Conversion of non-agricultural land other than residential land to residential land;

e) Conversion of land for construction of public works, land used for public purposes with business purposes to non-agricultural production and business land;

g) Conversion of non-agricultural production and business land that is not commercial or service land to commercial or service land.

Converting agricultural land to non-agricultural land in general, including the case of converting to residential land for rice cultivation.

Accordingly, setting up residential land for rice-growing land is one of the cases that require permission from a competent State agency.

Conditions for settling on rice-growing land from 2 hectares

In addition to having to ask for permission from competent authorities, according to Article 46 of Decree 102/2024/ND-CP, when converting to residential land for rice cultivation of 2 hectares or more, the following criteria and conditions must also be ensured:

- Have a plan to use the topsoil according to the provisions of the law on cultivation;

- Have a preliminary assessment of environmental impact or an environmental impact assessment according to the provisions of the law on environmental protection.

Cost of settling on rice-growing land

These include 4 typical fees and charges that must be paid to convert land use purposes later.

1. Land use fee

- Land use fee is the amount of money that land users must pay to the State when the State allocates land with land use fees, permits change of land use purpose or cases of land use that must pay land use fees according to the provisions of law (Clause 44, Article 3 of the 2024 Land Law).

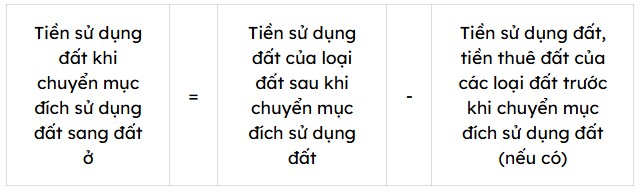

Land use fees when changing land use purposes for households and individuals are determined as follows: (Article 8 of Decree 103/2024/ND-CP).

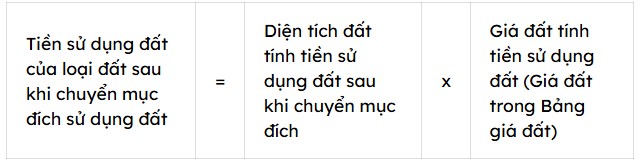

In which: Land use fee of the land type after conversion is calculated as follows:

2. Registration fee

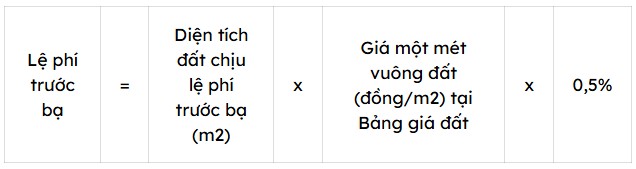

- Pursuant to Article 8 of Decree 10/2022/ND-CP, the registration fee for houses and land is 0.5%.

- Formula for determining registration fees:

In which, the price for calculating the registration fee for land is the land price in the Land Price List issued by the People's Committees of provinces and centrally run cities according to the provisions of the law on land at the time of declaration of registration fee.

3. Fee for appraisal of land use right certificate application

- Fees for appraisal of land use right certificate application are on the list of fees under the authority of the Provincial People's Council in Clause 11, Article 2 of Circular 85/2019/TT-BTC.

- Collection rate: depends on the regulations of each province and city.

4. Fees for granting certificates of land use rights and ownership of assets attached to land

- Fees for granting certificates of land use rights and ownership of assets attached to land are on the list of fees under the authority of the Provincial People's Council in Clause 5, Article 3 of Circular 85/2019/TT-BTC.

- Collection rate: depends on the regulations of each province and city.