Regarding the form of pension and social insurance allowance payment via personal account, Vietnam Social Insurance requires social insurance agencies of provinces and cities to strictly implement the preparation, control, and approval of electronic payment orders before the 1st of the payment month.

Coordinate with banking systems to review, compare and authenticate beneficiary information between the database of Vietnam Social Insurance and beneficiary information at banking systems to ensure the payment of pensions and social insurance benefits is accurate, complete, timely, and uninterrupted.

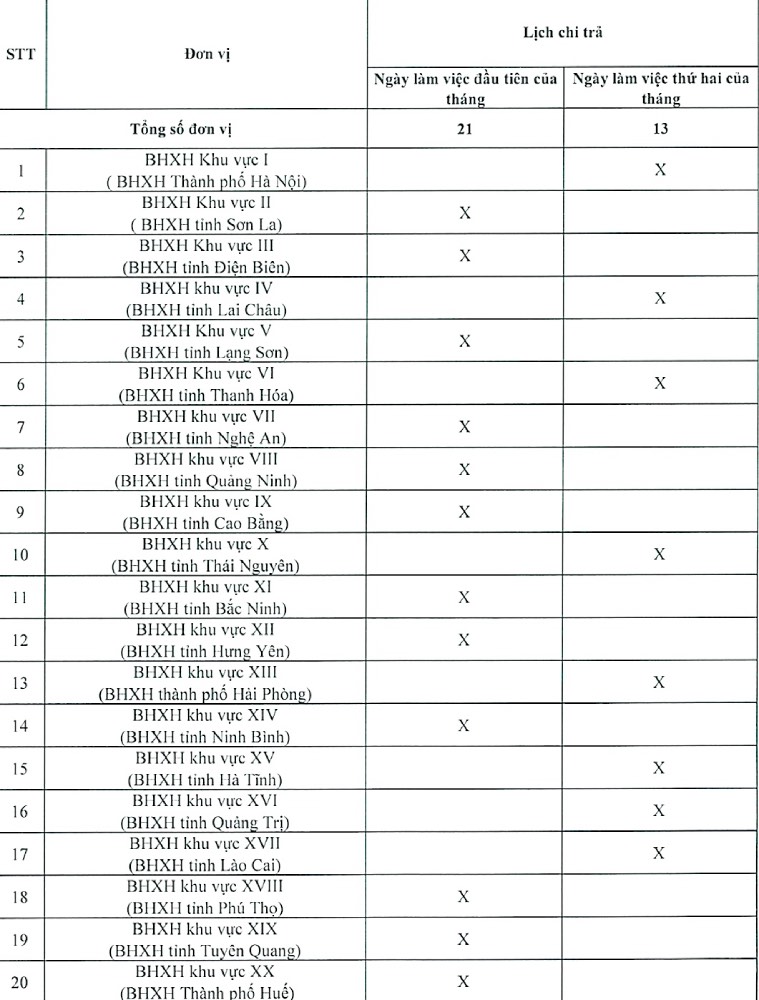

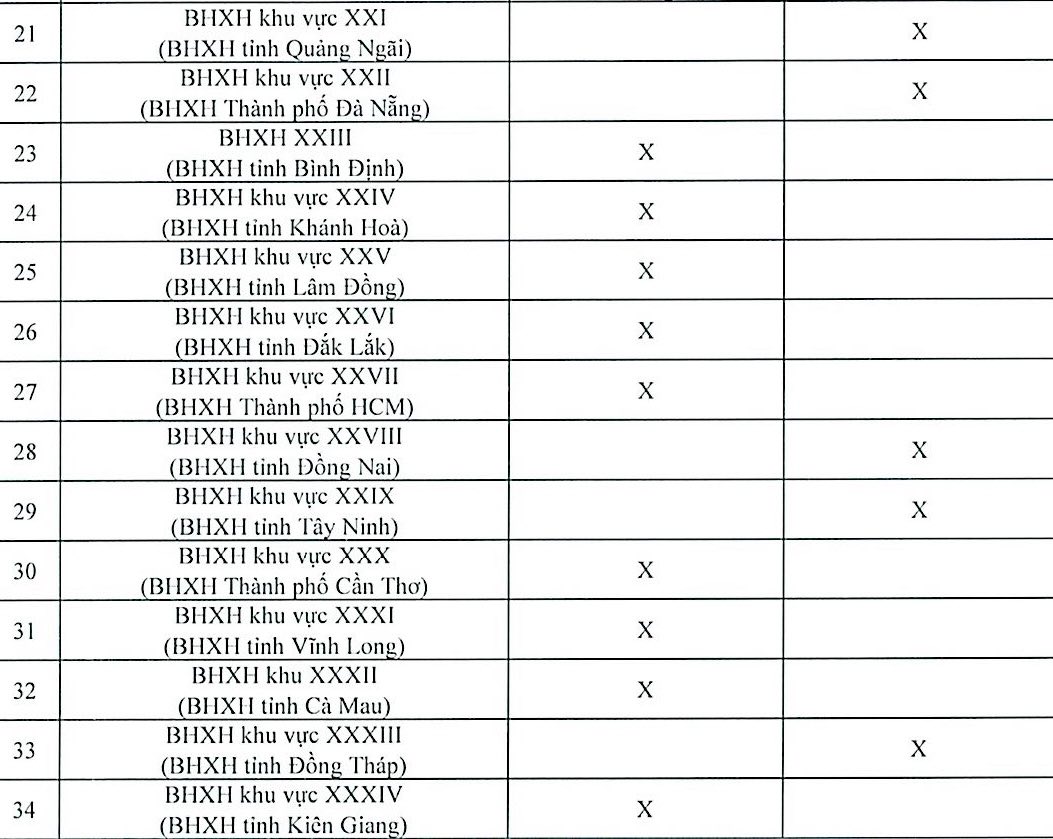

Regarding the payment of pensions and social insurance benefits in cash, local social insurance agencies coordinate with provincial and municipal post offices in their areas in charge of organizing payment according to the agreed pension and monthly social insurance benefits payment schedule between the regional social insurance agency and the provincial post office.

Vietnam Social Insurance has also made some notes on authorizing pension receipt according to the Social Insurance Law 2024.

Accordingly, in order for the payment of monthly pensions and social insurance benefits to continue to go smoothly, ensuring the smooth rights of beneficiaries when operating the two-level local government and in accordance with the provisions of the Social Insurance Law No. 41/2024/QH15 ( social insurance law 2024) effective from July 1, 2025, beneficiaries need to pay attention to some changes in the authorization of receiving pensions and social insurance benefits as follows:

Regarding the authorization to receive pensions and social insurance benefits: In cases of authorization to receive pensions and social insurance benefits and other regimes, the authorization document is valid for a maximum of 12 months from the date of authorization; The authorization document must be certified in accordance with the provisions of law on certification. "For the authorization granted according to the provisions of Law No. 58/2014/QH13 ( social insurance law 2014), it will be implemented until June 30, 2026. After July 1, 2026, beneficiaries must re-establish authorization or carry out certification procedures in a timely manner so as not to interrupt the receipt of monthly pension and social insurance benefits.

Every year, beneficiaries of social insurance regimes through personal accounts opened at banks are responsible for coordinating with social insurance agencies or service organizations authorized by the social insurance agency to verify information that is eligible for social insurance regimes according to regulations.