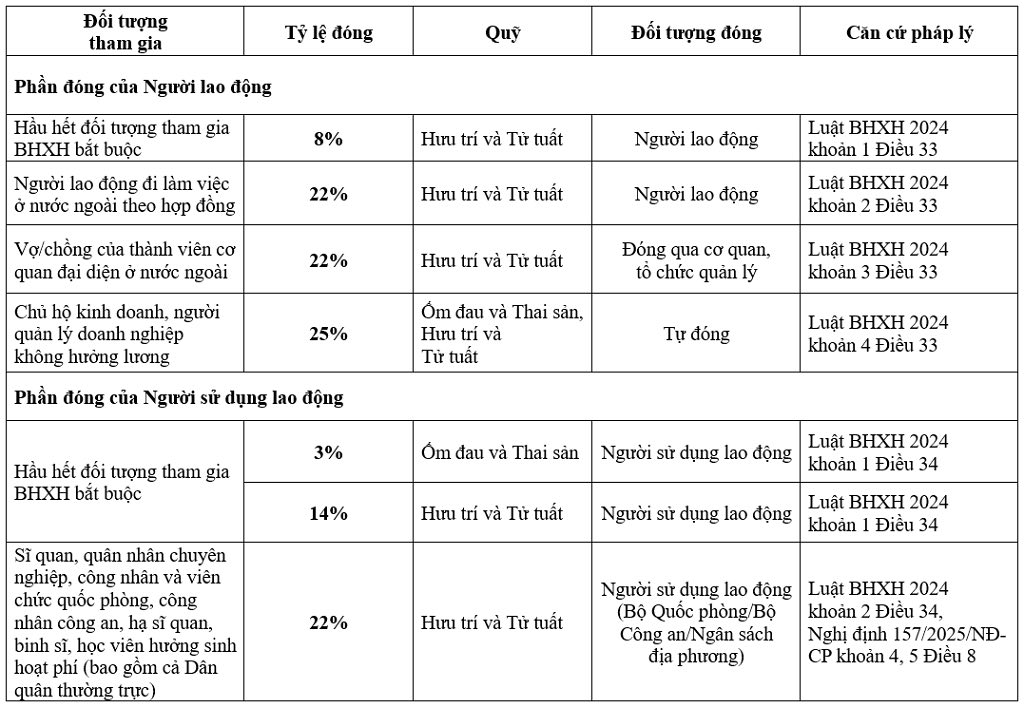

Regarding the level of compulsory social insurance payment:

According to the Social Insurance Law 2024, the rate of compulsory social insurance payment is determined as follows:

- 3% of salary used as the basis for contributions to the sickness and maternity fund.

- 22,2% of salary is used as the basis for pension and death contributions.

In total, the rate of compulsory social insurance payment is 25% on salary used as the basis for payment. This rate is distributed between employees and employers in the following cases:

Bases for compulsory social insurance payment:

The basis for compulsory social insurance payment is regulated differently depending on the salary regime applied:

For employees implementing the salary regime prescribed by the State: Monthly salary used as the basis for social insurance contributions is salary according to position, title, rank, level, military rank and position allowances, seniority allowances exceeding the framework, seniority allowances, salary retention coefficient (if any).

For employees who implement the salary regime decided by the employer: The salary used as the basis for social insurance contributions is the monthly salary, including the salary according to the job or position, salary allowances and other supplements agreed to be paid regularly and stably in each salary payment period.

For officers, professional soldiers, workers and defense officials, police workers, non-commissioned officers, soldiers and trainees who are entitled to living expenses: The monthly salary used as the basis for social insurance contributions in the first 02 years is 02 times the reference level, then each following year will increase by 0.5 times the reference level, up to 04 times the reference level at the time of contribution.

Minimum and floor: The salary used as the basis for compulsory social insurance contributions is at least equal to the reference level and at most 20 times the reference level at the time of contribution. The reference level is the amount of money decided by the Government to calculate the contribution level and the benefit level of some social insurance regimes. When the basic salary is abolished, the reference level will replace it and will not be lower than that basic salary.

Method and duration of compulsory social insurance payment:

For employees: Pay social insurance to the social insurance agency monthly. In particular, workers receiving salaries according to products, according to contracts in the fields of agriculture, forestry, fishery, and salt making can pay monthly, every 3 months or every 6 months.

For employers: The deadline for compulsory social insurance payment is no later than:

The last day of the following month for the monthly payment method.

The last day of the following month is immediately after the payment cycle for the 3-month or 6-month payment method.