Meanwhile, many business owners are still "uncertain" with debts of up to tens of billions of VND, while the Social Insurance Fund (SI) has a balance of up to 1.2 million billion VND. The 2024 Social Insurance Law increases the responsibility and sanctions of social insurance agencies, but the monitoring mechanism and handling process are not strong enough. The story of debt and evasion of social insurance payment has affected social security and fairness issues, requiring a clear sense of responsibility of the entire enterprise, social insurance agencies and authorities at all levels to ensure the rights of employees.

Although sanctions have been tightened, the situation of enterprises deliberately slowing down and evading social insurance (SI) payments continues persistently. This situation shows that, in addition to the responsibility of violating units, the Vietnam Social Security Agency has not fully fulfilled its responsibility.

Long-term debt suspension and evasion is the responsibility of the Social Insurance agency

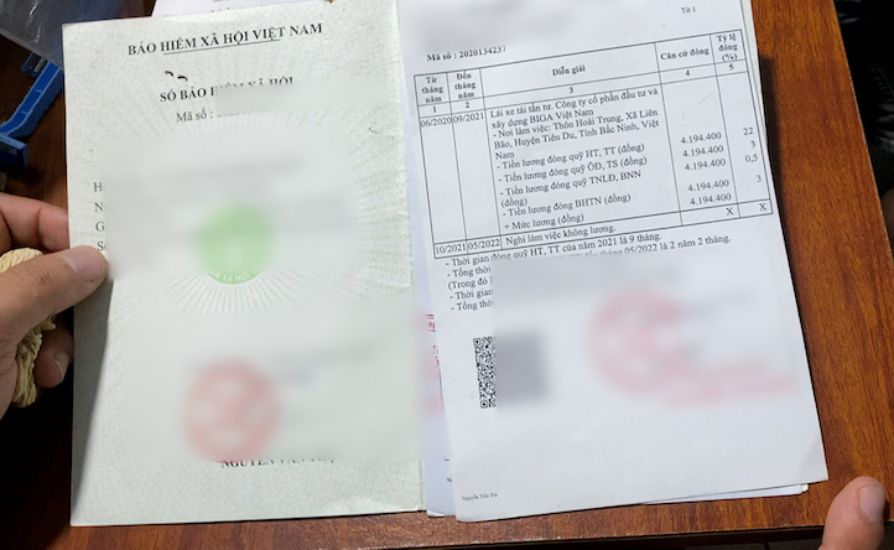

Many businesses are late and evade paying social insurance with amounts ranging from billions of VND to tens of billions of VND. In many cases, business owners have fled, especially foreign enterprises, making it impossible for employees to close social insurance books, not enjoy benefits and not be able to continue paying insurance at other workplaces.

While workers and employees suffer, the problem of handling is still a gap, causing public opinion to question the role of the social insurance agency.

According to the report of Social Insurance in 2024, the Social Insurance fund has a surplus of up to 1.2 million billion VND. The social insurance agency has the right to deposit the social insurance fund in a bank for interest calculation. However, when employees encounter difficulties, the Social Insurance agency has not taken any effective measures to handle and support them.

According to Article 17 of the Law on Social Insurance 2024, Vietnam Social Insurance agencies have the right to conduct specialized inspections and examinations of the implementation of laws on compulsory social insurance, voluntary social insurance, health insurance (HI), and unemployment insurance (UI); at the same time, they are responsible for handling or recommending handling of violations of the law in this field. This regulation shows that Social Insurance is not only a unit that manages and collects funds but also an agency with a role in law enforcement, ensuring that all participants enjoy full benefits according to regulations.

Talking to Lao Dong Newspaper, lawyer Nguyen Thu Trang - Deputy Director of Heva Law LLC - expressed that social insurance is a practical social security regime. Therefore, the regimes need to be resolved immediately. The case of business owners fleeing is not the fault of workers and laborers. To solve this problem, State agencies, including social insurance agencies, cannot be indifferent or stay on the sidelines.

When the law has granted the right to inspect the industry, the right to handle and the right to propose handling of violations, it is the responsibility of the Social Insurance agency to continue to have a situation of long-term debt and evasion.

Dr. Nguyen Quoc Viet - Deputy Director of the Vietnam Institute for Economic and Policy Research (VEPR) - also said: "Currently, social insurance is all declared online. In which month is recorded in that month, I do not understand why there are so many debts that the Social Insurance agency does not have a mechanism to control risks and push the disadvantage to the employees like that?".

On the part of employees, many people believe that the long-term suspension of social insurance debts shows the laxity and lack of determination in exercising the assigned authority of the Social Insurance agency.

Ensuring social security is not only about collecting and spending in accordance with the law, but also about substantially protecting employees from all risks. Workers recommend strengthening independent inspection, publicizing inspection results, strictly handling loose management officials, as well as recommending the completion of the mechanism to support advanced allowances for affected workers, so that they are less disadvantaged.

It is necessary to clarify the responsibility of Vietnam Social Insurance if the amount of late payment is increasing

To clarify responsibilities and solutions to prevent businesses from being slow and evading insurance payments, Lao Dong Newspaper has repeatedly sent questions to Vietnam Social Insurance.

Informing Lao Dong Newspaper, Vietnam Social Insurance said that in 2024 and the first 4 months of 2025, the entire Vietnam Social Insurance system conducted inspections and examinations at 22,928 units.

According to Vietnam Social Insurance, the total amount of money that inspected units were late in paying before the inspection decision was 2,106.8 billion VND; the amount recovered during the inspection period was 1,099.8 billion VND.

Vietnam Social Insurance also said that in 2024 and the first 4 months of 2025, this unit issued 1,948 decisions to sanction administrative violations in social insurance, unemployment insurance, and health insurance contributions. However, the total amount of fines paid to the State budget is only 61.1 billion VND.

Thus, despite inspections, the amount of unrecovered social insurance is still VND 1,007 billion (accounting for 47%). The total amount of fines paid to the State budget is still modest.

In the report for the first 9 months of the year, although it did not clearly state the amount of late social insurance payment, Vietnam Social Insurance also admitted that this late payment amount continued to increase.

Prof. Dr. Hoang Van Cuong - a delegate of the 15th National Assembly - said that when employees work for organizations and enterprises, employers must pay them; at the same time, they must deduct the accompanying social insurance contributions.

Current regulations allow social insurance payment up to one month later than the salary payment period. These regulations create conditions for employers to have time to arrange budget sources to prioritize paying salaries to employees; but then still have to fulfill their social insurance payment obligations to ensure the rights of employees when they are past working age or encounter interruptions such as unemployment, illness.

Delegate Hoang Van Cuong said that this is clearly a humane policy, but in reality, many businesses take advantage of this to delay paying social insurance. There are enterprises that even deliberately do not declare social insurance.

Thus, the employee's money is still kept for the enterprise but not declared to the social insurance agency. Invisibly, businesses have misappropriated the money that must be paid into the fund for employees to receive it later. In the long term, when the enterprise encounters difficulties, has to close, go bankrupt, the social insurance payment will also go with the enterprise owner.

It is clear that in both cases of evasion and late payment, both cases seriously affect the direct interests of employees and general social welfare factors of the whole country. These problems are quite common. In particular, many foreign enterprises have a large number of employees but deliberately delay payment, delay payment time or even evade payment. After that, these enterprises closed, went bankrupt and the social insurance part disappeared" - delegate Hoang Van Cuong stated the reality.

According to the delegate, in addition to the responsibility of social insurance paying units, it is necessary to clarify the responsibility of Vietnam Social Insurance if the amount of late payment increases and the number of months of late social insurance increases. Because in reality, employees' rights have been affected even though it is not their fault.