Revenue growth, improved profits

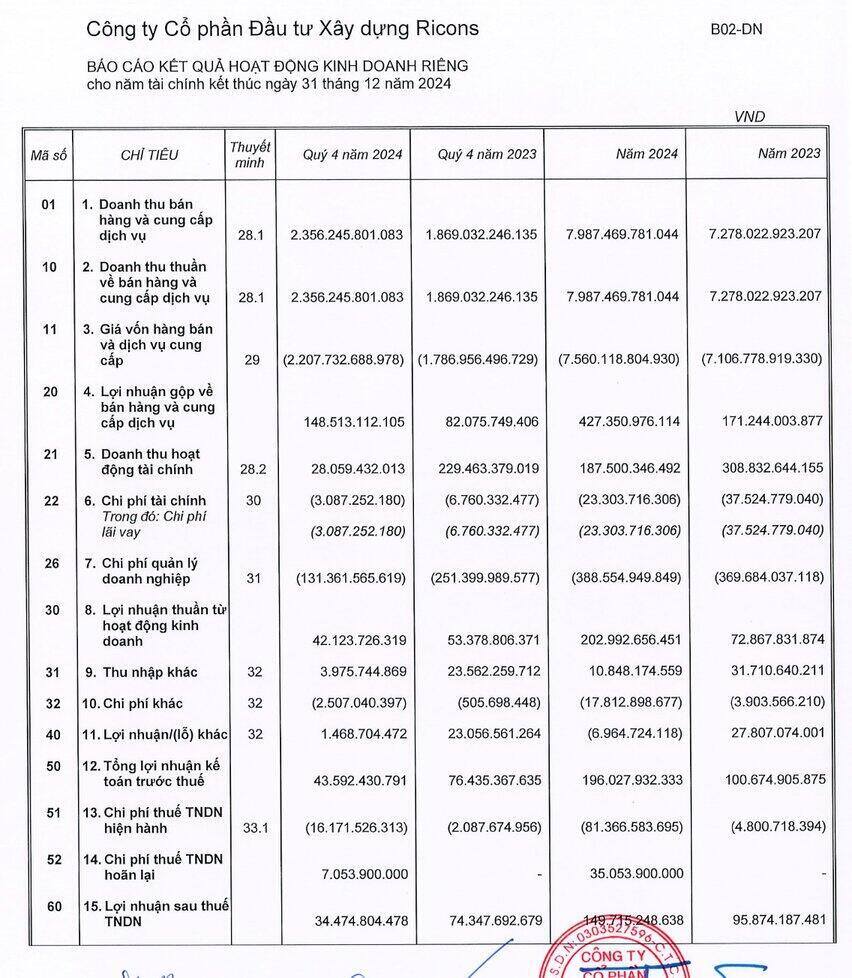

The financial report of the fourth quarter of 2024 of Ricons Construction Investment Joint Stock Company recorded net revenue of VND 2,356.2 billion, an increase of 26.07% over the same period last year (VND 1,869.0 billion). However, the profit after tax of the fourth quarter only reached VND 34.5 billion, a sharp decrease of 53.63% compared to the fourth quarter of 2023 (VND 74.3 billion).

In the whole year of 2024, Ricons achieved net revenue of VND 7,987.4 billion, an increase of 9.74% compared to 2023 (VND 7,278.0 billion). Gross profit reached VND 427.4 billion, a sharp increase compared to VND 171.2 billion of the previous year, showing an improvement in core business performance.

The individual profit after tax for the whole year reached VND 149.7 billion, up 56.1% compared to VND 95.9 billion in 2023. This is a positive result, reflecting the company's efforts to manage and control costs in the context of a volatile construction market.

Cash flow and finances improved but challenges remain

A bright spot in Ricons' financial report is the sharp increase in cash flow from operating activities, reaching VND507.5 billion in 2024, compared to VND8.35 billion the previous year. In particular, cash flow from investment activities has turned positive from negative VND113.6 billion in 2023 to positive VND110.4 billion in 2024.

However, revenue from financial activities decreased sharply by 39.29%, from VND 308.8 billion in 2023 to VND 187.5 billion in 2024. The main reason is the decrease in interest income from financial investments and bank deposits.

Financial expenses also recorded an improvement, decreasing from VND37.5 billion to VND23.3 billion. This helped reduce the financial burden and support the improvement of the company's after-tax profit.

Although core business activities recorded positive growth, Ricons still faces pressure from corporate management costs, increasing from VND 369.7 billion in 2023 to VND 388.5 billion in 2024. This is a factor that needs to be controlled more closely to ensure sustainable operating efficiency.

At the end of 2024, Ricons' total assets decreased by 12%, from VND 7,777.3 billion to VND 6,840.0 billion. Short-term assets still accounted for a large proportion, with short-term receivables from customers reaching VND 3,197.4 billion, a slight decrease compared to the previous year.

Ricons's liabilities will decrease from VND5,330.9 billion in 2023 to VND4,267.7 billion by the end of 2024. Of which, short-term payables to suppliers account for the largest proportion, reaching VND2,062.1 billion. The reduction in liabilities will partly help the company reduce financial pressure in the next period.