Updated SJC gold price

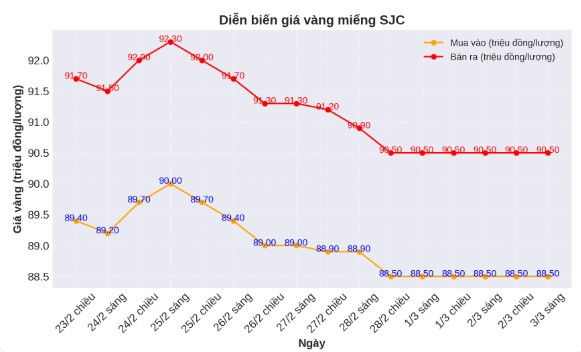

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 88.5-90.5 million VND/tael (buy in - sell out), unchanged in both buying and selling directions. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company at 88.5-90.5 million VND/tael (buy in - sell out), unchanged in both buying and selling directions. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 88.7-90.5 million VND/tael (buy in - sell out), keeping both buying and selling prices unchanged. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 1.8 million VND/tael.

9999 round gold ring price

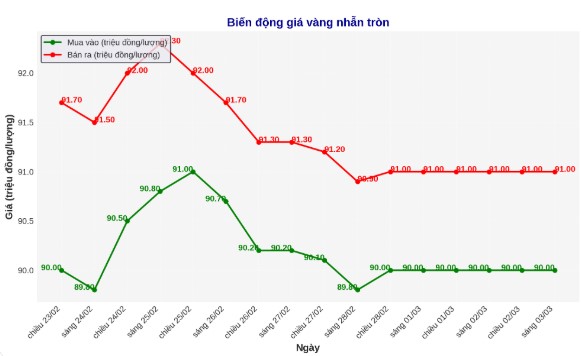

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI is listed at 90-91 million VND/tael (buy in - sell out); both buying and selling prices remain unchanged. The difference between buying and selling is listed at 1 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.1-91.3 million VND/tael (buy in - sell out); both buying and selling prices remain unchanged. The difference between buying and selling is 1.2 million VND/tael.

World gold price

As of 6:00 a.m. on March 3, the world gold price listed on Kitco was at 2,858.1 USD/ounce.

Gold price forecast

World gold prices are under pressure in the context of the USD increasing. Recorded at 6:00 a.m. on March 3, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 107.560 points (up 0.35%).

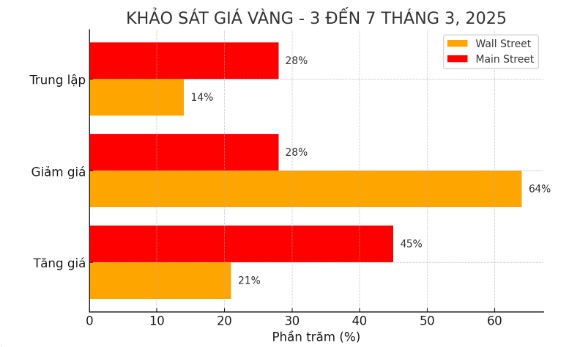

The latest weekly survey from Kitco News shows that the number of people optimistic about gold prices is decreasing.

Last week, 53% of experts (9/17 people) predicted gold prices to increase, while this week, this figure decreased sharply to only 21% (3/14 people). At the same time, experts predict that gold prices will fall from 24% (4/17 people) to 64% (9/14 people), showing increasingly negative sentiment.

Optimism among individual investors has also declined. Last week, 71 (744/204 people) expected gold prices to increase, but this week, the ratio has decreased to only 45% (62/138 people). Meanwhile, investors forecast gold prices to fall from 17% to 28%, while the forecast price for sideways remains at 28%.

Although selling pressure still exists, in the long term, some experts still give positive comments. In addition to speculative fluctuations, investment demand for gold is increasing, according to Neils Christensen - an analyst at Kitco News.

Last week, data from the World Gold Council showed that 48 tons of gold (worth $4.6 billion) flowed into gold ETFs in North America, marking the largest weekly increase since April 2020.

Looking to the future, experts predict that investment demand for gold in the West will continue to increase as the economy faces many uncertainties. In recent weeks, consumer confidence has fallen to a multi-year low, while concerns about inflation have increased.

These concerns are further reinforced by disappointing economic data. On Friday, the first quarter GDP forecast model of the US Federal Reserve (FED) Atlanta branch showed that the economy could decline by 1.5% this quarter, down sharply from the 2.3% increase forecast last week - one of the strongest declines in the history of this index.

Experts say that the situation of inflationary stagnation (a state of slow economic growth or recession while having high inflation) is an ideal environment for gold to promote its role as a safe-haven asset. In addition, high inflation will reduce real yields, thereby reducing the opportunity cost of holding gold - a non-interest-bearing asset.

Major investment groups, including WisdomTree and Goldman Sachs, still maintain the view that despite possible short-term downside corrections, gold could still reach the $3,000/ounce mark this year.

Another sign of investor sentiment is a report from BMO Capital Markets showing that gold and copper were the two most popular commodities at the mining conference organized by the bank. Meanwhile, silver is only in third place with a much lower level of interest.

"Although gold still faces downside risks in the short term, it is important to focus on the long-term outlook," Neils Christensen said.

See more news related to gold prices HERE...