7 steps to switch from fixed tax to declaration

From today (January 1, 2026), millions of business households and individuals will step into a new role, fully responsible for declaring and calculating taxes. Clear support and guidance on administrative procedures is necessary, helping business households feel secure in converting and declaring without worrying about the risk of being penalized.

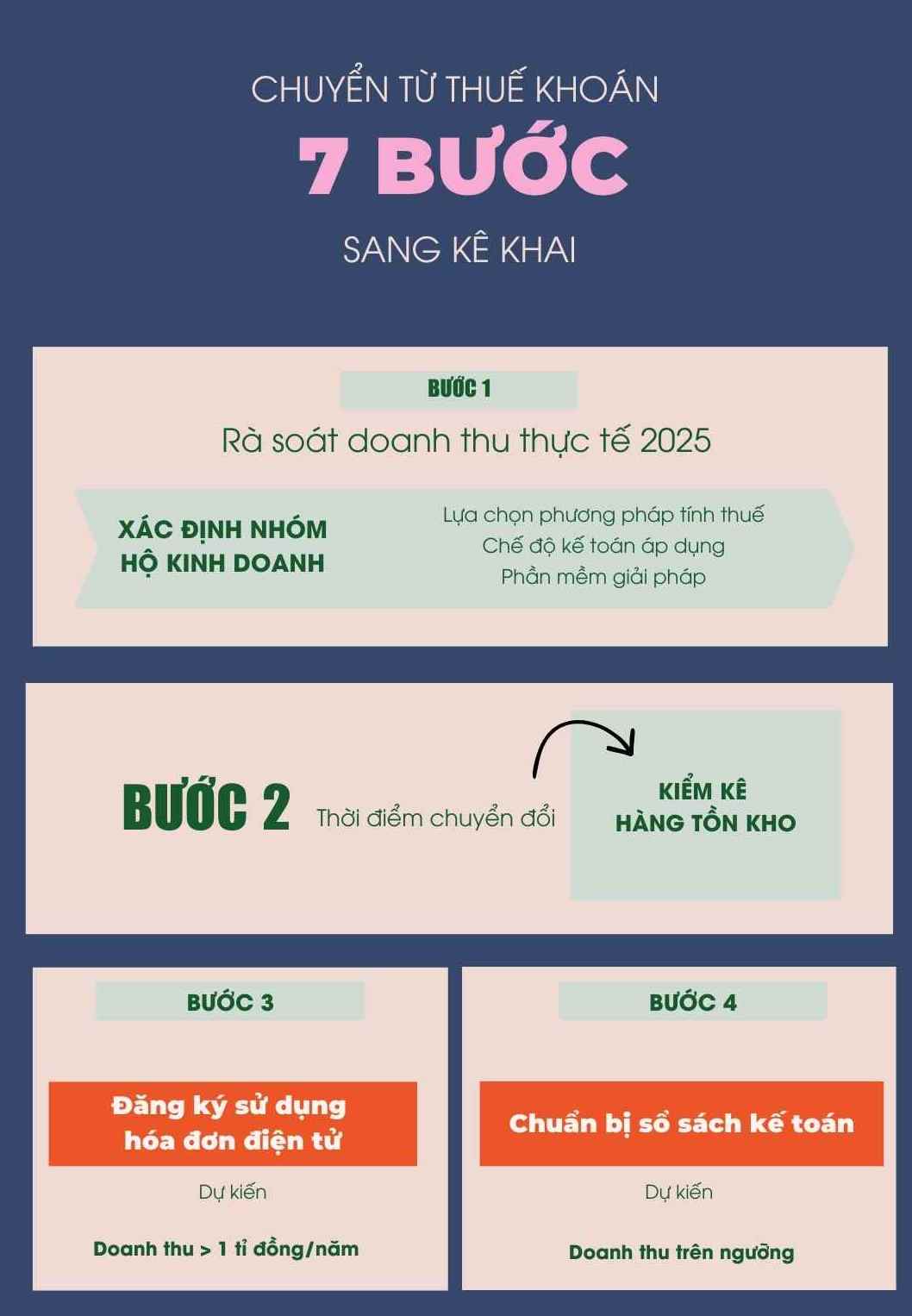

Regarding the process of converting from fixed tax to declaration, business households and individuals need to pay attention to following 7 steps:

Step 1: All business households need to review the actual revenue in 2025, estimated revenue in 2026, and identify the Business Household group. At the same time, based on the business operation model to choose tax calculation methods, applicable accounting regimes, software solutions for sales, accounting, invoices, and tax declarations corresponding to the scale of the group.

Tax calculation method for 4 groups of business households according to new regulations from 2026

Step 2: Conduct inventory of inventory at the time of conversion (if any).

Step 3: Register to use electronic invoices (if business households expect revenue in 2026 from 1 billion VND or more).

Step 4: Prepare accounting books (if business households expect revenue in 2026 to be above the threshold).

Step 5: Change business registration and tax registration information according to the inter-agency one-stop shop mechanism or directly at the tax authority to register the tax calculation method (if there are changes compared to the present).

Step 6: Register a private bank account for business activities (if you do not have a private bank account for business activities independent of personal payments).

Step 7: Tax declaration for business activities according to the declaration form suitable for tax calculation method and business lines (using eTax Mobile).

Recognizing the role of this new step, Mr. Mai Son - Deputy Director of the Tax Department (Ministry of Finance) - has repeatedly affirmed: "This transformation is an important step to implement the Party and State's policy on fair and transparent tax management and promote the development of the private economic sector".

He believes that this change helps improve transparency and fairness in tax collection. When switching from contracting to self-declaring and paying taxes according to actual revenue, tax authorities can more accurately grasp the business capacity of each household, while ensuring the principle of "self-declaration, self-payment, self-responsibility".

Need to clarify the legal status of business households

According to Dr. Le Duy Binh - Director of Economica Vietnam, the transition from fixed tax to declaration mechanism will create a very large impact on business households and individuals.

Regarding the long-term vision, the trend of abolishing fixed tax is necessary to increase transparency and fairness in tax management. However, the prerequisite for implementing reforms on taxes, social insurance, business conditions or regulations applied to business households is to clearly define their legal status.

In the current legal system of Vietnam, except for Decree 01/2021/ND-CP which only provides regulations on business household registration, no legal document has defined HKD or determined the legal status of business households. Therefore, although it can be registered, the legal status of business households is not clear.

Dr. Le Duy Binh said that clearly identifying business households as economic entities in what form will help management agencies have appropriate responses. In the world and in the modern legal system, business entities are often divided into 2 clear groups: Business individuals/business entities and legal entities (enterprises established under company law, enterprise law).

If not registered in the form of an individual business, the entity must register a business and fully comply with the Enterprise Law, standards on accounting, auditing, and management accordingly.

Through reviewing international experience, Dr. Le Duy Binh said that currently, almost no country maintains the concept of "business households".

In OECD countries, the US, European countries such as France, Italy or ASEAN countries such as Malaysia, Singapore, about 70-80% of newly registered businesses annually are in the form of business entities.

If it is a business individual, tax obligations will be implemented in the form of individual enterprises or individual business types. At the same time, regulations on accounting and social insurance (SI) are also designed with the principle of low compliance costs, convenience and ease.