MB supports customers with a variety of ways to update their citizen identification on the MBBank App.

From January 1, 2025, according to Circular 17 of the State Bank, payment accounts that have not been updated with chip-embedded citizen identification information and biometric authentication with the Ministry of Public Security will not be able to make withdrawals, electronic payments, or use online banking utilities. In order to support customers to easily comply with the new regulations while still maintaining a seamless transaction experience, many banks and financial institutions have quickly implemented solutions to update information via online channels.

As a pioneer bank in applying modern security technology, MB offers flexible support solutions, suitable for all customers and situations. MB is also one of the pioneer banks to successfully deploy the method of updating citizen identification via VNeID account to customers.

With a security infrastructure that meets the standards of the Ministry of Public Security and app-to-app connection technology between the MBBank App and the VNeID app, users can update their identity information quickly, anytime, anywhere, without the need for an NFC-enabled device. The solution opens up a simple, effective experience, helping customers easily complete the information update without worrying about technological or time barriers.

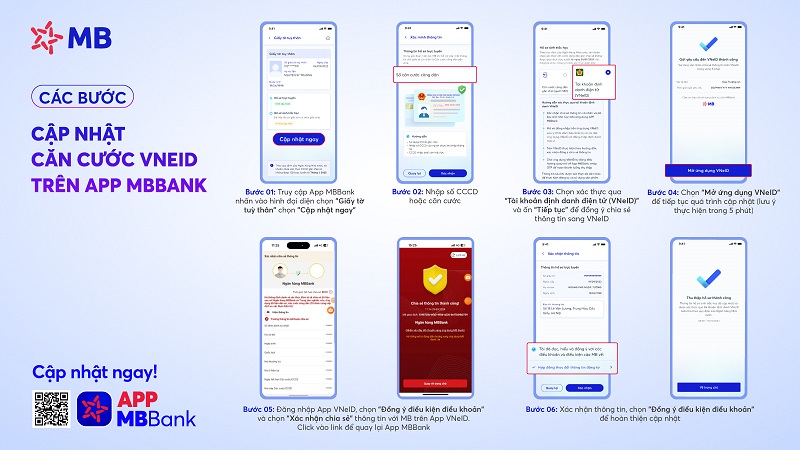

With just a few simple steps, you can update your citizen ID on the MBBank App:

Access the MBBank App, select "Identification documents".

Click “Update now”, then select the authentication method via “Electronic identification account (VNeID)”.

Follow the on-screen instructions, and complete the authentication in just a few minutes. (Note: Make sure your VNeID account is level 2)

For NFC-enabled devices: Customers can update their chip-embedded citizen identification quickly. Just go to the “Identification Documents” section on the MBBank App, the entire process is completed in just 1 minute. For devices that do not support NFC or for elderly customers: MB provides the “Biometrics with Opportunity” feature. Relatives who already have an MBBank App account can help collect information on behalf of customers who have difficulty in the operation. In addition, more than 400 branches, transaction offices, and MB SmartBank nationwide are ready to support customers in updating information easily and quickly.

Thanks to its tireless efforts, MB has so far supported nearly millions of customers to complete the update of their citizen identification information. This result not only helps ensure that all transactions take place smoothly, but also strengthens customers' trust in the digital banking system.

Technology Pioneer – Comprehensive Security for Applications and User Devices

Always aiming to protect customers' assets and information to the maximum extent, MB not only focuses on updating authentication data but also continuously strengthens the defense system against increasingly sophisticated threats. Security layers are upgraded to deal with fraudulent behaviors such as password theft, D-OTP electronic authentication forgery, account hijacking, and many other tricks.

In particular, MB also integrates a proactive warning system, based on data from the Department of High-Tech Crime Prevention and Control (A05), to promptly detect and warn when there are signs of fake accounts or devices being attacked by malware or spyware.

With the App Protection feature, the MBBank App automatically scans the device as soon as the user accesses the application. If the device is detected to be at risk of being infected with malware or spyware, the application will immediately send a warning directly to the user's screen. In serious cases, such as when the device shows signs of being hijacked or deeply copied, the MBBank App will automatically exit to prevent the risk of losing money or exposing sensitive customer information.

The Deputy Director of Digital Banking said that investing in developing new technologies is part of the Bank's sustainable digital transformation strategy, helping customers feel more secure in all financial transactions, thereby having more time to improve their own living values.

MB continues to affirm its pioneering role in the banking industry, bringing peace of mind and convenience to millions of users.