In the context of Vietnam's tax management mechanism changing strongly, especially the roadmap to eliminate contract taxes and switch to reporting based on actual revenue from 2026, many business households are asking: Are all transactions required to issue invoices? Or do you just need to make an invoice when customers request or when the transaction value is large?

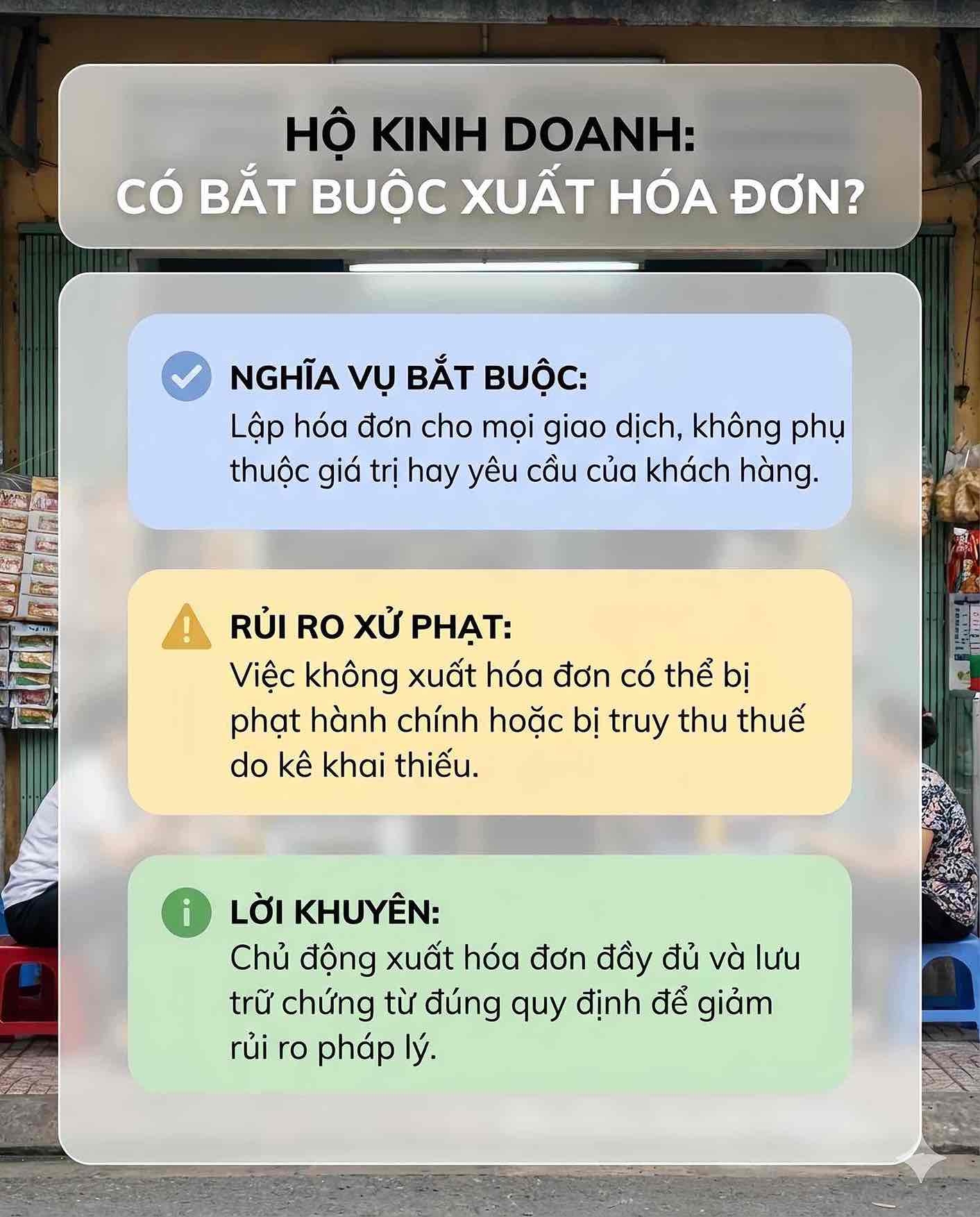

In fact, current legal regulations are not as complicated as many people are concerned. The invoice is not the "option" of the seller, nor is it the "right" of the buyer, but the legal obligation of the seller of goods and services. field misunderstandings that are not adjusted in a timely manner can put businesses at risk of being fined when the new management mechanism is fully applied.

Issuing invoices is a mandatory obligation of sellers

According to the Law on Tax Administration for the Year, taxpayers including business households, are required to declare, pay taxes and fully comply with tax administrative procedures. In the tax management system, invoices are an important document to determine revenue and tax obligations.

Specifically, Article 3 of Decree 123/2020/ND-CP (regulations on invoices and documents) clearly states: When selling goods or providing services, sellers must prepare invoices according to regulations, unless otherwise provided by law.

From this regulation, it can be seen that:

- Business households must prepare invoices for each sale and service provision;

- Regardless of large or small transaction value;

- Whether the buyer has a request or not changes the seller's obligation to make invoices.

Exceptions are available, but not the general principle

The law does not require the issuance of invoices in all absolute cases, but cases that do not require the issuance of invoices are all exemptions with specific regulations or instructions.

According to current documents and instructions of tax authorities, some specific cases can be applied in other forms, such as:

- Some small-scale retail activities are allowed by the tax authority to use statements instead of invoices;

- Some specific transactions or activities in remote areas are carried out according to the specific instructions of the tax authority, with the condition of fully meeting related procedures.

Note: This is an exception, not a general rule. When the roadmap for eliminating contract tax is approaching, these excections will be reviewed more carefully and applied more strictly according to the instructions of the tax authority

Only issuing invoices when customers request is a common misunderstanding

In business reality, many households still think that if customers do not need it, they do not have to issue invoices. This is one of the most common misunderstandings and also the reason for many cases of being punished.

According to current regulations, the obligation to make invoices belongs to the seller, not depending on the buyer's request. Even small transactions, if not exempted according to regulations, still have to issue invoices. Failure to issue invoices when arising transactions may be subject to penalties under Decree 125/2020/ND-CP on administrative sanctions for tax and invoice violations.

When is not making an invoice considered tax evasion?

Not all cases of not making invoices are considered tax evasion. Current law clearly distinguishes between violations of administrative procedures and tax evasion.

If a business household does not prepare an invoice but does not generate a missing tax amount, this behavior is determined to violate procedures and will be subject to administrative sanctions. Only when there is a basis to show that not making invoices leads to a lack of revenue and tax payable, will the tax authority apply tax collection and accompanying penalties.

Tax collection must be based on data, documents and comparison results, not applied in a speculative manner.

What should business households do to avoid risks?

To limit the risk of being fined or having tax collected when the roadmap for eliminating contract tax is fully implemented from 2026, business households need to:

- Clearly understand the obligation to prepare invoices: Issuing invoices for all arising transactions.

- Make and store invoices in accordance with regulations: There must be sufficient and clear documents.

- Declare revenue correctly and fully: No missed transactions.

- Prepare clean book data: Service for comparison and inspection by tax authorities.

- Learn and apply electronic invoices if it is eligible: Meet modern management requirements.

In reality, most cases of punishment are due to failure to comply with the obligation to prepare invoices or to declare inaccurately, not for tax evasion. Understanding and fulfilling this obligation will help businesses minimize legal risks in the coming time.