The focus of the market is on the meeting on September 18 of the US Federal Reserve (Fed). If the Fed cuts interest rates, this could be the main driver for gold to increase and weaken the USD.

Uncertainty in the world is showing positive signs. If the UK Brexit event happens, a deal will also be reached.

In Hong Kong, Special Zone Chief Carrie Lam recently announced the withdrawal of the extradition bill in a television speech. The decision to withdraw the bill means the authorities will respond to one of five requests from protests, who have been patrolling for nearly three months to protest the extradition bill, allowing suspected cases to be taken to court areas where Hong Kong has not yet signed an extradition treaty, including mainland China. This has investors predicting that tensions may ease.

The Chinese Ministry of Commerce's confirmation of holding high-level talks with the US in early October has eased trade tensions between the US and China. The above developments have caused investors to turn to more risky assets such as stocks and push gold prices down for the second consecutive week.

According to the forecast results of gold price trends next week on Kitco News, out of 15 gold experts surveyed on Wall Street, 9 people (equivalent to 60%) predicted gold prices to increase; 3 experts predicted prices to decrease (equivalent to 20%) and the rest predicted gold prices to remain flat.

Meanwhile, 1,164 respondents participated in an online survey on Main Street, with 679 people (58%) predicting gold prices to increase; 198 people (25%) predicting prices to decrease and the rest saying prices would go sideways.

Investors are optimistic about predicting gold prices to increase next week because they expect the US Federal Reserve (Fed) to cut interest rates to support the economy at its meeting in mid-September. Investment funds are trending to buy more gold. Gold's price decrease last week was considered excessive.

However, those who predict gold will decrease or go sideways believe that the market is in the over-selling zone (ie, more investors are selling gold than buying), investors should be cautious with the market during this period.

China - the world's largest gold importer continues to make net purchases of gold for reserves. According to the latest data released by the National Administration for Foreign Trade (SAFE), the country's foreign exchange and gold reserves increased simultaneously in August. As of the end of August, China's gold reserves have reached 62.45 million ounces, up 190,000 ounces compared to July. Notably, this is the ninth consecutive month that China has increased its gold reserves.

According to experts, increasing gold reserves in addition to trying to diversify reserves alongside the US dollar is also an important strategy for China and the country's Central Bank is likely to continue to net buy gold in the coming months.

In 2019, many central banks around the world took a big stake in gold reserves. Gold is seen as helping to diversify foreign exchange reserves of countries, reduce dependence on the US dollar, in the context of slowing economic growth, rising trade and geopolitical tensions as at present.

The world spot gold price is currently at 1506.50 - 1507.50 USD/ounce. Meanwhile, December gold futures rose $4.4 to $1,529.90 an ounce.

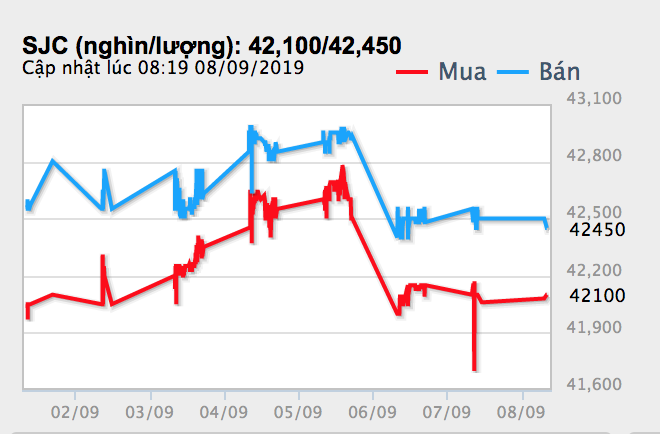

Domestic gold prices are currently listed at 42.10 million VND/tael (buy) and 42.47 million VND/tael (sell).