core business segment improves

According to the Consolidated Financial Statements for the third quarter of 2025, BV Land Joint Stock Company (UPCoM: BVL) recorded net revenue of more than VND202 billion, up nearly 14% over the same period last year. Thanks to the slight decrease in capital prices, gross profit increased sharply to VND 58.1 billion, equivalent to a gross margin of nearly 28.7%, double the 14.6% of the third quarter of 2024.

After deducting expenses, BV Land net profit was nearly VND37 billion, 6.5 times higher than the same period last year. The company explains this breakthrough result from the fact that member units still maintain production and business efficiency, although the product consumption rate is somewhat slower than in the first half of the year.

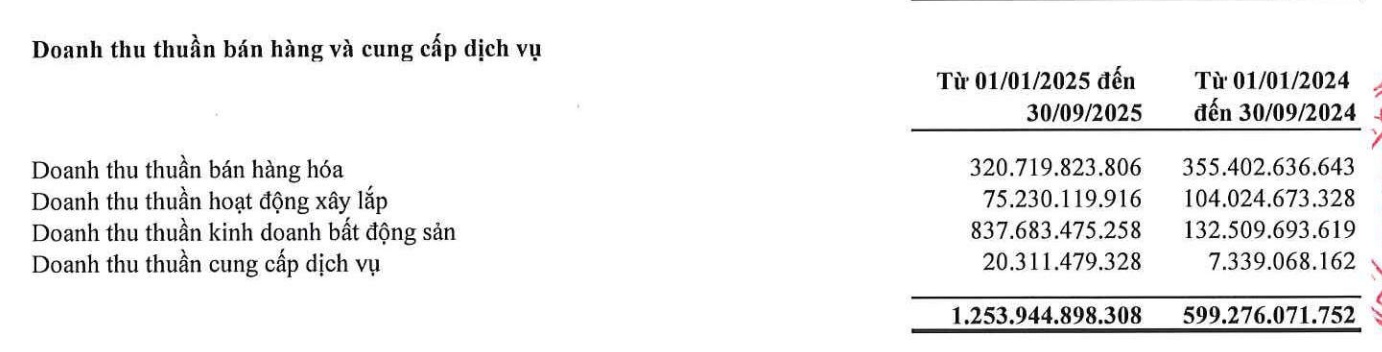

Accumulated in the first 9 months of 2025, BVL's net revenue and after-tax profit reached nearly VND 1,300 billion and VND nearly VND 299 billion, respectively. Revenue from real estate business reached nearly 838 billion VND, an increase of 6.3 times, while financial revenue increased 3.9 times, reaching more than 49 billion VND thanks to deposit interest and a profit of nearly 4 billion VND divided from the Tay Dinh Tri Project.

As of September 30, 2025, BV Land's total assets reached more than VND 2,654 billion. The debt payable is VND 1,036.7 billion, equity is VND 1,618.1 billion, equivalent to a debt/equity ratio of about 0.64 times. The equity/total asset ratio reached 61%, reflecting the capital structure being cautious in the context of many market fluctuations.

Increase investment, maintain key projects and control inventory

Compared to the beginning of the year, BV Land's payables have doubled (from 498.7 billion to 1,036.7 billion VND) due to capital needs for project implementation. In particular, the "pre-paid buyer" amount decreased to 78.9 billion VND compared to 110.3 billion VND at the beginning of the year, reflecting the handover - recording of revenue or adjusting the progress of collection.

Inventory is at 771.6 billion VND, accounting for about 29% of total assets. Of which, unfinished production and business costs are 433.5 billion VND, finished real estate products are 240.6 billion VND. This structure shows that the company has a large enough quantity of completed products to record quick revenue when selling, while still maintaining the project under construction to ensure future revenue.

The list of buyers who pay in advance currently includes BV Land's key projects such as Diamond Hill Thai Nguyen (12.47 billion VND), Tay Dinh Tri New Urban Area (5.96 billion VND) and other related items related to Diamond Hill. The company still recorded sales strength, but the scale was not large, causing the knee revenue in the next 1-2 quarters to depend on actual sales progress.

The report shows that interest rates are low compared to the scale of revenue - profit, business cash flow is positive. However, rapidly increasing debt is a challenge in accelerating inventory consumption. In the coming time, BV Land plans to focus on sales in 3 projects including Diamond Hill Bac Giang BV, Bavella Lac Ngan and Bavella Green Park, while promoting debt collection and preparing to launch new products at Diamond Hill Thai Nguyen.

As of the end of the third quarter, the amount of money that buyers paid in advance for the Diamond Hill project decreased from more than 106 billion VND to more than 60 billion VND. However, the company still recorded more than 12 billion VND in advance payment to Diamond Hill Thai Nguyen and nearly 6 billion VND to Tay Dinh Tri. This shows that BV Land needs to maintain a steady sales rhythm, converting inventory into money faster in the coming period.

Spending more than 410 billion VND to buy shares at Hung Dong Group

Notably, in the third quarter of 2025, BV Land spent more than VND 410.4 billion to buy shares at Hung Dong Group Joint Stock Company (Hung Dong Group) - a real estate enterprise headquartered in Thai Nguyen.

According to the report's explanation, the investment was made through two subsidiaries, BV Invest Joint Stock Company and TMG Infrastructure Development Joint Stock Company. After the transaction, BV Land held 38.54% of the interest rate and 47.67% of the voting rate at Hung Dong Group, thereby this company became an affiliated enterprise of BV Land.

Hung Dong Group is currently known for real estate projects in Thai Nguyen such as Danko City Thai Nguyen and Danko Avenue Song Cong. In 2023, Hung Dong was announced by Thai Nguyen province as an investor to meet the preliminary requirements for the Thanh Nam Urban Area Project (nearly 38 hectares, total capital of more than 1,152 billion VND).