In 2025, gold prices recorded the strongest increase since the oil crisis in 1979, with the price of this precious metal doubling in just two years. In the past, such a development was often accompanied by a forecast of a deep correction. However, this time the market context is changing fundamentally.

The rapid expansion of investors, along with a series of factors from US economic policy to geopolitical conflict in Ukraine, has caused major financial institutions such as JP Morgan, Bank of America (BoA) and Metals Focus to simultaneously forecast gold prices to reach the mark of 5,000 USD/ounce by 2026.

Spot gold prices set a historical record of $4,381 an ounce in October, while before March of the same year, gold had not even surpassed $3,000 an ounce. The main driving force comes from strong buying demand from central banks and investors, with the emergence of new buyers such as Tether - the world's largest stable coin issuer - to businesses putting gold in their fund management portfolios.

According to Mr. Michael Widmer, strategist of Bank of America, expectations of continued gold prices or the need to diversify investment portfolios are the main drivers of buying power. This trend is also supported by a large US budget deficit, efforts to narrow the short-term account deficit and the policy of maintaining a weak USD.

From another perspective, Mr. Philip Newman, CEO of Metals Focus, said that gold prices are also supported by concerns surrounding the independence of the US Federal Reserve (Fed), tariff disputes, as well as increasing geopolitical risks, especially the conflict in Ukraine and the strained relationship between Russia and NATO in Europe.

Central banks shape the gold price increase cycle

Experts say that for the fifth consecutive year, the trend of diversifying foreign exchange reserves and reducing dependence on USD-denominated assets of central banks will continue to create a solid foundation for gold prices in 2026. This buying power often appears when investors' positions become tense, cash flow rotates and prices are adjusted.

Gold prices are currently anchored at a much higher level than the start of the cycle, mainly due to persistent demand from central banks, said Alexander Shearer, Head of Basic Metals and Precious metals Strategy at JP Morgan.

According to him, the maintenance of gold prices above the 4,000 USD/ounce mark in a "cleaner" market environment in terms of investment position has created conditions for the continued increase cycle, as investors began to return to expand their positions after a period of risk reduction.

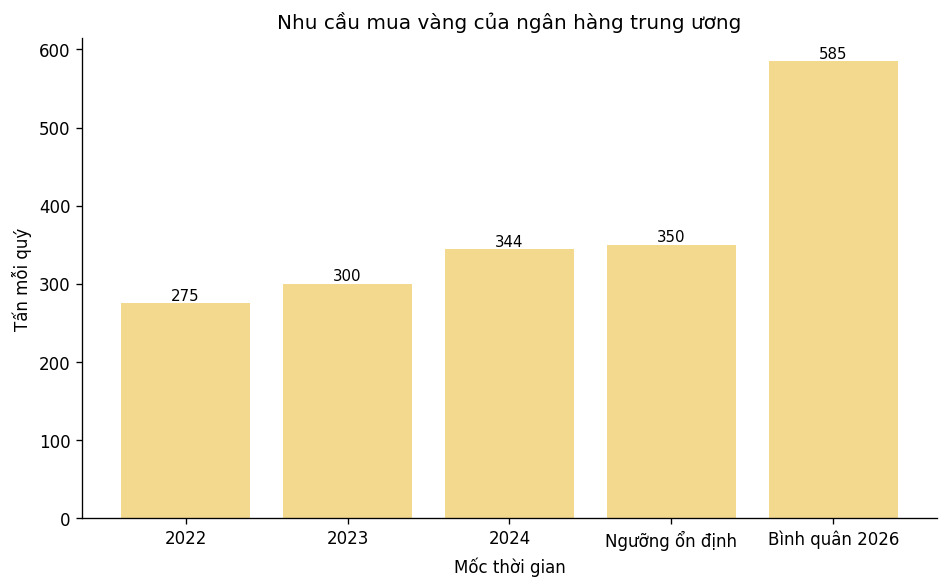

JP Morgan estimates that to keep gold prices stable, central bank and investor demand needs to reach about 350 tons per quarter. In 2026, this figure is forecast to average up to 585 tons per quarter.

The share of gold in total investor-managed assets has increased to 2.8%, compared to 1.5% before 2022. Although it is at a high level, Mr. Shearer believes that this is not necessarily the "ceiling" of the cycle.

In terms of price prospects, Morgan Stanley forecasts gold to reach $4,500/ounce by mid-2026. Meanwhile, JP Morgan expects average prices to exceed $4,600/ounce in the second quarter of 2026 and above $5,000/ounce in the fourth quarter of 2026. Metals Focus also issued a similar forecast, reaching the 5,000 USD mark by the end of 2026.

Gold becomes a hedge against stock risks

The Bank for International Investment (BIS) warned that the sharp increase in gold prices and global stock markets is a rare phenomenon that has not appeared in at least the past half century, raising concerns about the risk of bubbles in both markets.

According to analysts, part of the gold buying momentum this year comes from demand to defend against the strong correction of the stock market, in the context of tensions between traditional allies on tariffs, global trade and conflict in Ukraine.

However, this is also a potential risk for gold, as sharp declines in the stock market sometimes force investors to sell safe-haven assets to compensate for losses.

Ms. Nicky Shiels, Head of Metals Strategy at PAMP Brokers, predicted that the average gold price will reach 4,500 USD/ounce in 2026, and commented that gold is transforming into a long-term strategic asset in the portfolio, instead of just playing the role of a cyclical defensive tool.

Many experts believe that the increase in gold in 2026 will be less "hot" than this year. Macquarie said the global economy is gradually stabilizing, growth can recover, while the monetary easing cycle of central banks slows down and real interest rates remain relatively high. Accordingly, Macquarie forecasts the average gold price in 2026 at 4,225 USD/ounce, slightly lower than the current level.

Meanwhile, central bank demand for gold and capital flows into gold ETFs are forecast to slow down next year. Jewelry demand has fallen 23% in the third quarter, and is still under pressure, only partially offset by the demand for gold bars and coins from individual investors.