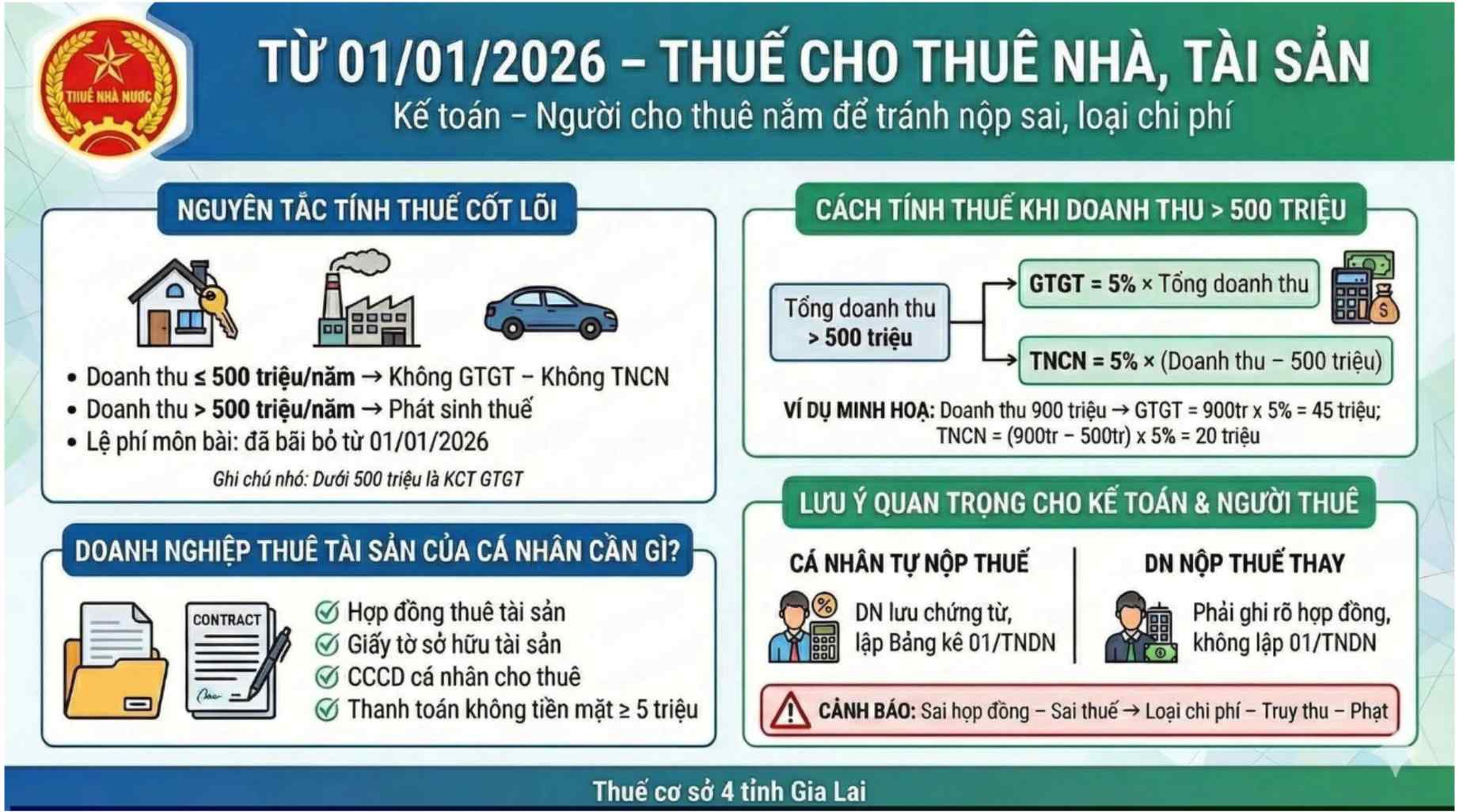

From 2026, the activities of renting houses and renting assets of individuals will be determined by tax obligations in a new approach, based on total revenue generated in the calendar year.

According to the guidance of the Grassroots Tax Department 4 of Gia Lai province, individuals with rental revenue not exceeding 500 million VND/year will not have to pay value-added tax and personal income tax.

This regulation creates a clear boundary between groups of individuals with small-scale rentals, which are income-supplementing, and groups with rental activities with large revenue, incurring tax obligations. In case the revenue exceeds the threshold of 500 million VND/year, the leasing individual must fully fulfill tax obligations according to current regulations.

How to calculate tax when revenue exceeds 500 million VND

For cases where rental revenue is over 500 million VND/year, value-added tax is determined at a rate of 5% on total rental revenue generated in the year. In parallel, personal income tax is calculated at a rate of 5% on the revenue exceeding the threshold of 500 million VND.

For example, individuals with asset lease revenue reaching 900 million VND/year. The amount of value-added tax payable is determined to be 900 million VND multiplied by 5%, equivalent to 45 million VND. Personal income tax is calculated on the portion of revenue exceeding 500 million VND, which is 400 million VND, with a tax rate of 5%, equivalent to 20 million VND. The total amount of tax payable in the year is 65 million VND.

The tax authority's guidance also notes that the subject fee for asset leasing activities has been abolished since January 1, 2026. The abolition of this fee helps reduce administrative costs for individuals with lent assets, while simplifying financial obligations compared to previous years.

Businesses renting assets must pay attention to records and payment

For businesses leasing personal assets, tax authorities should pay attention to strict requirements on dossiers and payment methods so that the expenditure is accepted as a valid expense when tax finalization.

Property lease documents must be complete with the lease contract, documents proving the ownership of the leased individual's property and the individual's citizen identification card. Payments from 5 million VND or more are required to be made in the form of non-cash, in order to meet the conditions for documents according to tax regulations.

Regarding tax obligations, two cases are set out. In case individuals directly pay taxes, the leasing enterprise is responsible for preserving documents and preparing Statement 01/TNDN according to regulations. In case the enterprise pays taxes on behalf of individuals, this content must be clearly stated in the asset lease contract and the enterprise does not have to prepare Statement 01/TNDN.

The 4th base tax of Gia Lai province also warns that errors in the lease contract or incorrect determination of tax obligations can lead to risks when finalizing, including being deducted costs, tax arrears and penalties. Therefore, both leasing individuals and leasing businesses need to carefully review the contract terms, payment methods and tax liability from the beginning to avoid arising problems later.