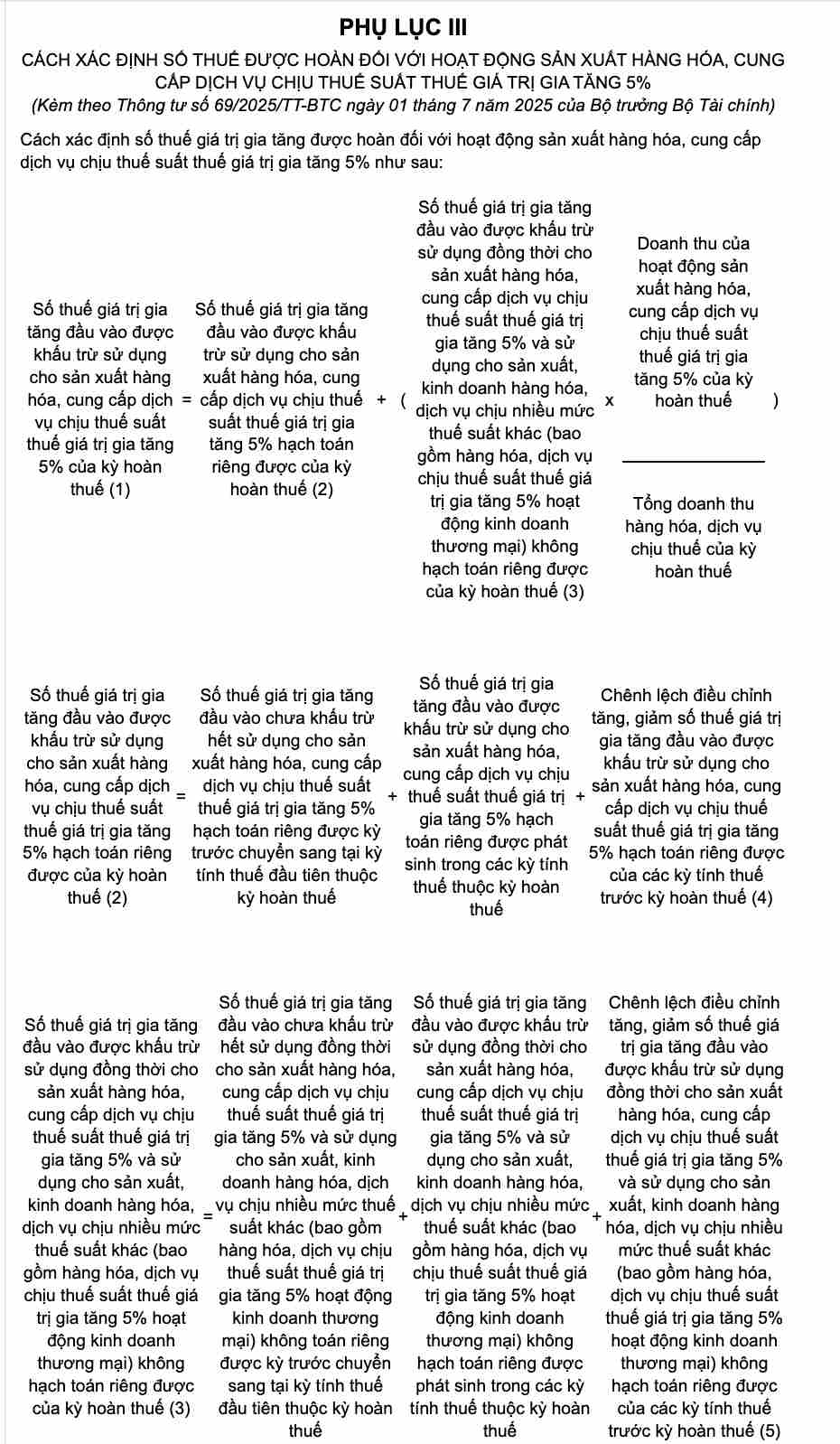

Appendix III issued with Circular 69/2025/TT-BTC guides how to determine the amount of value added tax refunded for the production of goods and service provision subject to the rate of 5% value added tax as follows:

In which:

1. Different adjustment of separate accounting input VAT ( box 4.

The adjustment difference for increasing or decreasing the input value-added tax (VAT) deducted from tax calculation periods before the tax refund period, used for goods manufacturing activities, providing services subject to a tax rate of 5% and accounted for separately, is determined by: the adjustment increase minus the adjustment for reducing input VAT deducted from tax calculation periods before the tax refund period.

2. The difference in adjusting input VAT without separate accounting ( box (5).

The adjustment difference for increasing or decreasing the amount of input VAT deducted for simultaneous use for goods manufacturing activities, providing services subject to a tax rate of 5% and other production and trading activities subject to many other tax rates (including commercial activities subject to a tax rate of 5%) but cannot be accounted for separately, determined by: the adjustment increase minus the adjustment for reducing input VAT deducted from the general tax rate of tax calculations before the tax refund period.

3. Conditions for VAT refund for activities subject to a tax rate of 5%

In case after offsetting the VAT payable from the production and trading of goods and services subject to many other tax rates (including goods and services subject to a tax rate of 5% in commercial activities), the remaining input VAT used for the tax rate of 5%, the business establishment will be refunded input VAT according to regulations.