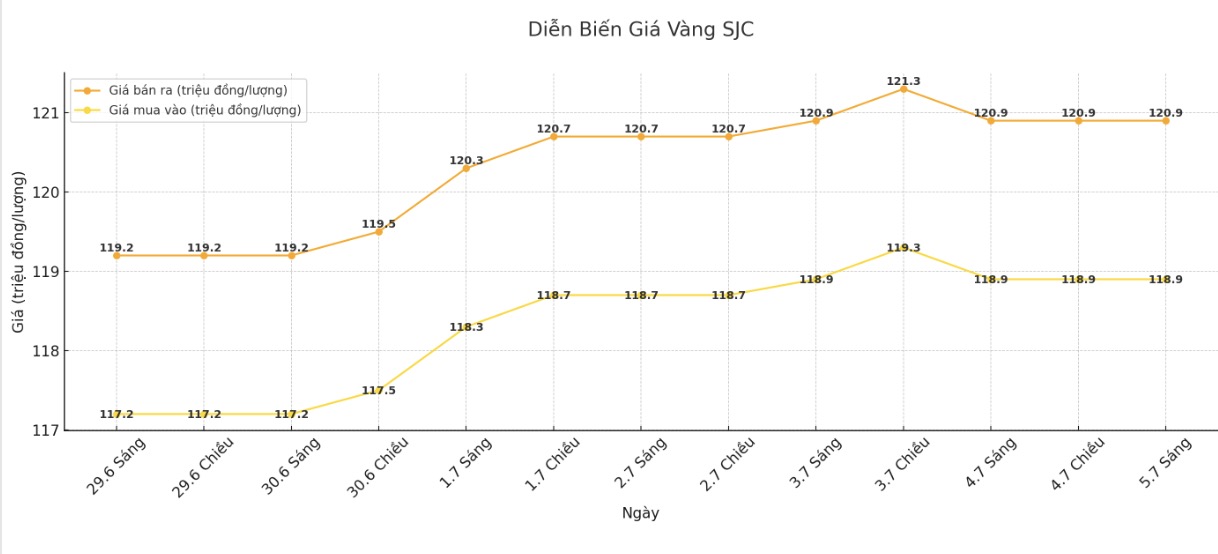

Updated SJC gold price

As of 8:50 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118.9-120.9 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed SJC gold bar price at 118.9-120.9 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.9-120.9 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Gemstone Group listed the price of SJC gold bars at VND 118.2-120.9 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.7 million VND/tael.

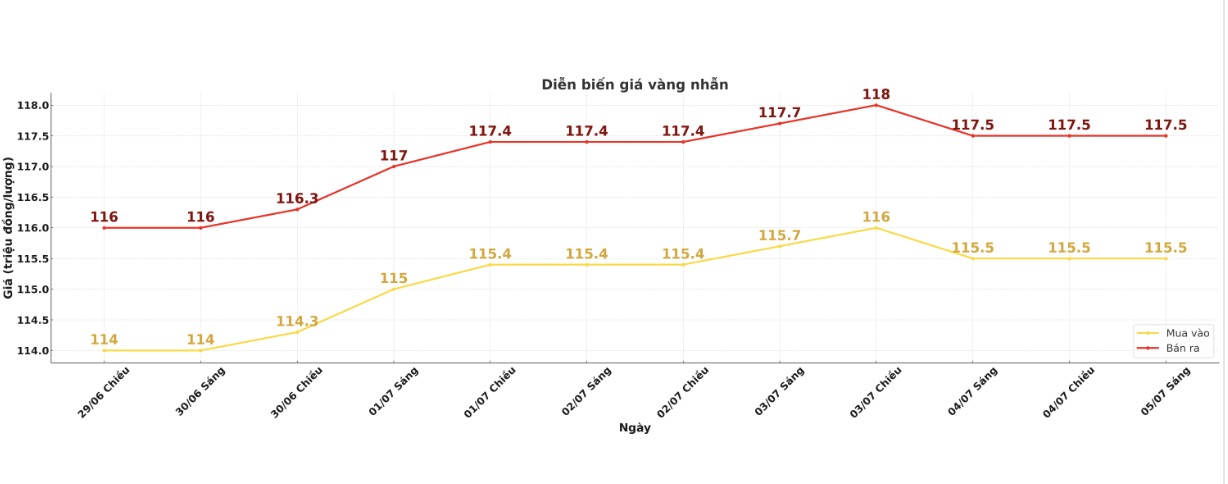

9999 round gold ring price

As of 8:50 a.m., DOJI Group listed the price of gold rings at 115.5-117.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.3-117.3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

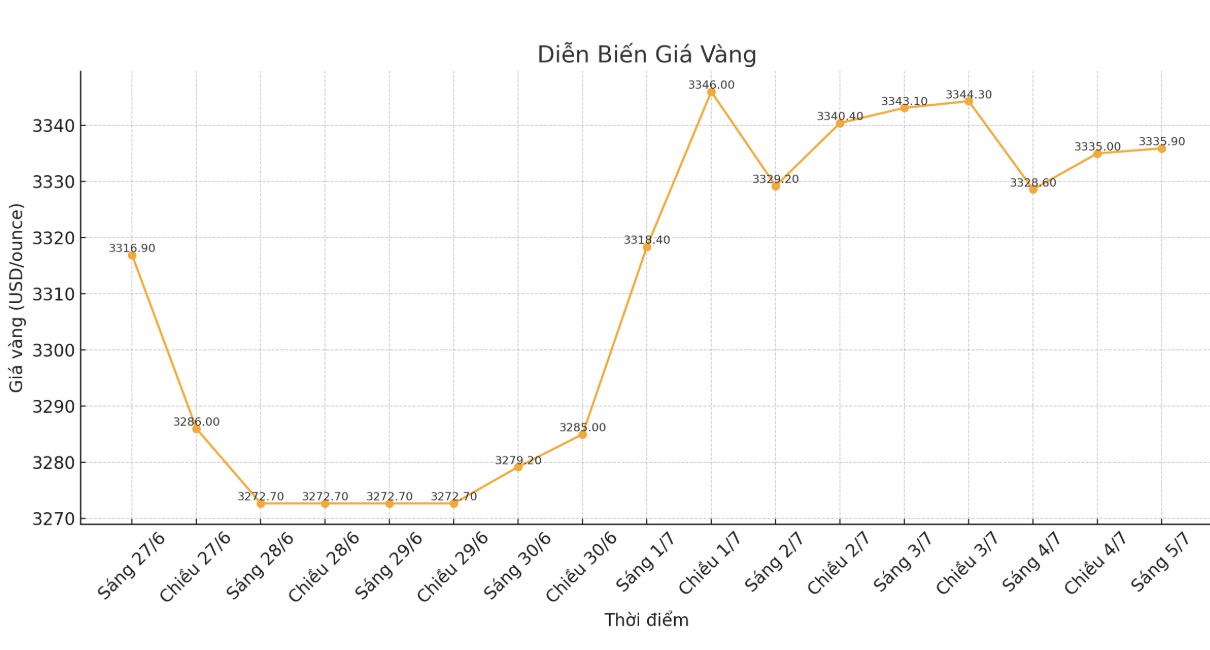

World gold price

At 8:50 a.m., the world gold price was listed around 3,335.9 USD/ounce, up 7.3 USD/ounce compared to 1 day ago.

Gold price forecast

World gold prices are being supported by increased demand for safe-haven assets in the context of the US House of Representatives having just approved a bill to reduce taxes combined with expanding budget spending. This move has raised concerns about financial risks that could have a long-term impact on the world's largest economy.

The new bill extends the effectiveness of tax reduction measures, while increasing the budget for border security and defense. However, it also significantly cuts funding for two major health care programs, Medicare and Medicaid. Schedules show that the bill risks pushing the US public debt up by trillions of dollars.

Not only that, on July 3, US President Donald Trump announced that he would start issuing a notice of tariffs from July 4, instead of continuing individual negotiations with trading partners. If he keeps the tax plan on July 9, observers predict that the USD could be under downward pressure, thereby supporting gold's increase.

According to many experts, the US Federal Reserve (FED) is facing a dilemma. Inflation has cooled down, creating a basis for the possibility of a rate cut. However, if the Fed cuts interest rates while the economy remains stable, the risk of inflation returning will be huge, especially when new tariff fences are activated and prices can escalate further.

In another development, the World Gold Council (WGC) said that many major central banks such as Germany, Italy, India and China are accelerating the return of gold. Germany and Italy currently hold 3,352 tons and 2,452 tons, respectively, with the majority stored in the US.

Turkey is one of the countries that quickly brings gold from the US and Europe to strengthen economic confidence.

India has withdrawn all its gold from London in 2024, while Turkey has been ahead since 2018. Under Finance Minister Berat Albayrak, the country has withdrawn about 350 tons of gold from the US, UK, and Switzerland for domestic storage. Turkey's gold reserves fell from 28.7 tonnes in 2016 to 0 tonnes in 2017 at the US Federal Reserve alone.

By the end of 2020, Turkey's gold reserves increased to 719.2 tons. According to the latest data, gold reserves reached 85.1 billion USD, exceeding foreign exchange reserves by 70.7 billion USD.

Amid global uncertainty, gold is gradually becoming an economic barrel, reshaping the monetary system, with Turkey as a pioneer.

Economic data to watch next week

Tuesday: Reserve Bank of Australia monetary policy meeting.

Wednesday: Minutes of the Fed's June FOMC meeting.

Thursday: US weekly jobless claims.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...