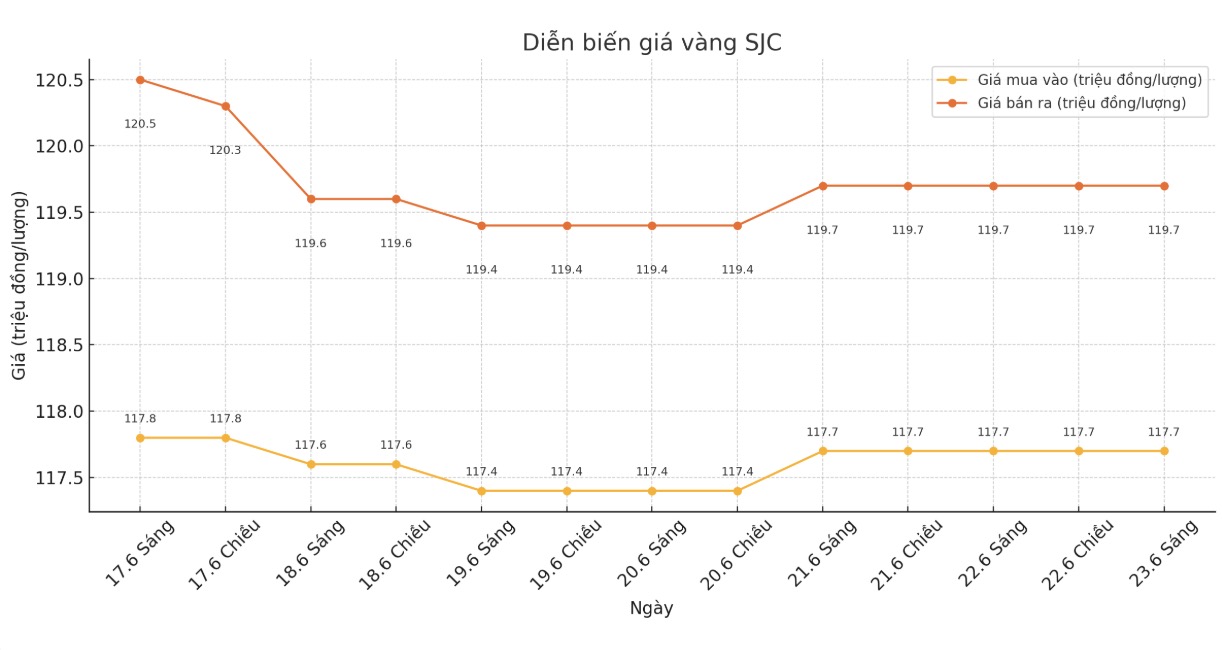

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.7 hydrologically 7.7 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.7-119 seven million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117-119 7.7 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.7 million VND/tael.

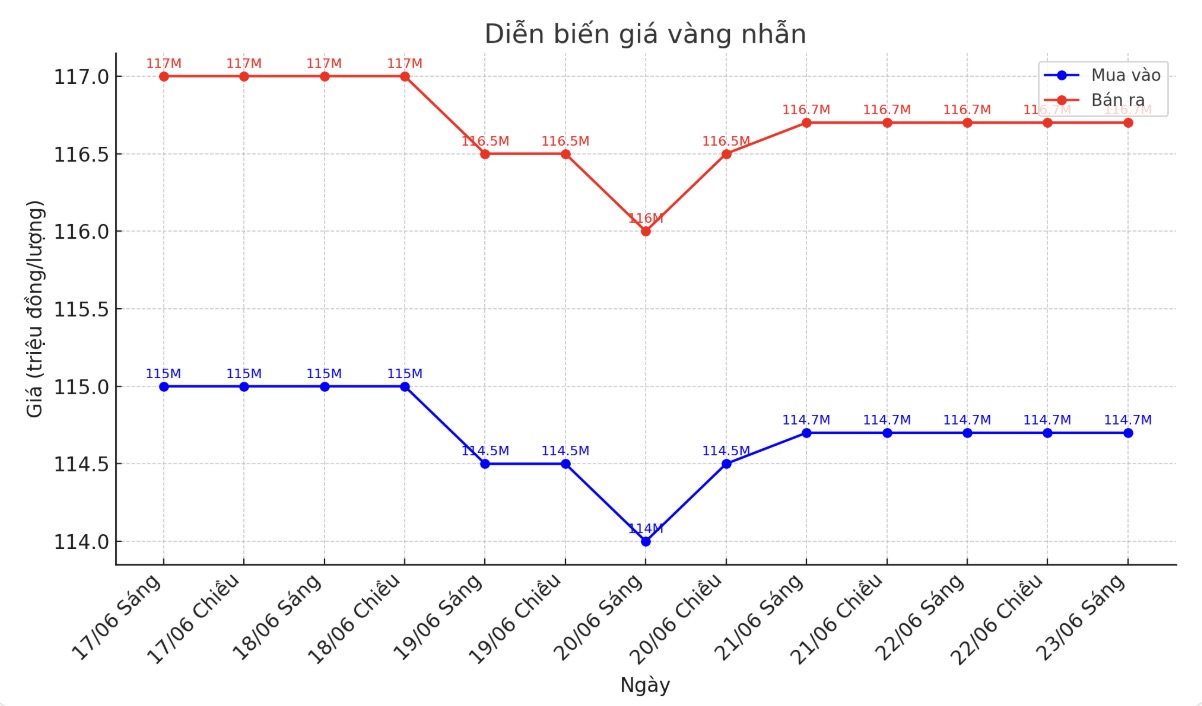

9999 gold ring price

As of 6:00 a.m., Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.7-116.7 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

World gold price

The world gold price was listed at 6:00 a.m. at 3,367.1 USD/ounce.

Gold price forecast

Gold prices are currently experiencing major fluctuations. Citi Financial Services Group predicts that the gold price fever may have peaked and may decrease by up to 25% by the end of 2026, down to $2,500-2,700/ounce.

Although gold prices are now nearing a historical peak, Citi believes that demand for gold will gradually decline as the US political and economic situation becomes more stable, and the US bond market does not have a major shock in interest rates, which has led many investors to seek gold as a safe haven.

Over the past week, world gold prices fell 1.87%, down to 3,367.1 USD/ounce. The reason does not come from a major shock, but from the change in expectations of interest rate policy of the US Federal Reserve (FED) and a slight recovery of the USD, which reduces the attractiveness of gold as a defensive asset.

However, this decrease still surprised many experts, as supporting factors for gold such as geopolitical tensions and inflation still exist.

Some experts say this adjustment is necessary after a long series of price increases over the past half year, while investors are shifting their cash flow to industrial metals such as silver and platinum, where real demand is increasing.

However, gold is still considered a safe haven asset in the long term, especially when geopolitical and economic instability continues. The gold price survey next week shows a differentiation between experts and investors, but no one is skeptical about the defensive role of gold.

With important upcoming US economic reports such as PMI, consumer confidence and core PCE, the gold market will need to monitor closely to make appropriate investment decisions.

Economic data to watch this week

Monday: S&P Preliminary PMI.

Tuesday: US consumer confidence; Chairman of the US Federal Reserve (FED) auctioned before the House Financial Services Committee.

Wednesday: New home sales; FED Chairman holds a hearing before the Senate Banking, Housing and Urban Committee.

Thursday: Weekly unemployment benefit application, long-term US order, GDP in the first quarter of 2025, Waiting for sale house transactions.

Friday: US PCE core inflation.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...