According to Decision 3389/QD-BTC in 2025, from January 1, 2026, contract tax will be officially abolished, business households will apply self-declaration and self-payment methods.

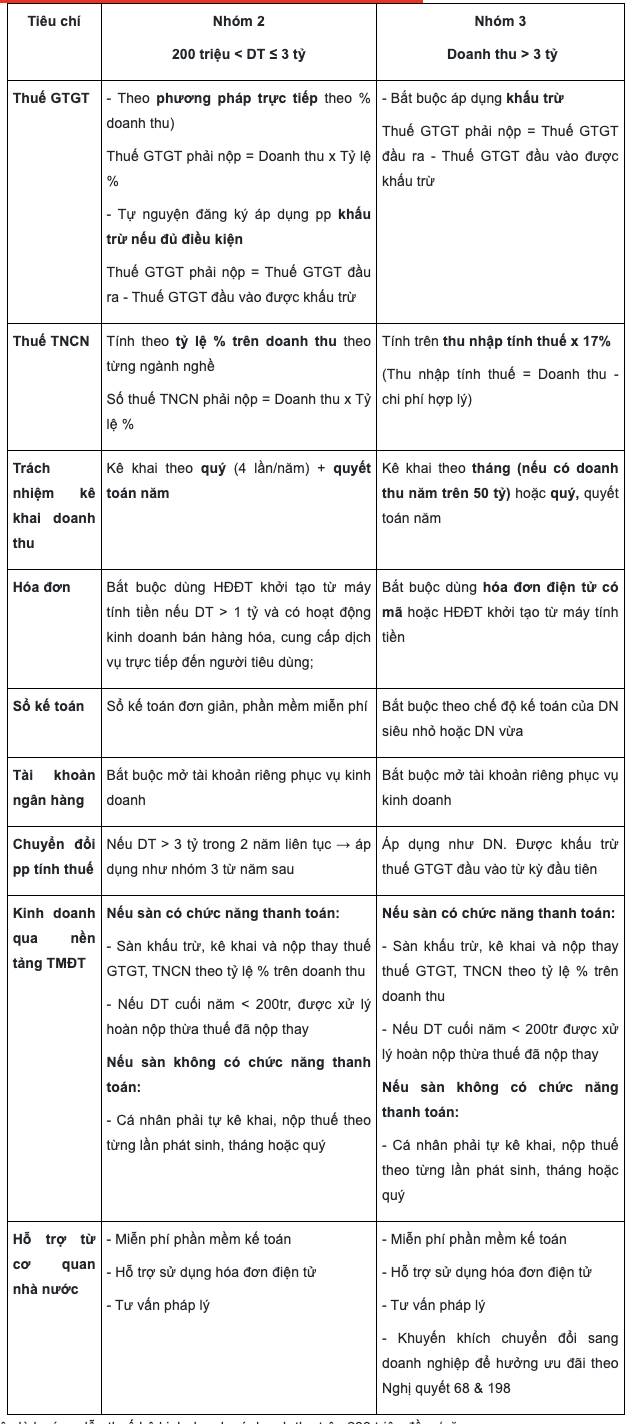

Based on Table 2 issued with Decision 3389/QD-BTC in 2025, the tax management model for households and individuals doing business when eliminating contract tax will be divided into 03 groups:

- Group 1: Revenue ≤ 200 million VND/year

- Group 2: 200 million < revenue ≤ 3 billion VND/year

- Group 3: Revenue > 3 billion VND/year

Regarding tax policies for business households with a revenue of over 200 million VND/year, details are as follows: