The price list for calculating registration fees for cars and motorbikes applies until December 31, 2025

In Official Dispatch 5363/CT-CS dated November 20, 2025, the Tax Department requested the Provincial and Municipal Tax Departments to urgently report and advise the Provincial People's Committee to proactively assign affiliated units to develop and submit to the Provincial People's Committee to issue a new price list for calculating registration fees for cars and motorbikes applicable to localities from January 1, 2026, as a basis for periodic adjustments and supplements in accordance with legal regulations.

At the same time, based on Clause 2, Article 2 of Decree 175/2025/ND-CP stipulating that from the effective date of Decree 175/2025/ND-CP (from July 1, 2025) to December 31, 2025, in case the People's Committees of provinces and centrally run cities have not issued a price list for calculating registration fees for cars and motorbikes, the Registration fee calculation price list and the Registration fee calculation price list will continue to be applied, adjusted and supplemented for cars and motorbikes issued by the Ministry of Finance.

Thus, from January 1, 2026, there will be a new price list for calculating registration fees for cars and motorbikes applied to localities.

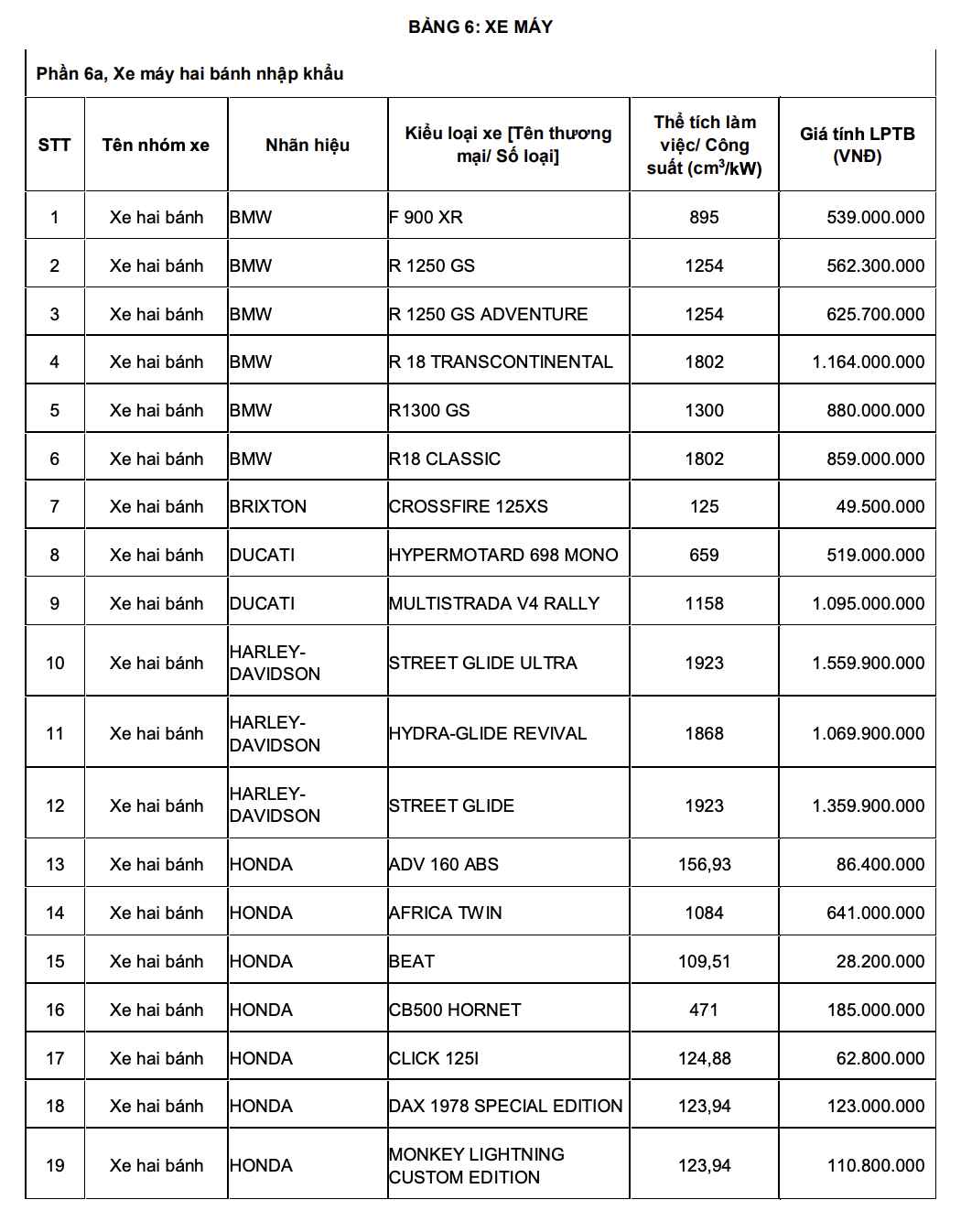

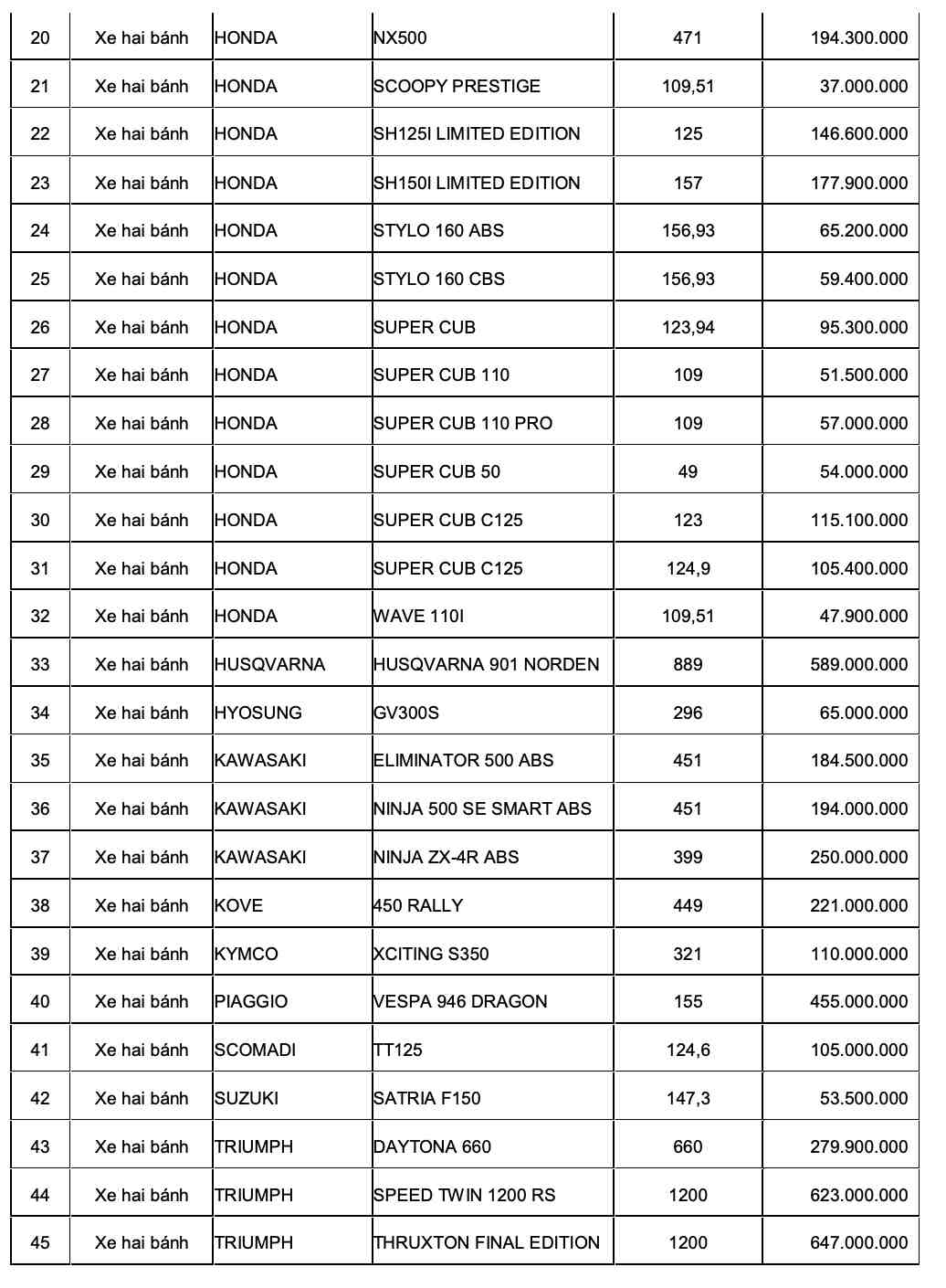

The price list for calculating registration fees for cars and motorbikes currently applied (until December 31, 2025) is the price list issued with Decision 2226/QD-BTC in 2025 adjusting and supplementing the price list for calculating registration fees for cars and motorbikes issued with Decision 2353/QD-BTC dated October 31, 2023; Decision 449/QD-BTC dated March 15, 2024; Decision 1707/QD-BTC dated July 22, 2024; Decision 2173/QD-BTC dated June 26, 2025.

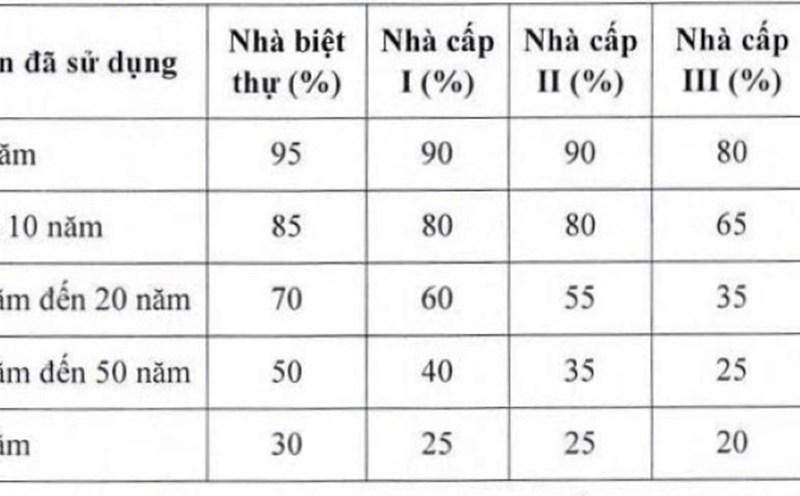

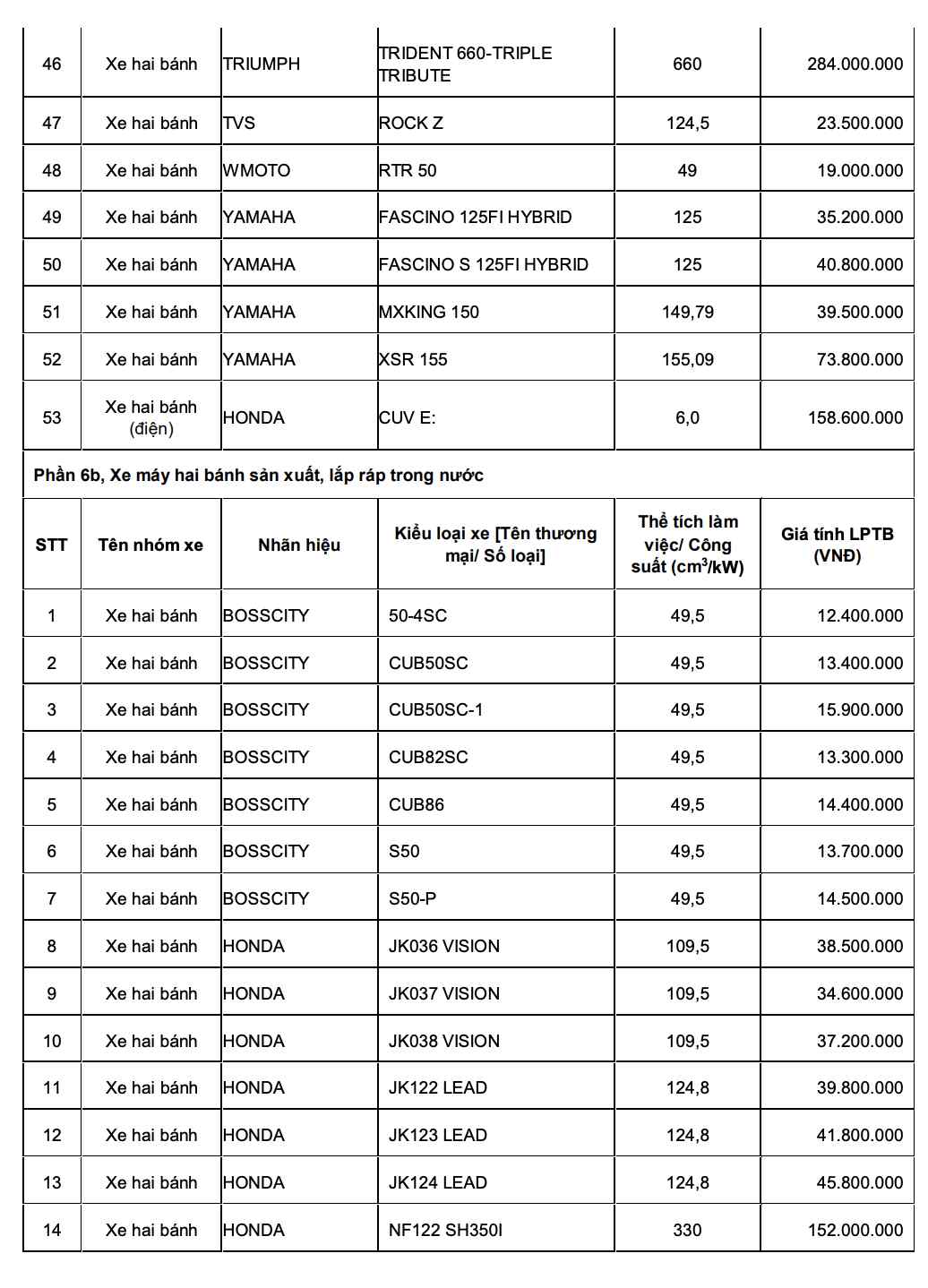

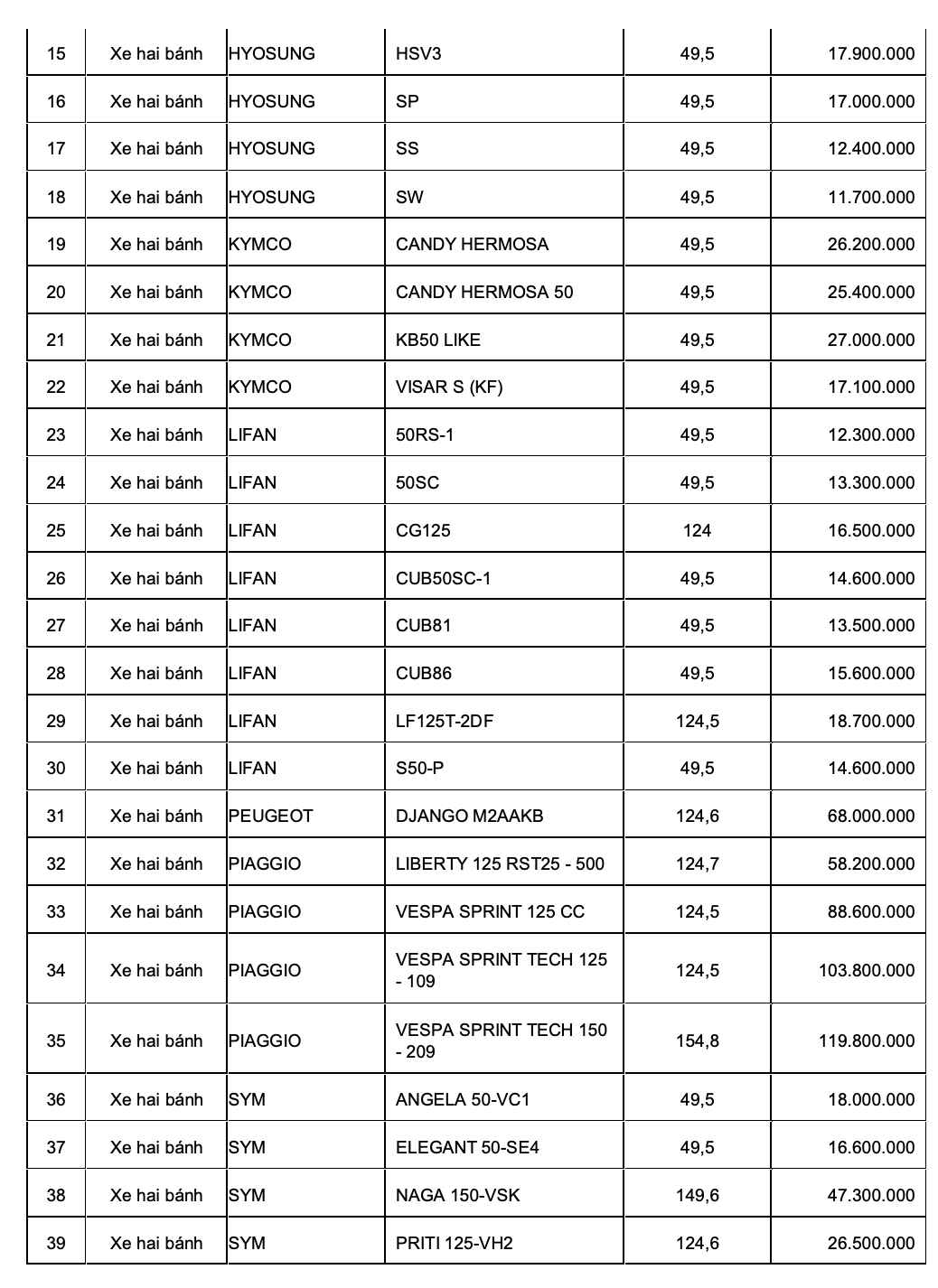

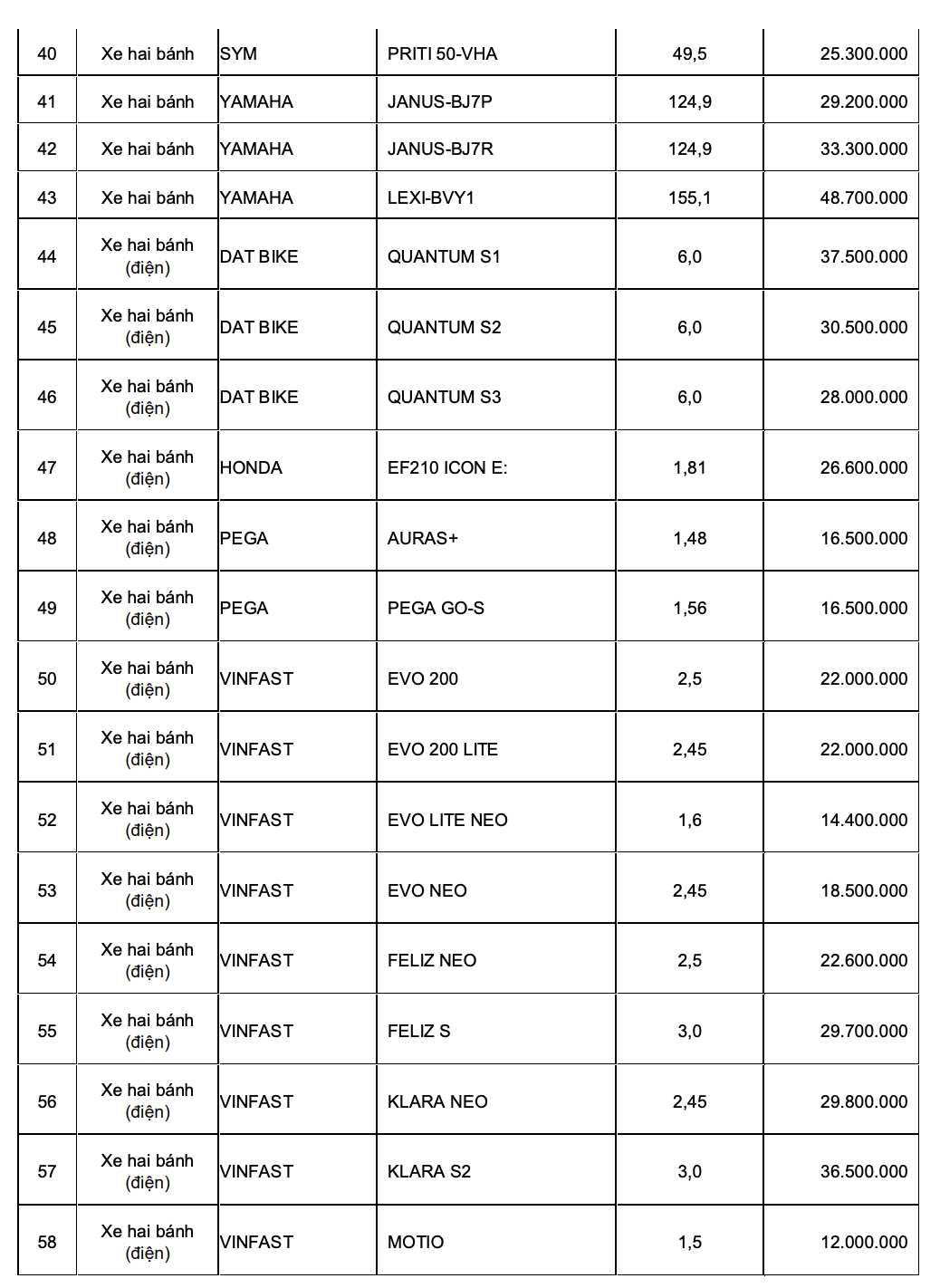

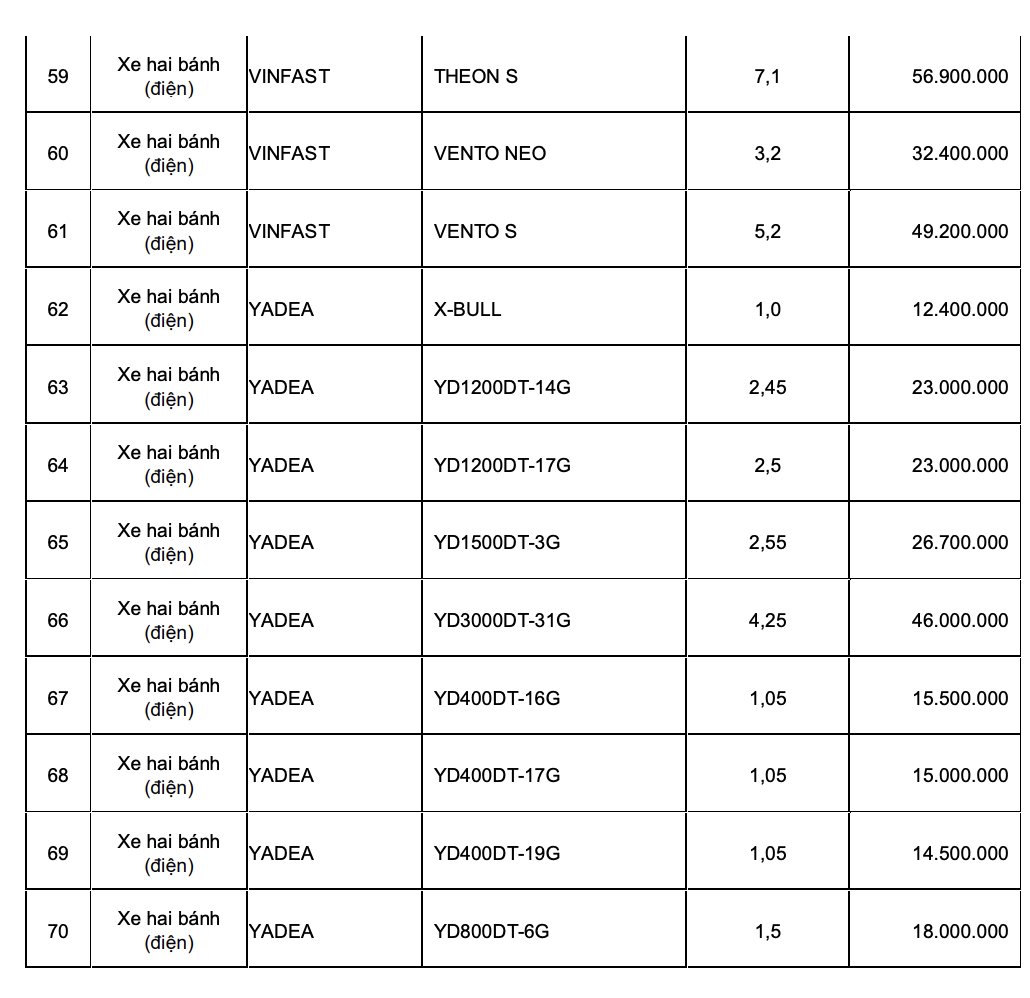

Below is the price list for calculating registration fees for 123 types of motorbikes today:

Current registration fee for cars and motorbikes

According to Clause 4, 5, Article 8 of Decree 10/2022/ND-CP (amended and supplemented by Decree 175/2025/ND-CP and Decree 51/2025/ND-CP), the registration fee collection rate for cars and motorbikes is expressed as follows:

- Motorbikes: The fee is 2%. For motorbikes that pay the registration fee for the second time onwards, the fee will be applied at 1%.

- Cars, trailers, semi-trailers, four-wheeled motorized passenger vehicles, four-wheeled motorized cargo vehicles, specialized motorbikes, and vehicles similar to these types of vehicles: The fee is 2%.

+ For passenger cars with 09 seats or less (including passenger pick-up vehicles): Pay the first registration fee at a fee of 10%. In case it is necessary to apply a higher collection rate to suit actual conditions in each locality, the People's Councils of provinces and centrally run cities will decide to adjust it up, but not exceeding 50% of the general collection rate prescribed in this point.

+ Dual-cabin cargo pick-up cars, VAN trucks with two or more rows of seats, with a fixed retaining wall design between the passenger compartment and the cargo compartment that pays the first registration fee with a fee of 60% of the first registration fee for passenger cars with 09 seats or less.

+ Battery-powered electric cars: From March 1, 2025 to February 28, 2027: pay the first registration fee at the rate of 0%.

+ The above-mentioned types of cars: pay the registration fee for the second time onwards with a collection rate of 2% and applied uniformly nationwide.

Based on the type of vehicle stated in the Certificate of Technical Safety and Environmental Protection Quality issued by the Vietnam Inspection Agency, the tax authority shall determine the registration fee for the vehicle as prescribed in this clause.