The stock market continued to differentiate on the electronic board in today's trading session, October 10. Along with that, there is not much strong buying power, but supply continues to decrease, while the VN-Index still maintains a fairly positive increase.

With today's increase, VN Index continues to set a new record score. Specifically, the closing session index recorded an additional 31.08 points, equivalent to 1.81%, up to more than 1,747 points. Although the score was recorded to have skyrocketed, the HoSE electricity billboard was not too different with 177 codes of increase, compared to 125 codes of decrease.

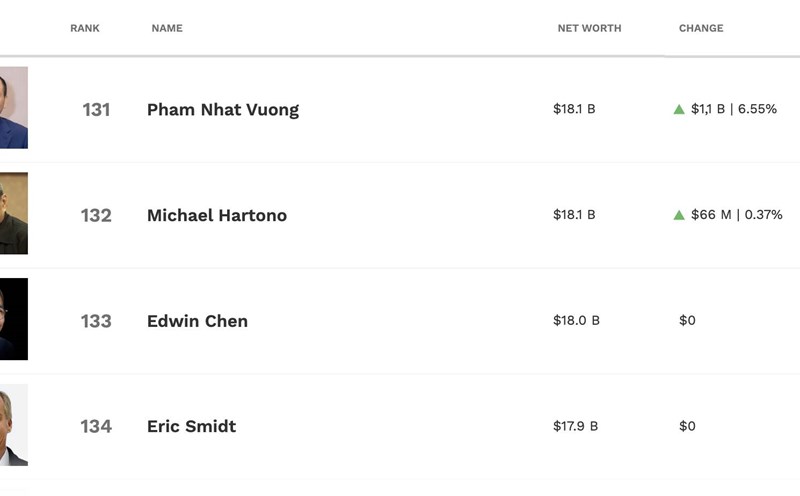

Similar to the previous session, the index received support from Vingroup stocks VIC, VHM and VRE. According to statistics, these 3 stock codes alone contributed 21.3 points to the VN Index.

In today's session, foreign investors are still trading in a less positive state as they maintain pressure to sell. Specifically, foreign investors net sold VND 462 billion on the HoSE, focusing on the banking and securities groups. On the contrary, foreign investors net bought HPG (447 billion VND), along with the Vingroup duo VIC (216 billion VND) and VHM (275 billion VND).

Liquidity in today's session did not change with 1.07 billion shares matched, equivalent to a trading value of VND 33,941 billion. Today, there are 9 codes with a transaction value of more than VND 1,000 billion: HPG, MBB, VIX, SHB, GEX, SSI, MSN, VPB, VHM.

SSI Securities Company commented that the current market developments in Vietnam are similar to the initial period of previous uptrend cycles (2016 2018 and 2020-2022), when the VN-Index recorded an accumulated increase of over 130%. In addition, the combination of a stable macro foundation, improved liquidity and strengthened investor confidence shows that 2025 is not the peak of the cycle, but the foundation for a new growth period that will last for many years to come.

Although foreign investors continue to sell net, with the total accumulated net selling value up to the end of September reaching VND96.5 trillion, domestic capital has played a leading supporting role, effectively absorbing the sales volume and maintaining market liquidity. The number of personal transaction accounts reached 11 million, equivalent to 10.6% of the population, an increase of 17.2% compared to the beginning of the year.

"This shift reflects a structural change in the structure of Vietnamese investors: the emergence of the domestic investment class - the force of investors is creating liquidity depth and sustainability in trading behavior, similar to the trend seen in Korea and Taiwan in the previous period," SSI experts commented.

In addition, deposit lending activities also increased sharply as securities companies expanded their leverage limits in the context of low capital costs and good profits. This effect helps increase profits in the uptrend, contributing to helping the VN-Index continue to outperform regional markets for the second consecutive year.