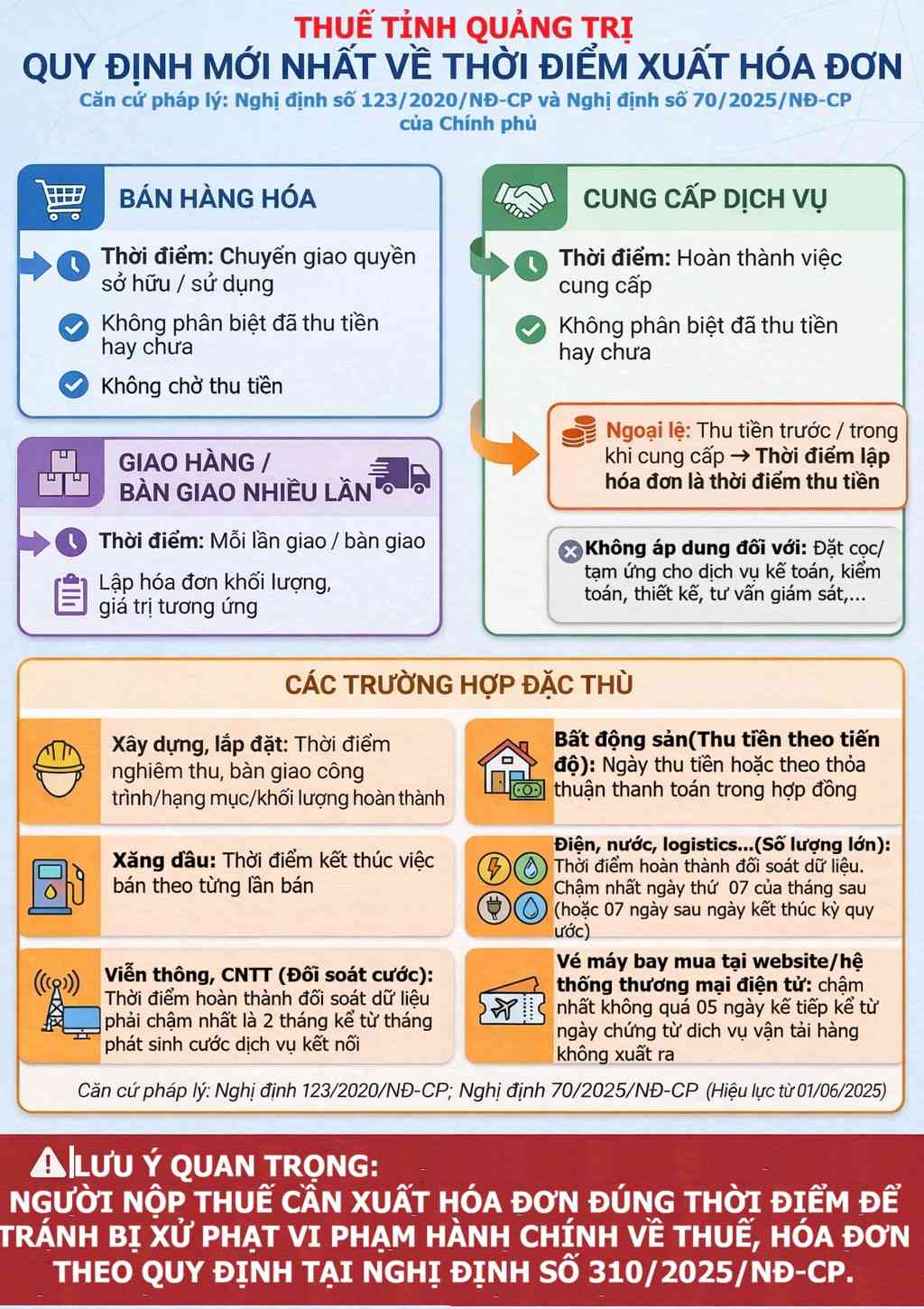

Quang Tri Tax Department has just issued guidance on issuing invoices at the right time to avoid risks and avoid administrative violations related to taxes and invoices according to Decree No. 310/2025/ND-CP.

Accordingly, Decree No. 70/2025/ND-CP (amended and supplemented by Decree No. 123/2020/ND-CP) has clearly and strictly stipulated the time for issuing invoices for each type of operation.

Taxpayers need to pay special attention to:

- Selling goods: Create invoices immediately upon transfer of ownership or use rights, regardless of whether money has been collected or not.

- Service provision: Invoices are made when the service provision is completed, regardless of whether the money has been collected or not.

- Cases of collecting money before or during the provision of services:

+ Invoice issuance time: Invoices must be made immediately at the time of collection.

+ Exceptions (No invoice is required when collecting deposit/addition): For special services such as: Accounting, auditing, financial and tax consulting; valuation; survey, technical design; supervision consulting; construction investment project preparation.

- Electricity, water, telecommunications, logistics...: No later than July of the month after the month of service arising or no more than 07 days from the end of the convention period.

- Air tickets sold on e-commerce systems/websites: No later than 05 consecutive days from the date the air transport service voucher is issued.

Important notes

Issuing invoices at the wrong time is a violation, which may be administratively sanctioned for invoices and affect the deductible costs when tax is finalized.

Quang Tri Tax Department recommends that taxpayers need to:

- Review the invoice issuance process

- Issuing invoices correctly - fully - promptly according to new regulations

- Proactively update policies to limit legal risks regarding taxes