Latest formula for calculating agricultural land use tax

Agricultural land use tax = Land area x Tax rate calculated in kg of rice per unit of area of each land class.

How to calculate land area:

Based on the actual area used, recorded in the land register or measurement results confirmed by the land management agency (according to Clause 2, Article 13 of the 2024 Land Law).

If there is no land record or accurate measurement data, use the area recorded in the taxpayer's declaration.

In case the cooperative or production group allocates land, the taxable area is declared by the household and confirmed by the head of the unit.

The land management agency coordinates with the tax authority to determine the taxable area locally.

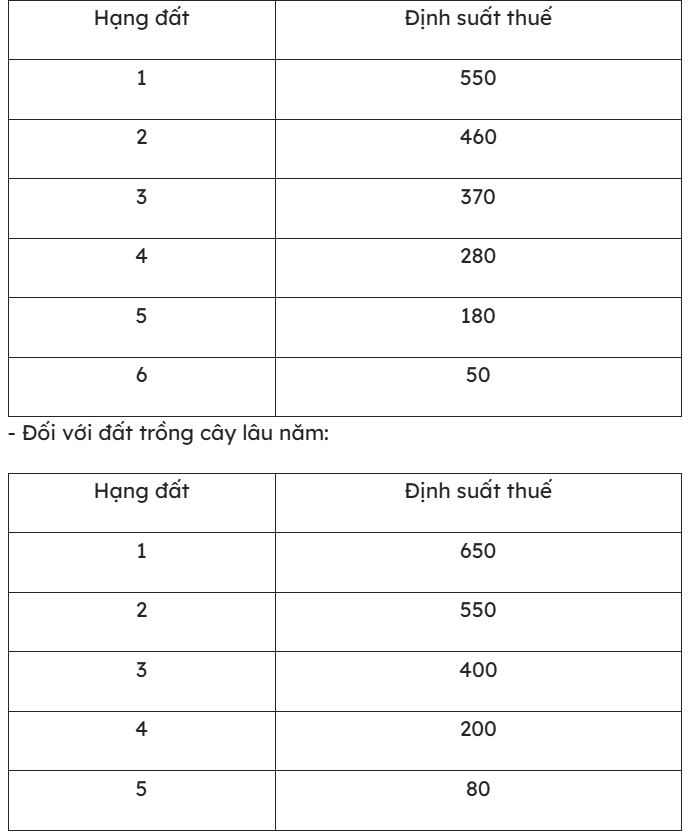

How to determine tax rate (weighing in kg of rice/unit of area):

Land for growing annual crops, land for aquaculture: Apply the rate according to land class.

Fruit trees grown on land for annual crops:

Class 13: equivalent to 1.3 times the annual land tax rate for crops of the same class.

Class 46: equal to the annual land tax rate of the same class.

Long-term crops harvested once: Pay tax at 4% of the value of exploited output.

Extending the period of agricultural land use tax exemption

The Government issued Decree No. 292/2025/ND-CP dated November 6, 2025, detailing and guiding the implementation of Resolution No. 216/2025/QH15 dated June 26, 2025 of the National Assembly on extending the agricultural land use tax exemption period. This Decree takes effect from January 1, 2026.

The agricultural land use tax exemption period prescribed in this Decree is implemented from January 1, 2026 to December 31, 2030.