Gold prices remained almost unchanged in Tuesday's session, maintaining around the highest level of all time amid escalating geopolitical tensions, while cautious sentiment ahead of the US inflation report limited the upward momentum.

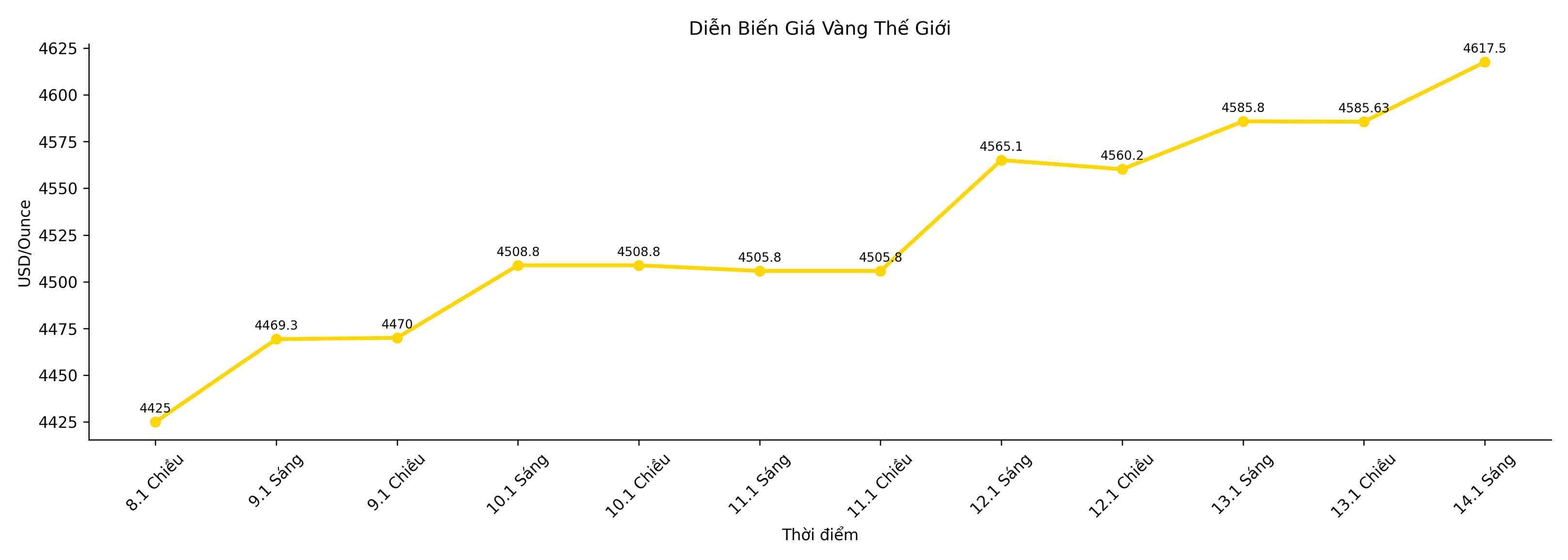

In this morning's trading session, spot gold rose to 4,617.93 USD/ounce, after setting a record of 4,629.94 USD in the previous session. US February gold futures fell 0.4% to 4,597.50 USD/ounce.

A slight recovery of the USD, driven by hawkish comments from senior officials of the US Federal Reserve (Fed), along with investors waiting for CPI data has created a resistance to gold," Ricardo Evangelista, an expert at ActivTrades, commented.

New York Fed Chairman John Williams said on January 13 that the central bank is not under pressure to adjust its short-term policy stance. Investors are currently expecting the Fed to cut interest rates twice this year, with CPI data released on the same day being considered an important signal for the upcoming policy direction.

On the geopolitical front, the Russian military on January 14 launched the most fierce missile attack since the beginning of the year against Ukraine, killing four people and injuring many others. At the same time, US President Donald Trump warned that any country trading with Iran would be subject to a 25% tariff when trading with the US.

Gold – non-profit assets often benefit in the context of low interest rates or rising geopolitical and economic risks.

With gold prices firmly consolidated above the $4,500 mark, supported by weakening USD prospects and geopolitical uncertainty, the $5,000/ounce target is increasingly within reach and can be challenged in the first half of the year" - Mr. Evangelista assessed.