According to the World Gold Council (WGC), although it has exceeded the threshold of 4,600 USD/ounce, gold prices are still not considered technically "overbought" until they approach the 4,770 USD/ounce zone.

In the latest Weekly Markets Monitor report, WGC said that after a somewhat quiet beginning of the year due to portfolio restructuring and profit-taking sales, gold prices quickly returned to an upward trend.

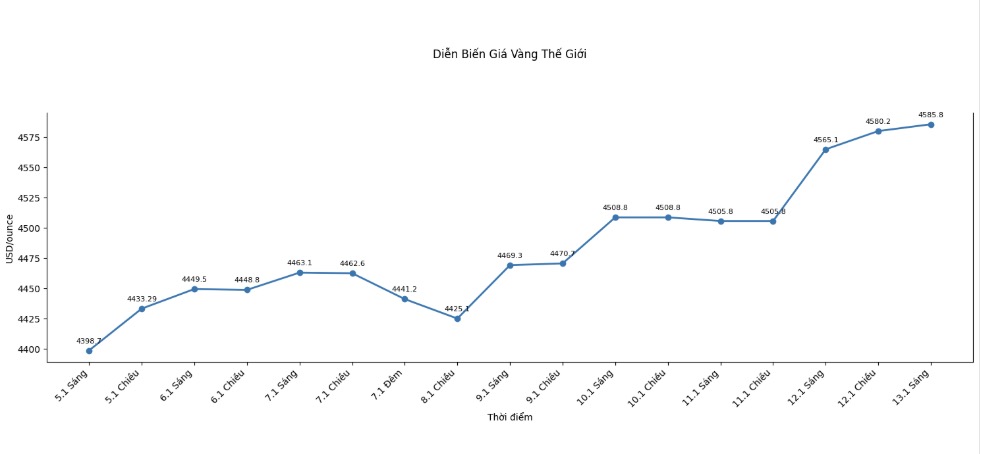

In just the first two weeks of 2026, gold prices have tripled to new historical peaks. When fluctuations and risks on the financial market appear with increasing frequency, they will form a higher level of risk compensation, thereby supporting gold prices.

The WGC assessed that concerns surrounding the prospects of US monetary and fiscal policy also contributed to boosting cash flow to gold, helping the price of this precious metal jump around the 4,600 USD/ounce mark in the first session of the week.

According to experts, in the context of a global economy with many unpredictable factors, holding gold continues to play an important role in the investment portfolio.

This week, a series of major economic data is expected to impact gold price movements. US inflation in December may increase slightly compared to the previous month, while economic growth in the UK and Germany is forecast to remain quite weak, reflecting the slow recovery of Europe.

In Asia, China's gold exports are likely to remain stable, thereby contributing to trade and exchange rate support.

Technically, WGC believes that the upward trend of gold has not been broken. The price is still standing firmly above the important support zone around 4,447 USD/ounce, corresponding to the 13-day short-term average. When this level is maintained, the risk of a deep decrease is not high and the main trend is still in the upward direction.

The nearest resistance level is determined around 4,600 USD/ounce, but the stronger technical resistance zone, formed from the price models at the end of 2025, is around 4,770 USD/ounce.

If gold prices adjust, important support zones are identified at 4,447 USD, 4,408 USD and lower is the area of 4,345 – 4,265 USD/ounce, where buying power is expected to return.

In the trading session on Monday, spot gold price set a new record when it reached 4,630.19 USD/ounce. By the time of writing the article (10:30 AM on January 13 - Vietnam time), this precious metal was still trading around 4,595.9 USD/ounce.

See more news related to gold prices HERE...