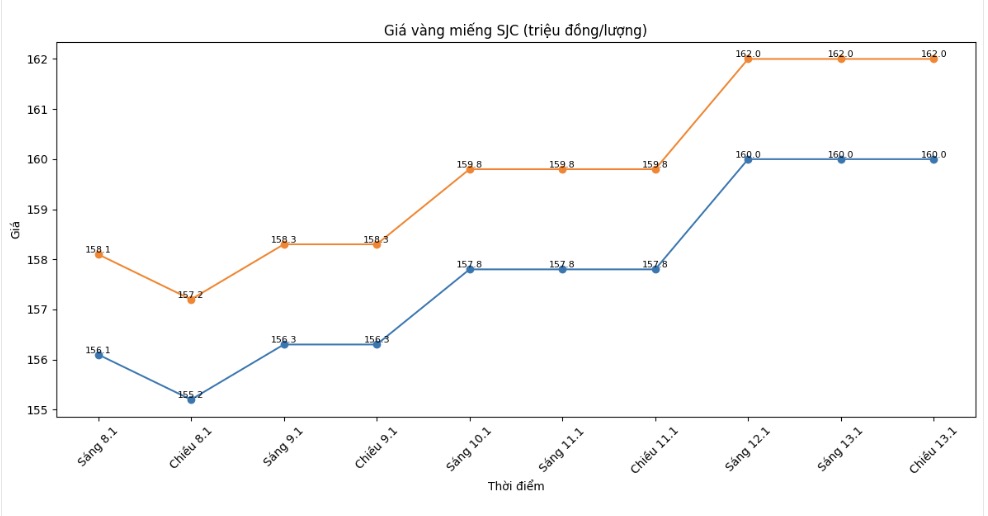

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 160-162 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 160-162 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 159.5-162 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

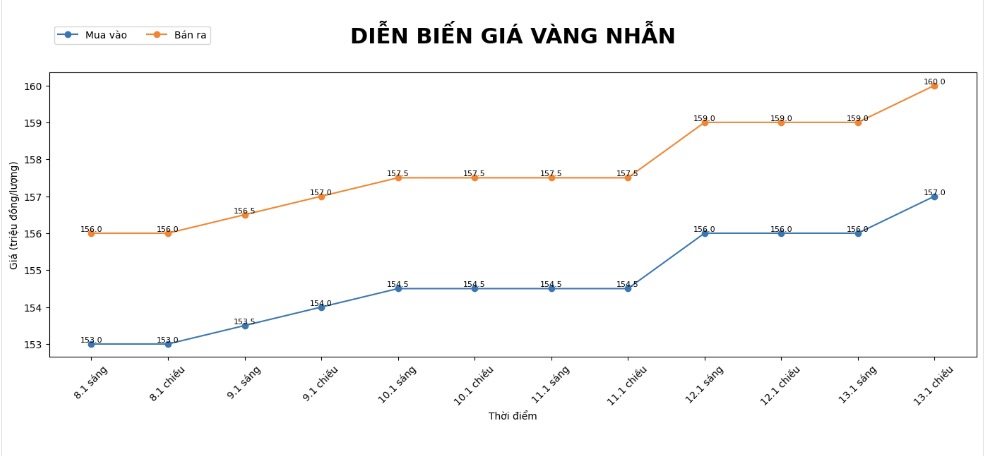

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of plain gold rings at 157-160 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 158.6-161.6 million VND/tael (buying - selling), an increase of 600,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 157.3-160.3 million VND/tael (buying - selling), an increase of 300,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

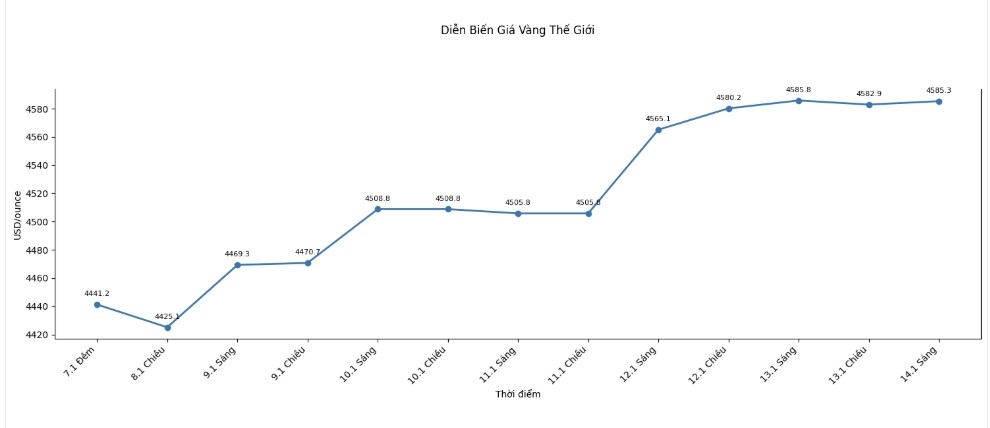

World gold price

World spot gold price listed at 5:25 am at the threshold of 4,585.3 USD/ounce.

Gold price forecast

In last night's trading session, February gold futures on the Comex exchange once jumped to a record high of 4,644 USD/ounce, before turning down slightly and trading around 4,613 USD/ounce, lower than 0.90 USD compared to the previous session.

Meanwhile, silver prices continued to break through strongly when the March delivery contract increased by 3.559 USD, to 88.6 USD/ounce after hitting an all-time high of 89.215 USD/ounce.

The strong increase in precious metals takes place amid growing concerns about geopolitical risks. Investors are pouring money into gold and silver to seek safe havens, while the global financial market is still facing many instability factors.

Important economic data released on the same day showed that inflation in the US in December remained at 2.7%, unchanged compared to November and in line with forecasts. The consumer price index showed that energy prices fell, mainly due to the cooling down of gasoline prices, while food and foodstuff prices remained high. Monthly, CPI increased by 0.3%. Notably, core inflation, excluding food and energy prices, only increased by 0.2%, lower than the forecast of 0.3%, while annually maintained at 2.6%, the lowest since March 2021. This development shows that inflationary pressure in the US is showing signs of cooling down, thereby creating more room for assets such as gold.

At the same time, CME Group commodity exchange announced that it will change the method of calculating margins for gold, silver, platinum and palladium futures contracts after precious metals prices soared and the market fluctuated sharply. Accordingly, the margin will be calculated as a percentage of the nominal value of the contract, instead of the fixed money level as before. The new regulation will take effect from the end of Tuesday's trading session and CME said it is to ensure a level of guarantee suitable to market fluctuations.

An expert talking to Bloomberg said that the new calculation method will help reflect risks more closely and limit the need for continuous adjustments, even in cases of volatility far exceeding historical levels, CME can still raise margin ratios.

Technically, the upward trend of gold prices is still very strong. Buyers are aiming to bring prices above the important resistance level of 4,750 USD/ounce, while sellers can only regain the advantage if they push prices below the support zone of 4,400 USD/ounce.

The nearest resistance level is currently at 4,644 USD, followed by 4,675 USD, while important support levels are 4,582.8 USD and 4,550 USD. The Wyckoff index at 8.5 shows that the gold market is in a very strong upward trend.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...