Gold prices rose on Tuesday as geopolitical instability continued to strengthen shelter demand, while silver prices jumped 8% and approached the historical peak.

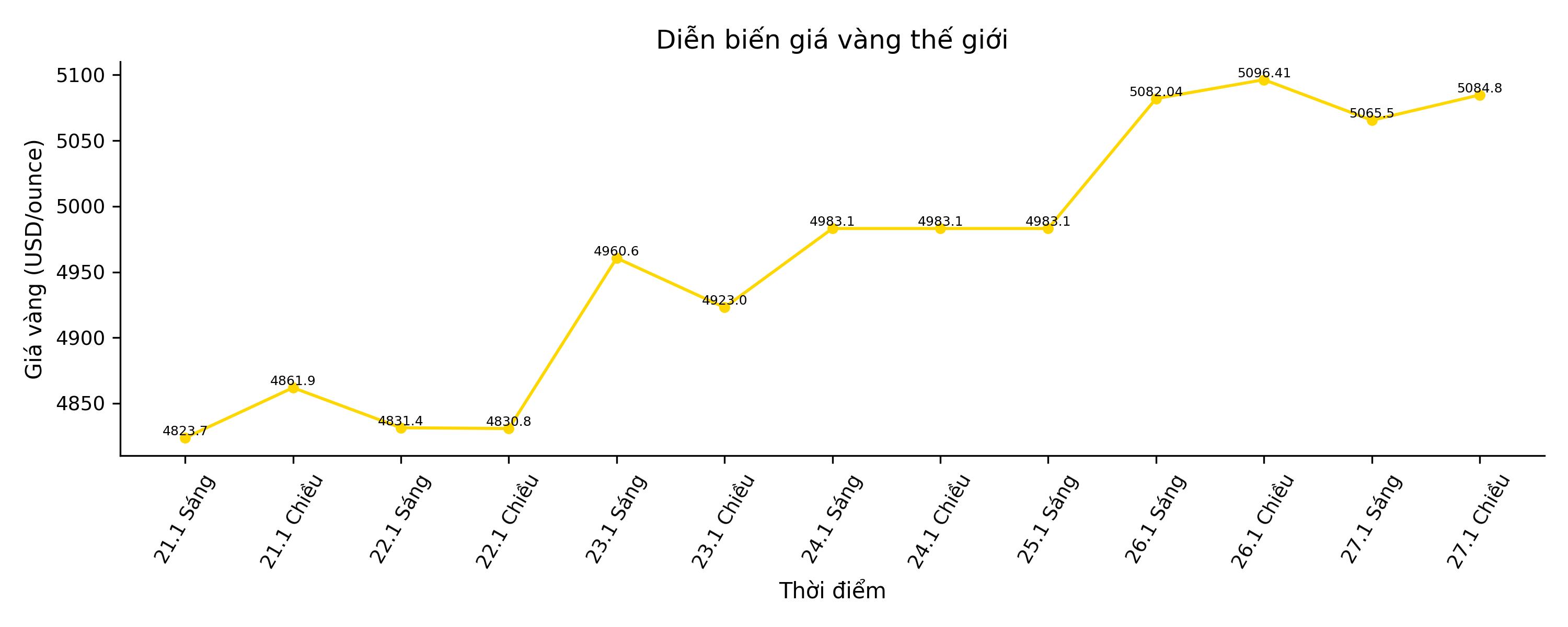

Spot gold prices rose 1.6% to 5,092.7 USD/ounce at 7:10 GMT, after setting a record of 5,110.5 USD on Monday, also the first time gold surpassed the 5,100 USD mark. US gold futures for February delivery edged up 0.1% to 5,088.4 USD/ounce.

Mr. Trump's disruptive policy approach this year is unintentionally energizing the precious metal as a defensive asset. Higher tax threats to Canada and South Korea are enough to keep gold in a top shelter position," said Tim Waterer, chief market analyst at KCM Trade.

Trade tensions escalated after US President Donald Trump announced a 25% increase in tariffs on cars, wood and pharmaceuticals imported from South Korea, while criticizing Seoul for not implementing the trade agreement with Washington.

Previously, he also warned of imposing taxes on Canada in the context of US-Canada relations warming up after Prime Minister Mark Carney's visit earlier this month.

Gold's upward momentum reflects a geopolitical risk hedge that has deeply ingrained in the price, is less cyclical and increasingly dominated by uncertainty in policy, geopolitics, and declining confidence in the USD," Christopher Wong, OCBC strategist, wrote in the report.

The risk of the US government shutdown and President Trump's inconsistent policies continue to put pressure on the USD, making gold priced in greenback cheaper for international buyers.

The US Federal Reserve (Fed) is forecast to keep interest rates unchanged in a meeting starting today, amid growing challenges to the independence of the US central bank.

Spot silver prices jumped 6.1% to 110.19 USD/ounce, after hitting a record 117.69 USD on Monday. Since the beginning of the year, silver has increased by more than 50%.

From a technical perspective, silver is now relatively expensive compared to gold as the gold/silver ratio falls to a 14-year low, according to BMI - a unit belonging to Fitch Solutions. BMI believes that the recent increase is mainly due to speculative buying pressure, and prices may cool down in the coming months as supply becomes less strained and industrial demand peaks in the context of slowing mainland China's economy.

Spot platinum prices fell sharply by 2.2% to $2,697.45/ounce after hitting a peak of $2,918.8 in the previous session, while palladium rose 1.1% to $2,004.37.