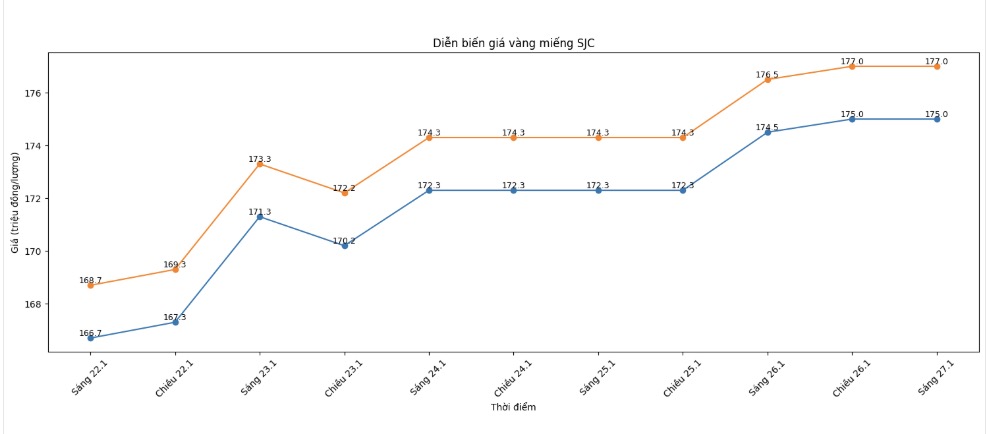

SJC gold bar price

As of 9:30 am, SJC gold bar prices were listed by DOJI Group at the threshold of 175-177 million VND/tael (buying - selling), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 174.5-176.5 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 174.5-177 million VND/tael (buying - selling), an increase of 700,000 VND/tael on the buying side and an increase of 500,000 VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

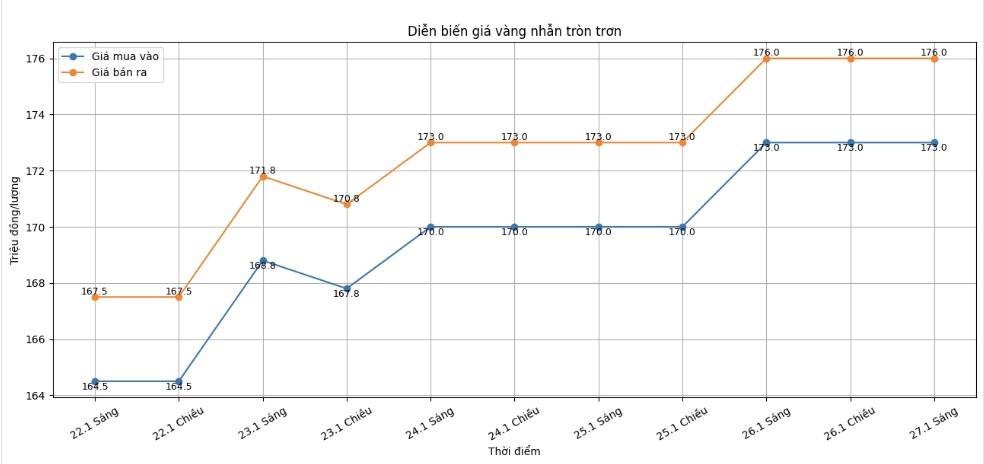

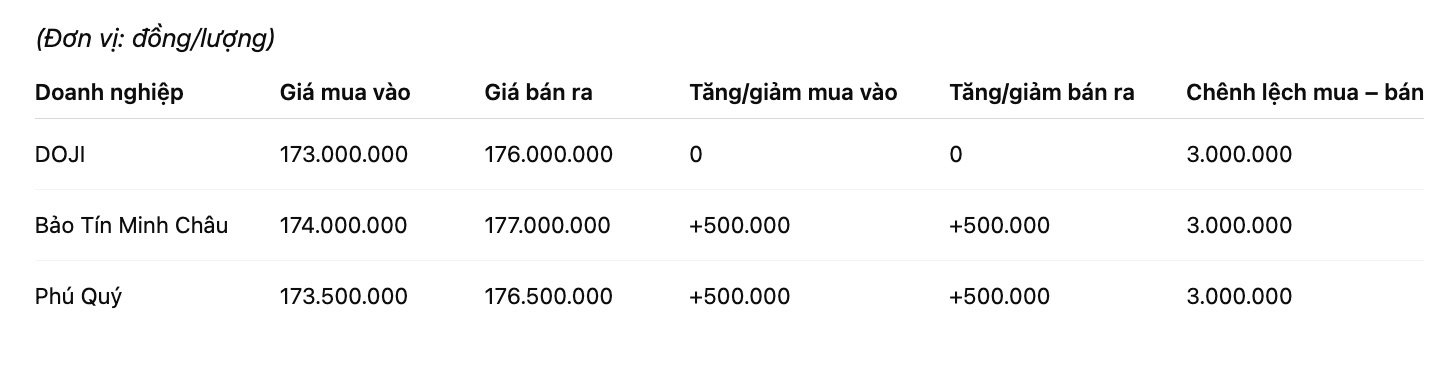

9999 gold ring price

As of 9:10 am, DOJI Group listed the price of gold rings at the threshold of 173-176 million VND/tael (buying - selling), going sideways in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 174-177 million VND/tael (buying - selling), an increase of 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 173.5-176.5 million VND/tael (buying - selling), an increase of 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 2 to 3 million VND/tael, posing a risk of losses for investors.

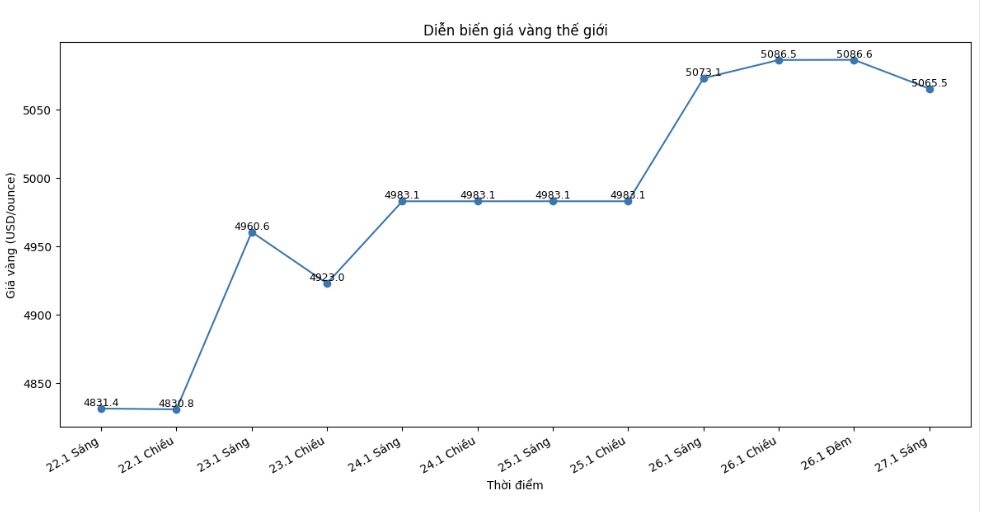

World gold price

At 9:30 am, world gold prices were listed around the threshold of 5,065.5 USD/ounce, down 7.6 USD compared to the previous day.

Gold price forecast

This week, the global gold market entered a sensitive phase when a series of important US economic data and monetary policy decisions from major central banks were simultaneously released. In that context, gold prices are likely to continue to maintain an upward trend, but the fluctuation range may expand more than in previous sessions.

Gioi phan tich cho rang dong luc chinh ho tro vang van den tu nhu cau tru an an toan, khi moi truong kinh te va tai chinh toan cau chua thuc su on dinh. Cac rui ro dia chinh tri, cung nhung dau hieu suy yeu cua dong USD, dang khien dong von phong ve tiep tuc tim den kim loai quy. Viec chi so USD Index lui ve vung thap nhat nhieu thang qua da gop phan gia tang suc hap dan cua vang doi voi nha dau tu nam giu cac dong tien khac.

Trong tuan, thi truong se theo doi sat niem tin tieu dung My, du lieu tro cap that nghiep hang tuan, chi so gia san xuat (PPI), dac biet la cuoc hop chinh sach cua Cuc Du tru Lien bang My (Fed). Du kha nang Fed giu nguyen lai suat duoc danh gia cao, nhung bat ky tin hieu nao lien quan den trien vong noi long tien te trong thoi gian toi deu co the tac dong manh den gia vang.

According to Mr. Kyle Rodda - senior analyst at Capital.com, the current upward momentum of gold is not only technical but also clearly reflects the decline in confidence in traditional US financial assets. “Gold is becoming a priority defense option as investors worry about policy stability and medium-term economic prospects,” Mr. Rodda said.

Chu tich Phoenix Futures and Options - ong Kevin Grady - cho rang xu huong tang cua vang van dang rat vung chac, khi luc mua tu nhien chiem uu the va thi truong gan nhu khong xuat hien ap luc ban manh. Du vay, ong luu y nha dau tu can than trong voi cac bien dong ngan han, nhat la trong boi canh thi truong dang o vung gia cao lich su.

In the domestic market, the buying - selling price difference of gold is maintained at a high level, posing a risk of losses if the price reverses quickly. Therefore, investors are recommended to closely monitor international developments and carefully consider trading strategies in the current sensitive period.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...