Mr. Ryan McIntyre - Senior Executive Partner of Sprott Inc., said that organizational capital is still stuck in what he calls the "direction phase" of the OODA loop – a military decision-making model often used by fighter pilots in high pressure conditions. As long as this loop does not go further, the cow market of gold is still operating much lower than its true potential.

The OODA loop consists of four steps: observation, orientation, determination, and action. According to Mr. McIntyre, this is a useful lens to explain why the strength of gold has not yet activated large-scale redistribution from institutional investors. He believes that large asset managers have clearly completed the first step.

They have observed gold prices increase" - he said, while emphasizing that gold's increase is now something that cannot be ignored. However, just observing cannot convert it into cash flow. The second stage - orientation - is where most organizations are stuck.

According to Mr. McIntyre, the problem for institutional investors is that their foundation of knowledge about precious metals has faded over the past decade. Many companies no longer have internal gold experts, and there is not even a "view advocate" capable of persuading investment committees to allocate to precious metals.

Although gold has recorded an increase that most other types of assets will immediately attract strong capital flows, organizations have not yet passed the initial appraisal stage, he said.

Mr. McIntyre said that he had witnessed this hesitation firsthand. According to him, Sprott has not received any new institutional investment entrustment specifically targeting gold or precious metal stocks, even after gold prices rose sharply.

If a group of common stocks increases by 60% or more in a year, asset managers will immediately rush to contact to find ways to pour money and seize the opportunity. But with gold, the reaction is completely different.

According to Mr. McIntyre, many indicators are reinforcing this view: holdings at gold ETF funds are still much lower than previous peaks, the level of participation of mining stocks is still very quiet, and the risk appetite in the entire sector is at a historically low level. He believes that this is not a characteristic of the end of the cycle, but a sign that a market has not yet attracted the largest buyers.

Although institutional investors are still ignoring gold, Mr. McIntyre believes that this trend will not last.

According to him, the shift to gold will be driven by instability in other markets, especially the stock market – which so far has helped investors avoid difficult decisions.

The next fluctuations in the bond market, in the context of public debt continuing to increase at an unsustainable rate, will also force investors to seek new safe haven assets.

With persistent inflation as it is now, there is almost no room for mistakes. Keeping long-term bonds in a low-interest environment is an extremely risky option" - he said.

Regarding the portfolio structure when organizations begin to adjust allocation, Mr. McIntyre said he prioritizes building a core position of about 10% in gold and a tactical position of about 5% in mining stocks.

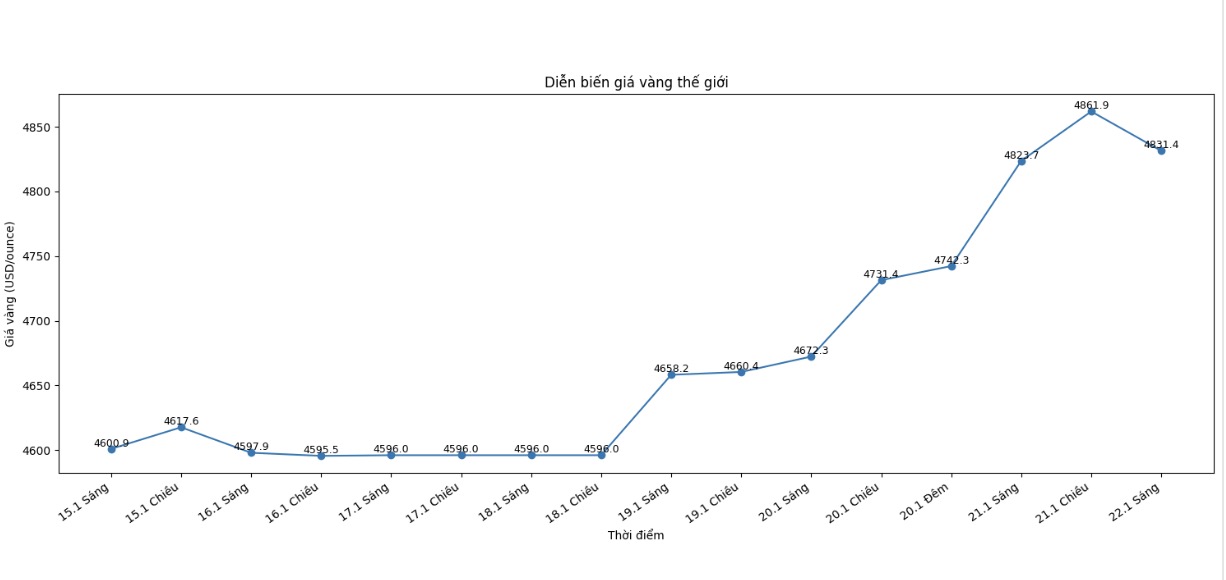

In the context that many analysts believe that gold may reach the $5,000/ounce mark this year, Mr. McIntyre emphasized that, regardless of specific price targets, he believes gold will continue to outperform stocks and bonds in the near future.

See more news related to gold prices HERE...