Gold and silver prices increased after the US employment figures were lower than expected, showing that the labor market is cooling down, thereby increasing expectations that the US Federal Reserve (Fed) will cut interest rates more next year.

Spot silver rose sharply by 3.3% to 75.91 USD/ounce, after hitting an all-time high of 66.52 USD/ounce in the previous session. This increase is driven by tight supply, strong industrial demand and increasing speculative activities.

Cold has become a speculative subject in the options market and I think this is based on a fairly clear view that the demand outlook is still very positive, said Ross Norman, an independent analyst.

This is an important mineral, a component of the green energy program. Supply is scarce in all aspects. Therefore, speculators are following the market trend," he added.

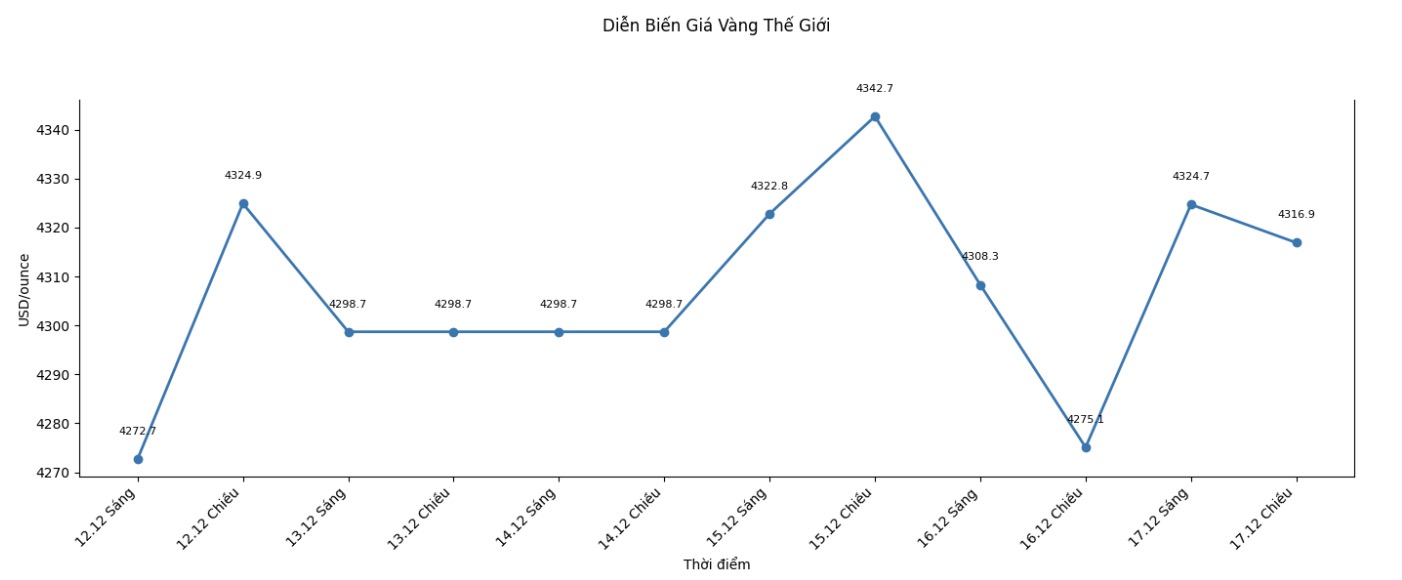

Gold prices also increased slightly, with spot gold increasing by 0.4% to 4,318.99 USD/ounce at 10:15 GMT, while US gold futures increased by 0.4% to 4,348.10 USD/ounce.

Since the beginning of the year, silver prices have increased by 128%, while gold prices have increased by 65%.

Gold prices continue to be supported by expectations that the Fed will pursue a loose monetary policy, along with economic uncertainty and geopolitical tensions, according to Ricardo Evangelista, an analyst at ActivTrades.

Data shows that US non-farm payrolls increased by only 64,000 jobs, while the unemployment rate increased to 4.6% in November - the highest level since September 2021.

The market is now awaiting important US inflation data this week, with the consumer price index (CPI) expected to be released on Thursday and the personal consumption expenditure (PCE) index on Friday.

The Fed last week made the third and last 0.25 basis point rate cut of the year. Fed Chairman Jerome Powell's statements were assessed by the market as less "hawlish" than expected. Traders are now betting on two rate cuts, each worth 0.25 percentage points, in 2026.

Non-yielding assets such as gold often have positive developments in a low interest rate environment.

In terms of geopolitics, US President Donald Trump on Tuesday ordered the exposure of all sanctioned oil tankers entering and leaving Venezuela.

In other precious metals, platinum prices rose 4.2% to $1,927.35 an ounce, the highest level in more than 17 years, while palladium rose 2.2% to $1,638.96/ounce, the highest level in two months.

The entire group of white metals is rising in price at the same time, and the European Unions preparation to lift the ban on internal combustion engines by 2035 has clearly given a big boost to the sector, said Norman.

See more news related to gold prices HERE...