World gold prices surpassed the 4,500 USD/ounce mark for the first time in the trading session on Wednesday, while silver and platinum also simultaneously set new peaks. Cash flow is pouring into the precious metals group as investors seek shelter from geopolitical risks, trade tensions and expect the US to continue cutting interest rates in 2026.

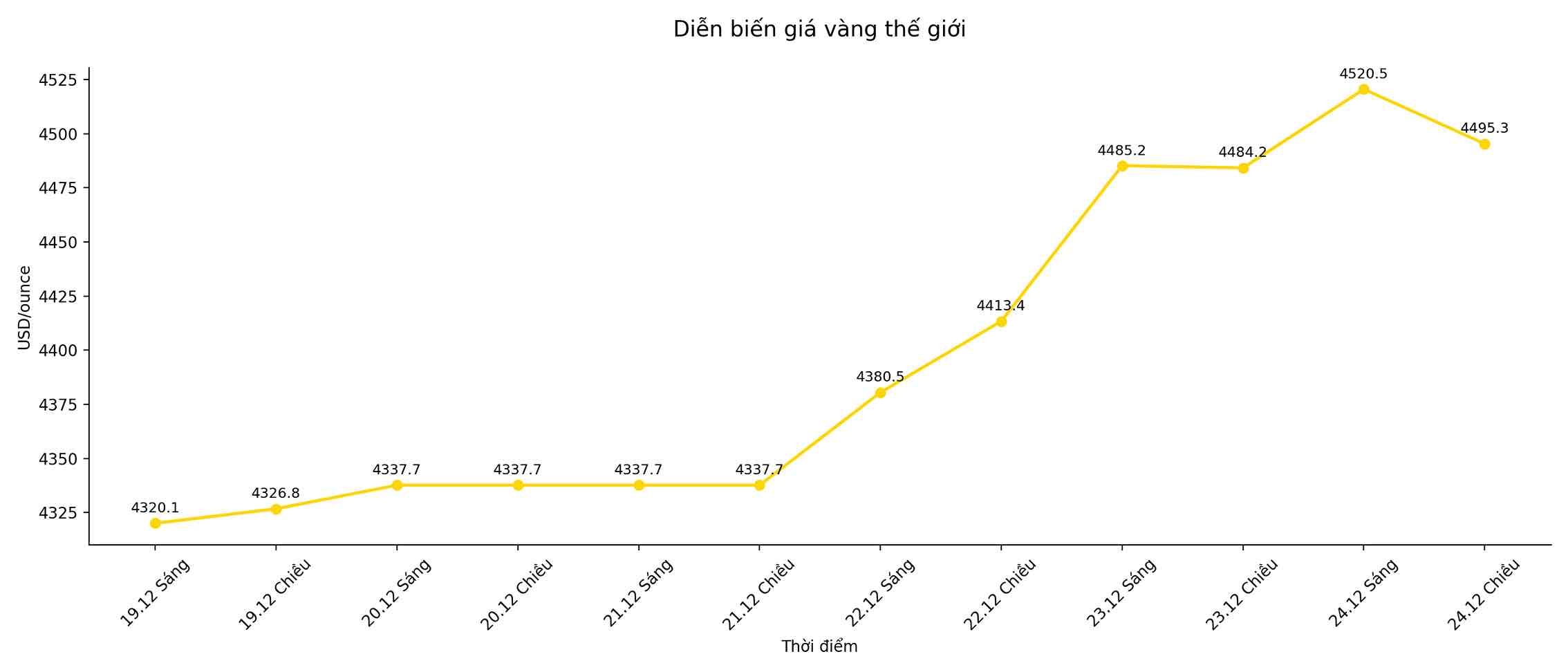

As of this afternoon's trading session, spot gold prices increased by 0.2%, to 4,495.39 USD/ounce, after reaching a record of 4,525.19 USD/ounce before. US February 2026 gold futures increased by 0.4%, reaching a historical peak of $4,522.10/ounce.

Silver prices rose 1.1% to $72.16 an ounce, after hitting an all-time high of $72.70 an ounce. platinum jumped 2.5% to $2,333.80 an ounce, after peaking at $2,377.50 an ounce. Palladium also rose nearly 3%, to $1,916.69 an ounce its highest level in three years.

Mr. Ilya Spivak, Head of Global Macro at Tastylive, commented that the precious metal is increasingly speculative in the context of increasing de- globalization trends. According to him, investors seek assets that can play a neutral role, not associated with sovereignty risks, especially when the US-China tensions continue.

thin liquidity at the end of the year has accelerated price fluctuations in the short term, but the uptrend is forecast to continue. Mr. Spivak believes that gold prices may move towards the 5,000 USD/ounce mark in the next 612 months, while silver is likely to approach 80 USD/ounce as the market reacts to important psychological thresholds.

Over the whole year, gold prices have risen more than 70% the strongest increase since 1979 thanks to safe-haven demand, expectations of the US Federal Reserve (Fed) lowering interest rates, strong central bank buying, the trend of de-dollarization and capital flows into ETFs. The market is currently betting on two interest rate cuts next year.

Silver prices even increased by more than 150% in the same period, surpassing gold thanks to strong investment demand, being included in the list of strategic minerals of the US and the wave of buying on the increase.

According to Mr. Tim Waterer, Market Analysis Director of KCM Trade, gold and silver are "accessively accelerating" this week with new price records, reflecting their role in preserving value in the context of expected US interest rates falling and the global debt burden still large.

Meanwhile, platinum and palladium - two main metals used in automobile exhaust catalysts also increased sharply this year due to tight mining supply, uncertainty related to tariffs and capital shift from gold. Since the beginning of the year, platinum has increased by about 160%, while palladium has increased by more than 100%.

Mr. Spivak believes that the increase of platinum and palladium is "catching up", while noting that the small market size makes these two metals vulnerable to strong fluctuations when liquidity returns to normal, although in the long term trend still goes hand in hand with gold.